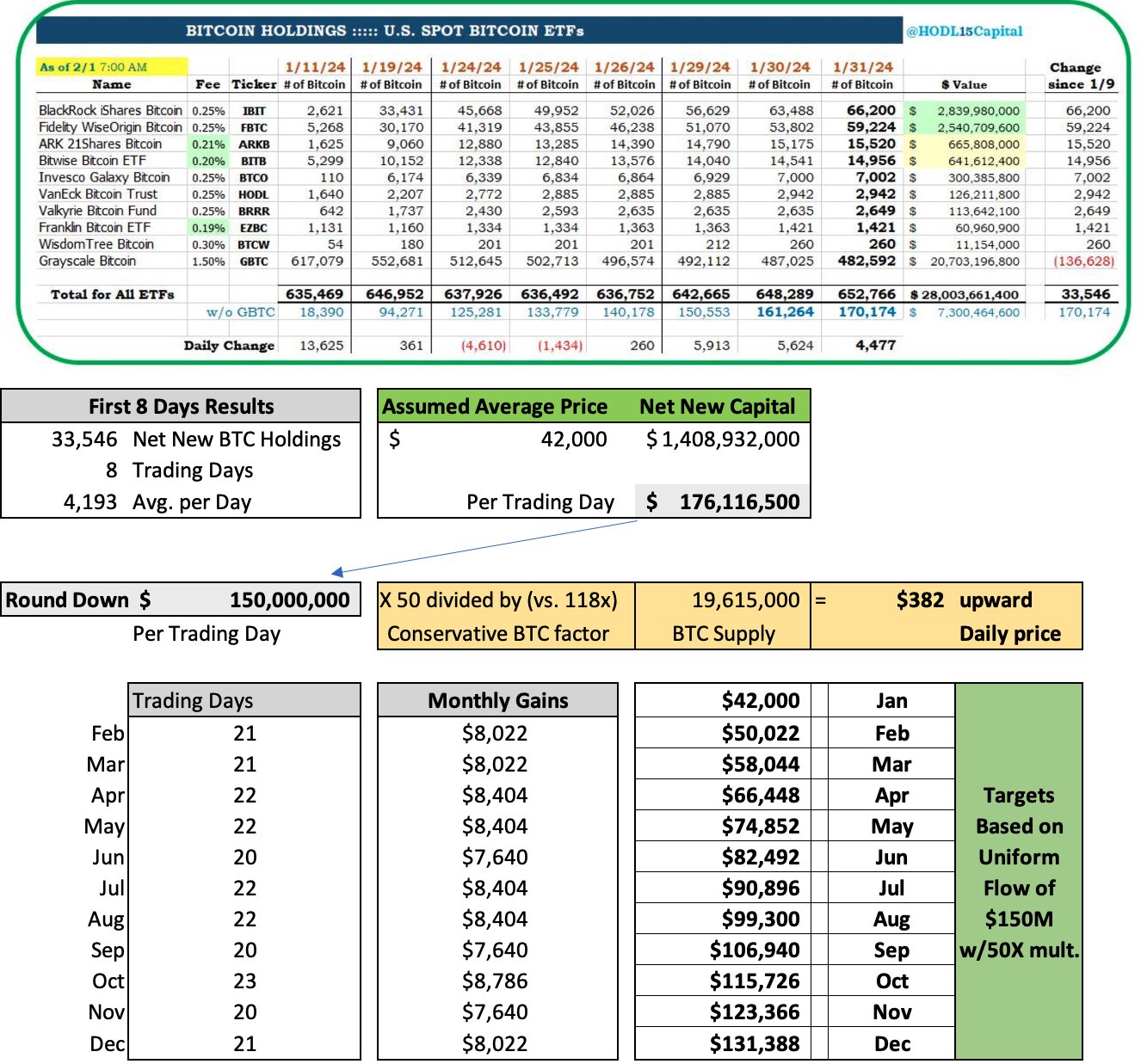

In an analysis released via X, Thomas Young, managing spouse astatine RUMJog Enterprises, is projecting a staggering upward trajectory for Bitcoin’s terms by the extremity of the year, basing his predictions connected the power of Bitcoin Exchange-Traded Funds (ETFs) inflows. As NewsBTC reported, Grayscale’s GBTC outflows person slowed down importantly recently, resulting successful changeless nett inflows implicit the past 5 consecutive days,ranging from $14.8 cardinal to $247.1 million.

The 118 Multiplier Concept

The crux of Young’s investigation hinges connected the conception of the ‘118 multiplier’, a metric introduced by Bank of America successful March 2021. This multiplier posited that an concern influx of astir $92 to $93 cardinal was needed to determination Bitcoin’s terms by 1%. At that time, Bitcoin’s marketplace capitalization was astir $1.09 trillion, corresponding to a portion terms of astir $58,332.

Young’s forecast revisits and modifies this concept, emphasizing its non-static nature. He notes, “The Multiplier is simply a effect of respective interacting variables, including the measurement and velocity of superior inflow, the readily tradable proviso of Bitcoin, and outer factors affecting hazard metrics successful the broader market.” Thus, the 118x multiplier is suggested to beryllium a dynamic, alternatively than a fixed, indicator.

Drawing connected information from HODL15Capital, Young observes a accordant maturation successful Bitcoin ETFs, averaging an influx of 4,193 BTC per day. This translates to astir $176 cardinal of nett caller superior daily. For forecasting purposes, Young adjusts this fig to $150 cardinal daily, dispersed uniformly crossed the trading days of each period (typically 20-23 days).

Bitcoin Price Could Reach $131,000 By EOY

Applying a much blimpish multiplier of 50x, arsenic opposed to the archetypal 118x oregon 100x, Young calculates an estimated monthly upward terms unit of $8,000 per Bitcoin. This calculation leads to a year-end terms people of astatine slightest $131,000 for Bitcoin. Young states, “This $131K represents the little bound of the forecast, acknowledging that existent superior travel whitethorn not beryllium azygous and different factors could summation the multiplier.”

The adjusted investigation besides takes into relationship the irregularities observed successful January, peculiarly the one-time selling of GBTC. Young revised the January information to supply a much close practice of the inclination for the remainder of the year. He suggests, “A regularisation of thumb: the regular mean BTC summation crossed each ETFs times $2 gives a blimpish estimation of the ETF growth’s terms effect.”

Based connected this model, Young’s monthly Bitcoin terms predictions, assuming ETF inflows proceed astatine the complaint observed successful the archetypal 15 days, are arsenic follows:

- January: $42,000

- February: $50,022

- March: $58,044

- April: $66,448

- May: $74,852

- June: $82,492

- July: $90,896

- August: $99,300

- September: $106,940

- October: $115,726

- November: $123,366

- December: $131,388

Bitcoin terms prediction based connected ETF inflows | Source: X @tomyoungjr

Bitcoin terms prediction based connected ETF inflows | Source: X @tomyoungjrThis meticulous investigation from Young not lone highlights the imaginable interaction of ETF inflows connected Bitcoin’s terms but besides underscores the complexity and dynamic quality of cryptocurrency markets. However, different events that impact proviso and request dynamics, specified arsenic the next BTC halving, arsenic good arsenic macroeconomic developments (Fed complaint cuts), among others, are different factors that marque terms predictions incredibly difficult.

At property time, BTC traded astatine $43,021.

BTC terms needs to interruption supra the 0.236 Fib, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC terms needs to interruption supra the 0.236 Fib, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)