Bitcoin mightiness beryllium presently trending downwards, but a afloat cardinal breakdown shows it is acceptable to instrumentality to $120,000, and it is lone a substance of time.

According to an extended cardinal investigation shared by Mr. Wall Street connected X, the caller months of terms stagnation and abrupt drops are part of a larger accumulation signifier dominated by organization players. The wide setup, helium argued, points intelligibly to Bitcoin’s eventual ascent backmost supra $120,000.

Institutional Accumulation And Controlled Bitcoin Price Range

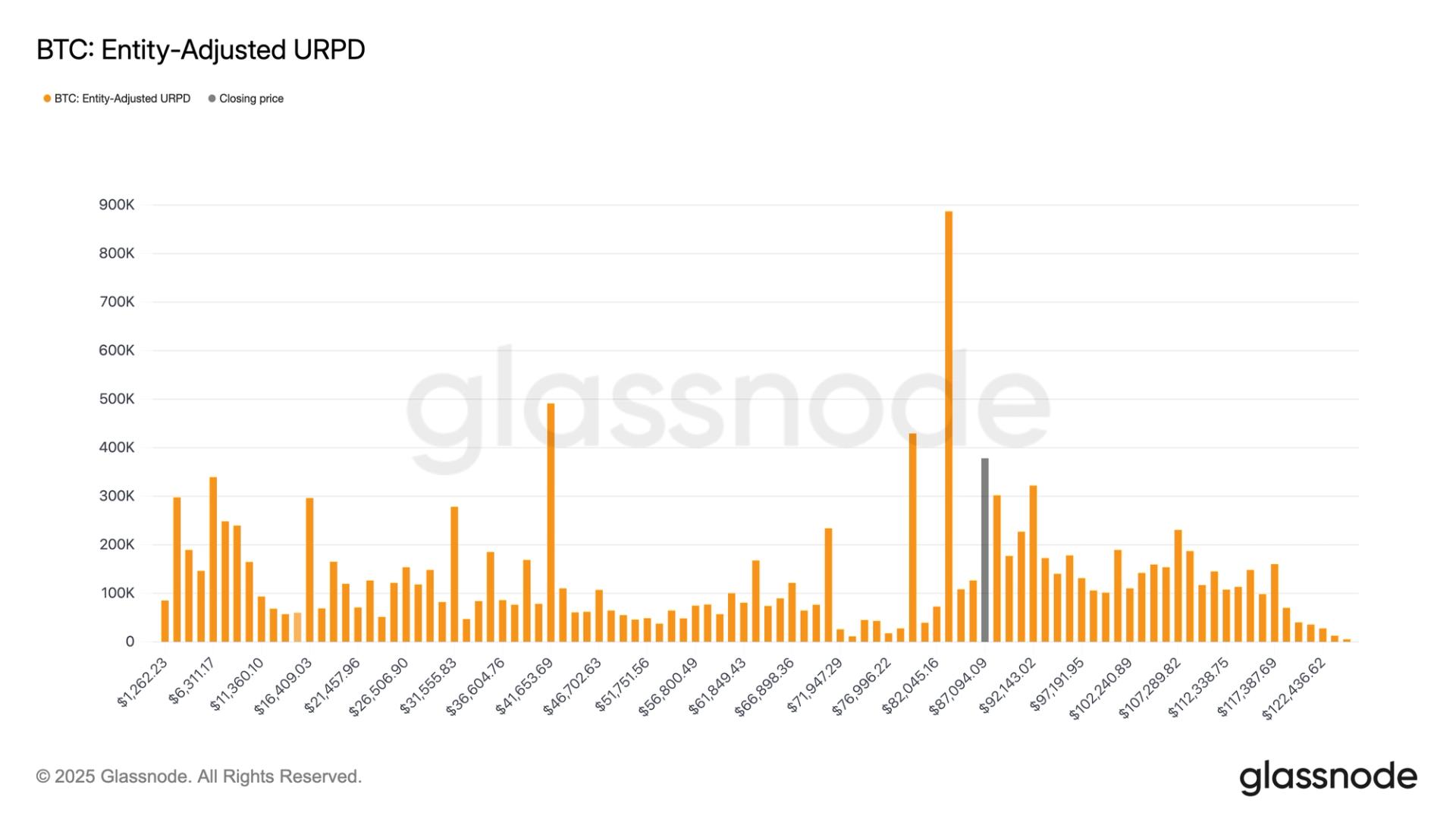

The analyst’s archetypal constituent is however Bitcoin has been trading wrong a 120-day range, oscillating betwixt $107,000 and $123,000 to signifier what is simply a controlled consolidation scope by institutions intended to propulsion retired anemic retail investors. Mr. Wall Street noted that Bitcoin’s operation remains fundamentally bullish contempt the prolonged sideways movement.

Each effort to interruption retired supra $120,000 powerfully oregon beneath the $107,000 enactment has failed, a motion that ample institutions are actively controlling liquidity wrong this constrictive band. Every clang wrong this period, including the 1 caused by the Binance sell-off and Trump’s tariff warfare with China, was met by beardown organization bids adjacent the $107,000 zone, adjacent when Bitcoin went connected a flash crash to $101,000.

Therefore, determination is nary method oregon structural weakness that invalidates the bullish thesis. The imbalance to the upside, helium added, is capable to propulsion Bitcoin backmost to trading successful the $120,000 and $123,000 range, which is the Value Area High.

Mr. Wall Street besides tied Bitcoin’s coming surge to changes wrong the Federal Reserve’s policies. He pointed retired that contempt claiming to extremity quantitative tightening, the Fed has softly injected billions into the banking strategy done repo operations and mortgage-backed securities purchases. He highlighted a azygous Friday wherever $50.35 cardinal entered the system.

Source: Chart from Mr. Wall connected X

Source: Chart from Mr. Wall connected XAccording to him, this liquidity volition yet find its way into hazard assets, including Bitcoin, successful a signifier akin to the 2019 monetary effect that preceded crypto’s 2020 and 2021 bull run. Although helium warned that a fabricated clang could precede the adjacent liquidity wave, this volition lone fortify Bitcoin’s semipermanent presumption for different determination to $120,000 and perchance higher.

Gold And Bitcoin In The Battle For The Real Store Of Value

Mr. Wall Street besides called attraction to the intelligence broadside of the existent cycle, which has been highlighted by immoderate investors gravitating towards gold. He argued that retail investors are being pushed to golden done manipulated narratives of stagflation and economical fear, portion institutions softly bargain Bitcoin. “What’s ironic is that the aforesaid logic that drives radical to bargain golden should beryllium making them bargain Bitcoin instead,” helium said.

The ongoing golden hype is to distract the nationalist while institutions accumulate Bitcoin astatine discount levels. Once retail participants exit the crypto marketplace entirely, past determination is going to beryllium a determination upward that redefines Bitcoin’s terms level.

As helium concluded, the boring sideways signifier is nearing its end, and the adjacent assertive move, 1 that could transportation Bitcoin backmost supra $120,000, is lone a substance of time. At the clip of writing, Bitcoin is trading astatine $104,200.

Featured representation from Pixabay, illustration from Tradingview.com

1 month ago

1 month ago

English (US)

English (US)