An investigation of the FTX and Alameda Research illness has been published by the blockchain and crypto analytics steadfast Nansen and the study notes that the Terra stablecoin collapse, and the liquidity crunch that ensued, apt started the domino effect that led to the company’s implosion. The survey from Nansen further details that “FTX and Alameda person had adjacent ties since the precise beginning.”

Report Shows Terra LUNA Collapse and Intermingled Relationships May Have Initiated FTX’s and Alameda’s Demise

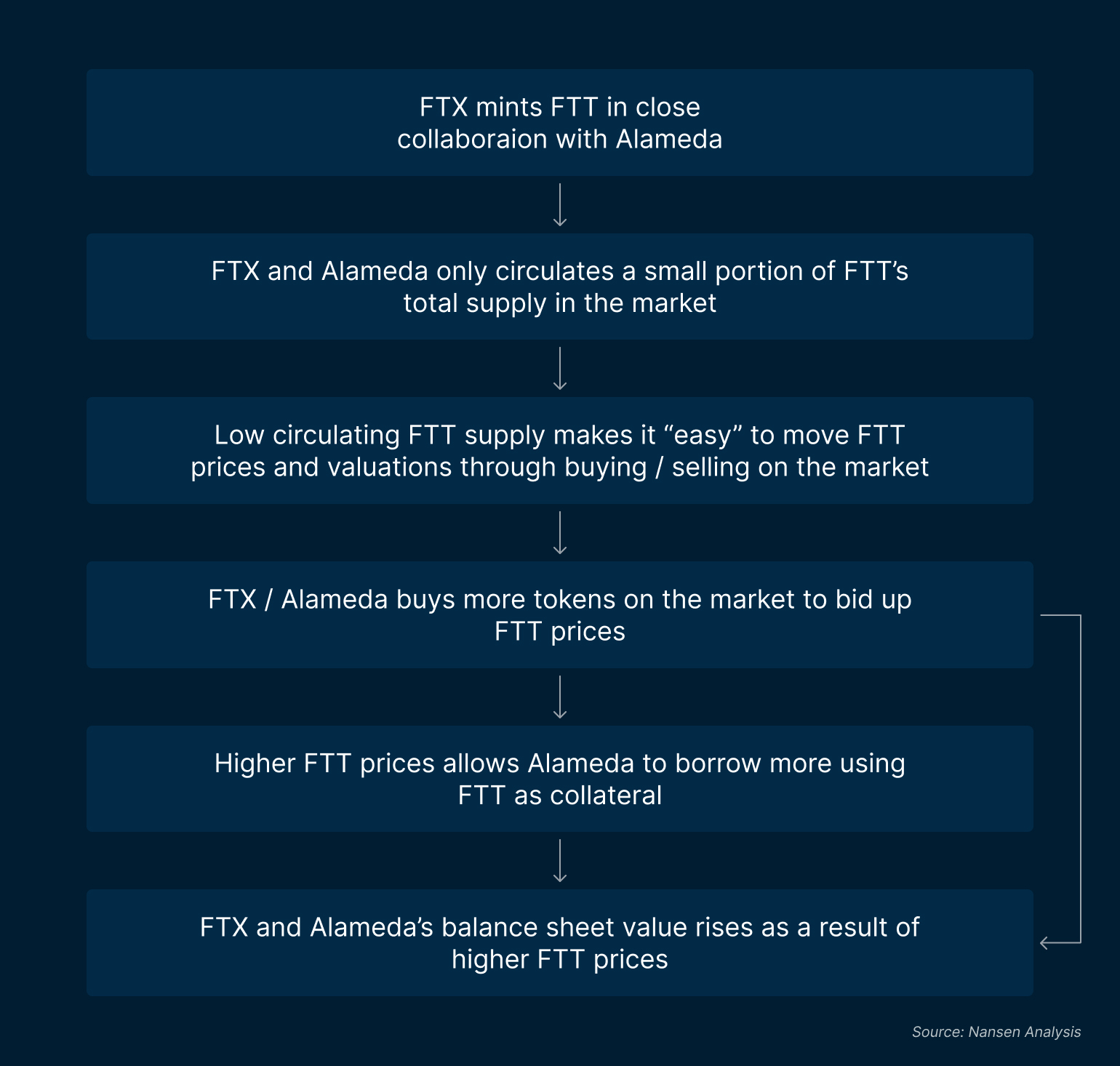

On Nov. 17, 2022, 5 researchers from the Nansen squad published a blockchain investigation and broad look astatine the “The Collapse of Alameda and FTX.” The study notes that FTX and Alameda had “close ties,” and blockchain records corroborate this fact. FTX’s and Alameda’s emergence to the apical started with the FTT token launch and the “two of them shared the bulk of the full FTT proviso which did not truly participate into circulation,” Nansen researchers detailed.

FTX and FTT’s meteoric scaling led to Alameda’s swelling equilibrium expanse which “was apt utilized arsenic collateral by Alameda to get against.” Nansen researchers item that if the borrowed funds were leveraged to marque illiquid investments, past “FTT would go a cardinal weakness for Alameda.” Nansen researchers accidental weaknesses began to amusement erstwhile Terra’s once-stable coin UST depegged and caused a monolithic liquidity crunch. This led to the illness of crypto hedge money Three Arrows Capital (3AC) and crypto lender Celsius.

While it’s not associated with Nansen’s report, 3AC co-founder Kyle Davies said successful a caller interrogation that some FTX and Alameda Research “colluded to commercialized against clients.” Davies implied that FTX and Alameda were stop hunting his crypto hedge fund. After the contagion effect from Celsius and 3AC, Nansen’s study says “Alameda would person needed liquidity from a root that would inactive beryllium consenting to springiness retired a indebtedness against their existing collateral.”

Nansen details that Alameda transferred $3 cardinal worthy of FTT connected the FTX speech and astir of those funds remained connected FTX until the collapse. “Evidence of the existent indebtedness from FTX to Alameda is not straight disposable on-chain, perchance owed to the inherent quality of CEXs which whitethorn person obfuscated wide [onchain] traces,” Nansen researchers admit. However, outflows and a Bankman-Fried Reuters interrogation suggest to Nansen researchers that FTT collateral whitethorn person been utilized to unafraid loans.

“Based connected the data, the full $4b FTT outflows from Alameda to FTX successful June and July could perchance person been the proviso of parts of the collateral that was utilized to unafraid the loans (worth astatine slightest $4b) successful May / June that was revealed by respective radical adjacent to Bankman-Fried successful a Reuters interview,” Nansen’s survey discloses. The study concludes that the Coindesk equilibrium expanse report “exposed concerns regarding Alameda’s equilibrium sheet” which yet led to the “back-and-forth conflict betwixt the CEOs of Binance and FTX.”

“[The incidents] caused a ripple effect connected marketplace participants, Binance owned a ample FTT position,” Nansen researchers noted. “From this constituent on, the intermingled narration betwixt Alameda and FTX became much troubling, fixed that lawsuit funds were besides successful the equation. Alameda was astatine the signifier wherever endurance was its chosen priority, and if 1 entity collapses, much occupation could commencement brewing for FTX.” The study concludes:

Given however intertwined these entities were acceptable up to operate, on with the over-leverage of collateral, our post-mortem [onchain] investigation hints that the eventual illness of Alameda (and the resulting interaction connected FTX) was, perhaps, inevitable.

You tin work Nansen’s FTX and Alameda study successful its entirety here.

Tags successful this story

3AC, Alameda Research, Alameda trading, blockchain records, FTT, FTT Token, FTT token collapse, FTX collapse, FTX Demise, FTX Exchange, intertwined, LUNA, Nansen, Nansen FTX, Nansen Research, Nansen Researchers, Nansen Study, over-leverage of collateral, Terra collapse, Terra UST, Three Arrows Capital

What bash you deliberation astir Nansen’s broad study concerning the illness of Alameda and FTX? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Editorial photograph credit: Nansen Research, Maurice NORBERT / Shutterstock.com

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)