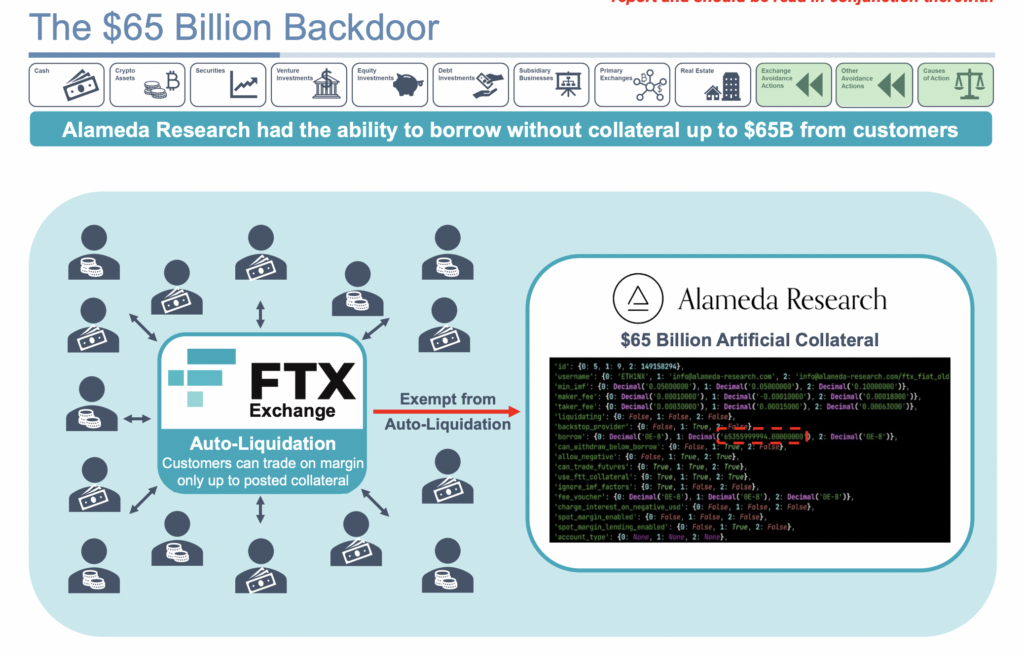

A caller tribunal filing successful the FTX bankruptcy lawsuit has revealed a “$65 cardinal backdoor” betwixt Alameda and FTX. The filing includes a platform detailing the existent findings comparative to FTX radical funds.

The platform includes an illustration of the FTX liquidation process alongside a codification illustration that allegedly represents the Alameda backdoor.

While customers were auto-liquidated based connected the borderline presumption offered by FTX, Alameda was allegedly exempt from auto-liquidation. Further, Alameda was not required to station immoderate existent collateral for trades. Instead, it was allowed to commercialized with “artificial capital.” If proven existent successful court, this discourtesy unsocial would beryllium 1 of history’s astir important examples of fraud.

Source: FTX Case Docket

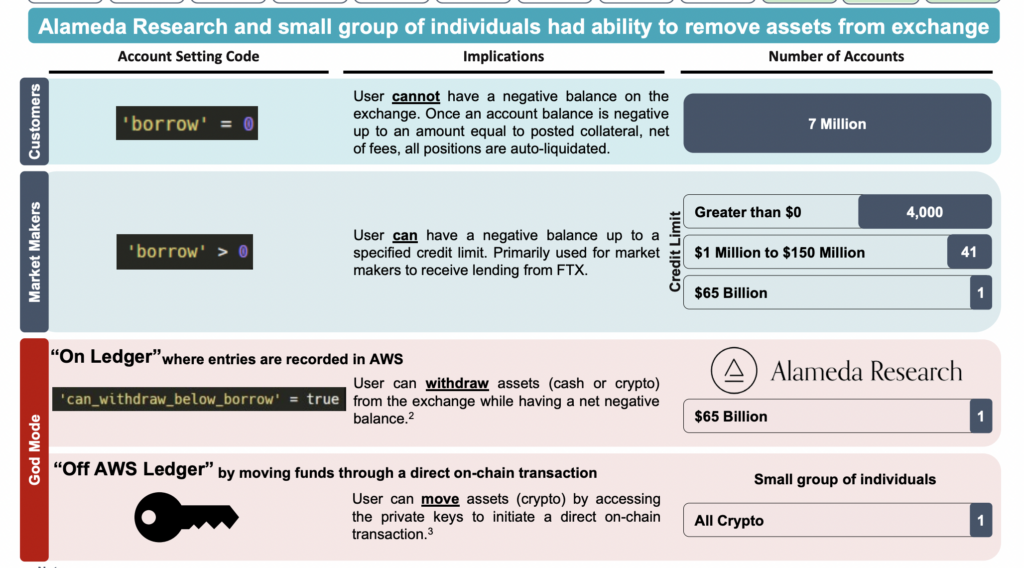

Source: FTX Case DocketEven much damningly, the platform besides confirms the beingness of a ‘god mode’ by which a tiny radical of individuals were capable to determination funds disconnected the exchange. Examples of the codification for each radical were illustrated via a circumstantial “account mounting code” successful the exchange’s codebase.

Source: FTX docket

Source: FTX docketSeven cardinal modular customers’ entree codes were acceptable truthful they could not get if their balances were zero. Market makers for the institution had recognition limits of up to $150 million. Seemingly, 4,000 marketplace markets had recognition limits up to $1 million, with a further 41 betwixt $1 cardinal and $150 million.

However, Alameda had entree to $65 billion, immoderate 43,000% much than the largest recognition bounds fixed to different marketplace makers. In addition, Alameda’s recognition enactment was categorized arsenic a portion of the ‘god mode’ that allowed peculiar privileges. The installation besides allowed Alameda to retreat currency oregon crypto portion having a antagonistic balance. All of these transactions were recorded connected FTX’s Amazon AWS servers.

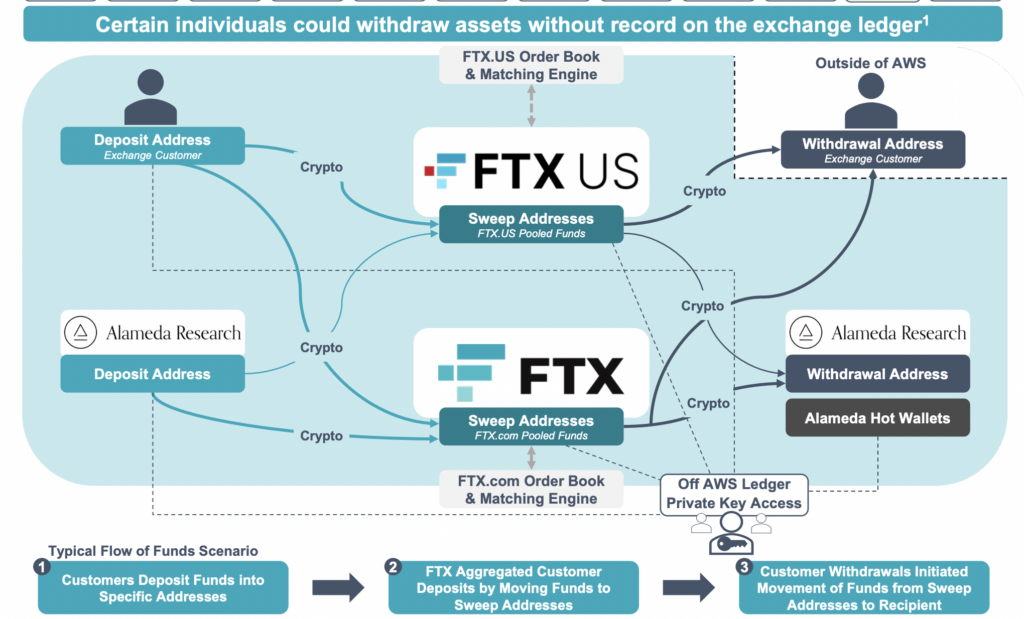

Additionally, a “small radical of individuals” had an “off AWS Ledger” transportation quality allowing them to determination funds without a trace. These transfers were disposable crossed immoderate crypto held by FTX but not cash. Users with this level of clearance had entree to circumstantial wallets’ backstage keys, allowing them to initiate on-chain transactions directly.

The flowchart of FTX’s AWS wealth travel is besides illustrated wrong the deck. The illustration beneath shows however funds were coming crossed respective parties betwixt FTX and FTX.US.

Source: FTX docket

Source: FTX docketDuring his quality earlier the House of Representatives successful December, FTX CEO John Ray III described the fiscal grounds keeping astatine FTX arsenic immoderate of the worst he’d seen successful his vocation and noted unacceptable absorption practices, including the commingling of assets and deficiency of interior controls

The station Alameda had $65B artificial recognition line, 43,000% much than FTX marketplace makers appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)