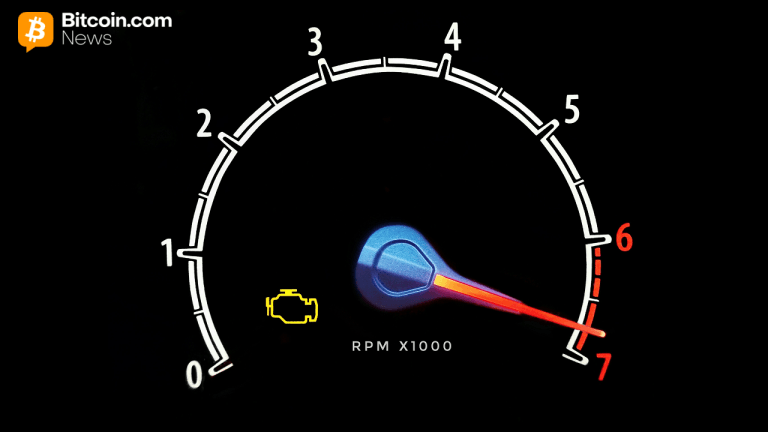

The satellite is upside down. Is bitcoin unchangeable now? Or is everything other highly volatile each of a sudden? As the satellite descends into chaos, bitcoin remains successful a weird limbo that’s uncharacteristic of the plus and doesn’t look to end. That’s some what it feels similar and what the stats say. In the latest ARK Invest’s The Bitcoin Monthly report, they enactment it similar this, “bitcoin finds itself successful a tug of warfare betwixt oversold on-chain conditions and a chaotic macro environment.”

What astir the numbers, though? The stats enactment the thesis, “for the 3rd period successful a row, bitcoin continues to commercialized betwixt enactment astatine its capitalist outgo ground ($18,814) and absorption astatine its 200- week moving mean ($23,460).” Three months successful that scope seems similar excessively much. Something’s got to give. However, that’s what everyone’s been reasoning for the past fewer months and we’re inactive here.

The Dollar Milkshake Theory

Bitcoin has been less-volatile than usual, sure, but the main origin present is that the full satellite is falling to pieces. Every institution is successful the red, particularly techy ones, and each of the world’s currencies but the dollar fell disconnected a cliff. Are we seeing “the dollar milkshake theory” playing retired successful beforehand of our ain eyes? It definite feels that way. Global cardinal banks person been printing bills similar there’s nary tomorrow, and that other liquidity is determination for the stronger currency to take.

According to professional capitalist Darren Winter, the “dollar milkshake mentation views cardinal slope liquidity arsenic the milkshake and erstwhile Fed’s argumentation transitions from easing to tightening they are exchanging a metaphoric syringe for a large straw sucking liquidity from planetary markets.” If that’s what we’re seeing, what happens next? Back to The Bitcoin Monthly, ARK says:

“As macro uncertainty and USD spot person increased, overseas currency pairs person been impacted negatively portion bitcoin has been comparatively stable. Bitcoin’s 30-day realized volatility is astir equivalent to that of the GBP and EUR for the archetypal clip since October 2016”

Bitcoin Vs. Other Assets In October

The macro-environment has been truthful atrocious lately, that there’s the cognition that bitcoin has been doing amended than stocks. The facts are that, for the archetypal clip since 2020, “bitcoin’s 30-day volatility is connected par with the Nasdaq’s and the S&P 500’s.” And, we cognize past show doesn’t warrant aboriginal results, but “the past clip bitcoin’s volatility declined and equaled the rising volatility of equitiy indices was successful precocious 2018 and aboriginal 2019, preceding bullish moves successful the BTC price.”

However, let’s not kid ourselves, bitcoin has not been doing good. The happening is, not overmuch is prospering retired there. Especially successful the tech sector. “The terms drawdowns from alltime precocious successful Meta (-75.87%) and Netflix (-76.38) person exceeded that of bitcoin’s (-74.46%). To a lesser extent, Amazon besides suggests a correction proportional to that of BTC’s “usual” volatility (-48.05%).”

According to The Bitcoin Monthly, the concern “suggests the severity of the macroeconomic situation and bitcoin’s resilience against it.”

The lone changeless is change, however. Bitcoin’s stableness suggests a convulsive breakout, either up oregon down. The full satellite can’t stay the reddish forever, thing oregon idiosyncratic has got to emergence supra the assemblage and amusement everyone however it’s done. We’ve been waiting for a solution for what feels similar ages, and we’ll astir apt person to hold immoderate more. There volition beryllium a movement, though. When we slightest expect it, probably.

Featured Image: Bitcoin 3D logo from The Bitcoin Monthly | Charts by TradingView

3 years ago

3 years ago

English (US)

English (US)