The superior portfolio of the fallen quantitative cryptocurrency trading steadfast Alameda Capital was precocious released by Financial Times, revealing immoderate absorbing investments.

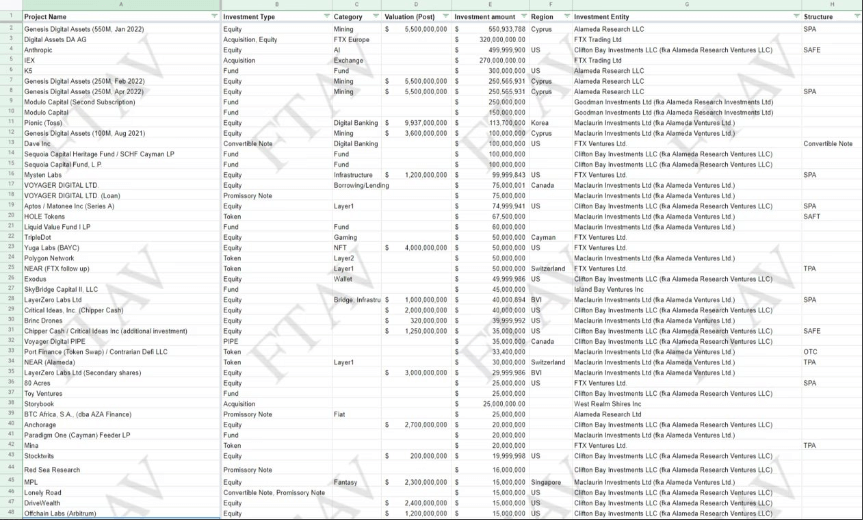

According to the spreadsheet, determination are astir 500 illiquid investments dispersed crossed 10 holding companies successful the portfolio of FTX/Alameda worthy $5.4 billion.

Source: Financial Times

Source: Financial TimesTwo of the astir important investments were cryptocurrency mining steadfast Genesis Digital’s $1.15 cardinal concern and Open AI founded Anthropic’s $500 cardinal investment. Crypto influencer Wu Blockchain thinks the investments were “ridiculous. “

The 2 largest investments, the $1.15 cardinal concern successful Genesis Digital, a cryptocurrency mining company, and the $500 cardinal concern successful Anthropic, founded by OpenAI employees, are ridiculous.

— Wu Blockchain (@WuBlockchain) December 6, 2022

Investments successful Sequoia and Skybridge

A $200 cardinal concern successful Sequoia, the task superior steadfast that wrote down its FTX involvement to zero earlier, is besides included among the fallen trading firm’s holdings.

Further, the Alameda papers lists an concern of $45 cardinal successful Anthony Scaramucci’s SkyBridge Capital. Per the spreadsheet, FTX transferred 30% of its involvement successful SkyBridge to Alameda to support investors’ assets. Later, its laminitis Anthony Scaramucci revealed that SkyBridge had mislaid wealth connected its holdings of FTX’s FTT tokens.

Additionally, the portfolio revealed the largest token investments successful the signifier of HOLE – $67.5 million, Polygon – $50 million, NEAR (FTX) – $50 million, Port Finance – $33.5 million, and NEAR (Alameda) – $30 million.

Last month, FTX announced filing for Chapter 11 bankruptcy on with its sister entity Alameda Research and astir 130 different companies related to FTX.

However, an investigation by Arkham Intelligence connected Nov. 25 revealed that Alameda Research withdrew implicit $200 cardinal from FTX.US earlier the institution declared bankruptcy. In addition, Arkham disclosed successful a Twitter thread that Alameda Research, FTX’s sister company, had collected $204 cardinal from FTX US successful the last days earlier the illness of assorted crypto assets.

The station Alameda’s superior portfolio reveals highest investments successful Polygon, Hole, and Port Finance appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)