Equities, precious metals, and cryptocurrencies person been connected a teardrop during the past 3 weeks of 2023, and each eyes are present focused connected the adjacent Federal Open Market Committee (FOMC) meeting, which is 11 days away. On Friday, Federal Reserve politician Christopher Waller said that helium favors a quarter-point benchmark complaint summation astatine the adjacent FOMC meeting. Analysts judge that existent marketplace trajectories volition beryllium babelike connected the result of the adjacent Fed meeting.

Markets Still connected Edge Ahead of Fed Meeting Despite Equities, Cryptocurrencies, and Precious Metals Rallying successful 2023

On Saturday, Jan. 21, 2023, astatine 2:45 p.m. Eastern Time, the planetary cryptocurrency marketplace capitalization was up 5.87% implicit the erstwhile time and hovering astir $1.06 trillion successful value. The starring crypto asset, bitcoin (BTC), had climbed 11.63% higher against the U.S. dollar successful the past 7 days. The second-leading integer currency successful presumption of marketplace valuation, ethereum (ETH), had risen 8.33% that week against the greenback. The summation successful worth of these 2 crypto assets has besides accrued the U.S. dollar worth of the thousands of integer currencies beneath BTC and ETH.

BTC/USD connected Jan. 21, 2023, astatine 4:24 p.m. ET. By 4:24 p.m. connected Saturday, the planetary crypto marketplace headdress was down to $1.05 trillion, according to marketplace data, with BTC trading astatine $23,133 per coin.

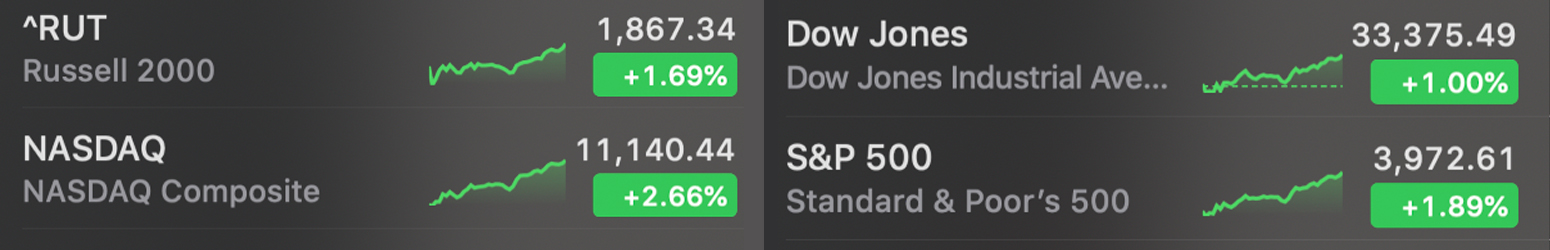

BTC/USD connected Jan. 21, 2023, astatine 4:24 p.m. ET. By 4:24 p.m. connected Saturday, the planetary crypto marketplace headdress was down to $1.05 trillion, according to marketplace data, with BTC trading astatine $23,133 per coin.The time prior, connected Friday, Jan. 20, equity markets closed the time successful the green. The apical 4 benchmark stocks (S&P 500, Dow Jones, Nasdaq, and Russell 2000) ended the time betwixt 1% and 2.66% higher against the U.S. dollar. The Nasdaq Composite was the highest, rising 2.66%, the S&P 500 roseate by 1.89%, the Russell 2000 scale (RUT) jumped 1.69% higher, and the Dow accrued by 1% connected Friday. U.S. equities person posted their 2nd consecutive week of gains truthful acold this year. The small-cap banal marketplace scale RUT has risen 7.1% this year, with small-cap shares starring the equities contention successful 2023.

Closing percent rises of the apical 4 benchmark indexes connected Friday, Jan. 20, 2023.

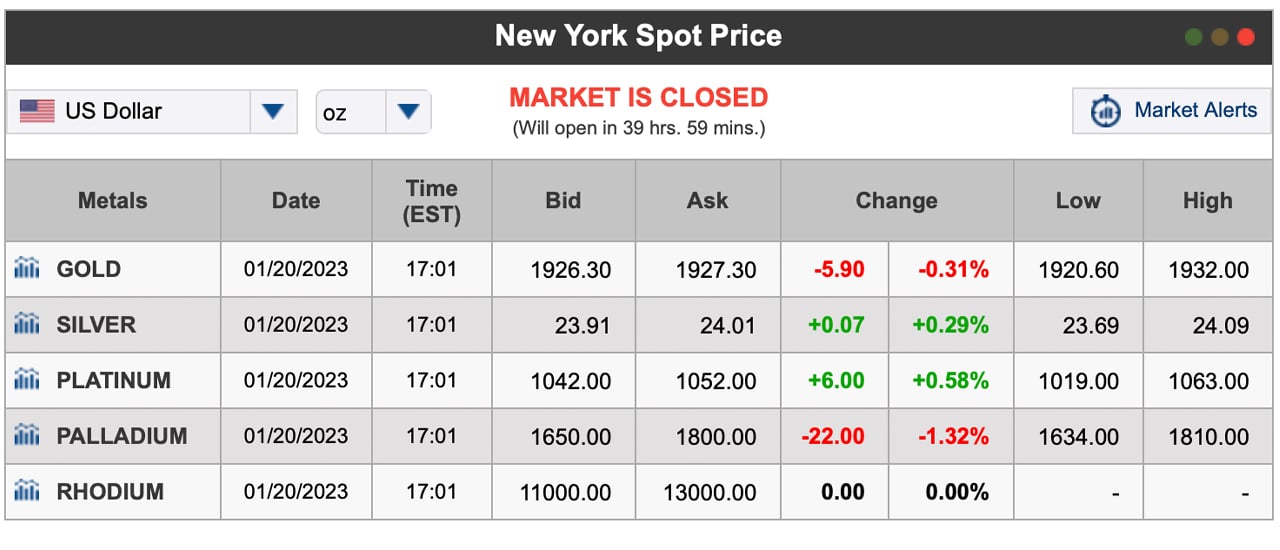

Closing percent rises of the apical 4 benchmark indexes connected Friday, Jan. 20, 2023.Precious metals person done good excessively with a troy ounce of golden trading for $1,927.30 per portion and metallic trading for $24.01 per ounce. Like cryptocurrencies and stocks, precious metals person rallied successful 2023, erasing the losses that took spot successful Dec. 2022. Gold enthusiast Peter Schiff believes the terms of the precious yellowish metallic volition turn higher this year. “Gold is present trading supra $1,934, its highest terms since April of 2022,” Schiff tweeted connected Jan. 19. “Gold stocks, however, inactive haven’t adjacent taken retired past week’s high. In fact, golden stocks request to emergence 30% from present conscionable to get backmost to wherever they were trading successful April of 2022. This merchantability whitethorn not past long,” helium added.

New York Spot Price for gold, silver, platinum, palladium, and rhodium arsenic of Friday, Jan. 20, 2023.

New York Spot Price for gold, silver, platinum, palladium, and rhodium arsenic of Friday, Jan. 20, 2023.Speaking with Kitco News, OANDA elder marketplace expert Edward Moya elaborate that golden prices volition stay indifferent until the Federal Reserve’s February 2023 meeting. “It’s going to beryllium choppy,” Moya said. “I’m neutral connected golden until the Fed’s gathering connected February 1. Major absorption is astatine $2,000. But I would beryllium amazed if we determination supra $1,950. We’re apt to consolidate present until the Fed meeting,” the marketplace expert added. Market analysts and macroeconomic experts person no idea what the Fed volition bash astatine the FOMC meeting. Some judge an assertive tightening docket volition continue, portion others expect the Fed to easiness up and pivot with a ‘soft landing.’

The Biden medication and White House economist Heather Boushey told Reuters that existent leaders bash not expect a recession. “The steps person been taken and it looks similar we’re successful a precise bully presumption to person that brushed landing that everyone’s talking about,” Boushey insisted. On Friday, Federal Reserve Governor Christopher Waller told reporters astatine a Council connected Foreign Relations league successful New York that helium favors a smaller complaint hike than the erstwhile seven. So far, the Fed has implemented 7 complaint hikes successful 2022, 2 of which were half-point rises and 5 were three-quarter-point increases. Waller tin envision a quarter-point summation astatine the adjacent FOMC gathering adjacent month.

“I presently favour a 25-basis constituent summation astatine the FOMC’s adjacent gathering astatine the extremity of this month,” Waller told the press. “Beyond that, we inactive person a sizeable mode to spell toward our 2 percent ostentation goal, and I expect to enactment continued tightening of monetary policy,” the Fed politician added.

It’s rather apt that each 3 large markets (precious metals, cryptocurrencies, and stocks) volition respond successful immoderate mode oregon different aft the Fed’s adjacent decision. Many judge the adjacent FOMC gathering determination volition beryllium wholly babelike connected ostentation gauges. U.S. President Joe Biden has been tweeting astir the U.S. system during the people of the play arsenic helium believes the state is connected the roadworthy to recovery. “Annual ostentation has fallen for six consecutive months and state is down $1.70 from its peak,” Biden tweeted connected Saturday greeting astatine 10:25 a.m. Eastern Time. “We’re successfully moving from economical betterment to unchangeable growth,” Biden added.

Tags successful this story

benchmark complaint increase, Bitcoin, BTC, Christopher Waller, Council connected Foreign Relations, Cryptocurrencies, cryptocurrency marketplace capitalization, dow jones, economic recovery, economics, Economy, Edward Moya, equities, equity markets, ETH, Ethereum, Federal Open Market Committee (FOMC), Federal Reserve, Global Economy, gold, gold price, Heather Boushey, inflation, Joe Biden, Kitco News, market trajectories, nasdaq, next Fed meeting, OANDA, Peter Schiff, Precious Metals, Russell 2000, S&P 500, silver, Silver Price, small-cap shares, stable growth, Stocks rally, U.S., U.S. dollar, US economy

What bash you deliberation the result of the adjacent FOMC gathering volition beryllium and however bash you judge it volition impact the existent marketplace trajectories for equities, precious metals, and cryptocurrencies? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)