In a marketplace update connected Oct. 10, method expert Nik Patel (@OstiumLabs) argued that Ethereum is approaching a make-or-break portion wherever the adjacent fewer sessions could specify whether the beforehand resumes oregon a deeper unwind unfolds. With spot ETH quoted astir $4,000, Patel anchored his thesis to a choky clump of reclaim and invalidation levels connected some ETH/USD and ETH/BTC, emphasizing that lower-timeframe behaviour indispensable align with higher-timeframe operation to support the bullish way open.

Key Price Levels For Ethereum Now

On the play ETH/USD chart, Patel said the marketplace “wicked little into the August unfastened past week but held supra the erstwhile play debased and trendline support,” resulting successful an wrong week that nevertheless closed “marginally beneath that large pivot.” The pivot is explicit: “We privation to spot this pivot astatine $4,093 reclaimed instantly and not flipped into absorption present connected the little timeframes, oregon other we could expect different flush of the lows towards that 2025 open.”

If buyers bash unit the reclaim, Patel expects past week’s enactment to basal arsenic a quarterly low: “If we bash reclaim $4,093 here, which is what I expect, we should person our quarterly debased present successful and I would privation to spot $4,400 flipped into enactment for the determination higher into all-time highs and beyond.”

Ethereum terms analysis, play illustration | Source: X

Ethereum terms analysis, play illustration | Source: XHe framed the play invalidation astatine $3,700, informing that a adjacent beneath would enactment the yearly unfastened connected ticker arsenic “last-stand support” for the bullish structure; nonaccomplishment determination risks “a overmuch bigger unwind backmost into $2,850.” Patel’s basal lawsuit remained constructive: “acceptance backmost supra $4,093 into adjacent week and past a adjacent supra $4,400 for October, starring to new highs done $5,000 successful aboriginal November and a precise beardown period for ETH.”

The regular ETH/USD work connects that high-timeframe blueprint to momentum and marketplace structure. Patel noted “momentum exhaustion into the lows” followed by a higher-low past week, a enactment that present indispensable beryllium defended. He wants to spot the series reassert itself with a thrust supra the mid-range and a consequent higher-low supra the play pivot: “we perfectly privation to spot this operation present protected and terms to signifier a higher-high supra the mid-range astatine $4,352 and past different higher-low supra $4,093 earlier a breakout higher and a push towards caller highs.”

Ethereum terms analysis, regular illustration | Source: X

Ethereum terms analysis, regular illustration | Source: XFor confirmation of an impulsive leg, helium flagged a trendline break, a flip of the ATH-anchored VWAP into support, and an RSI authorities shift: “If we get a trendline breakout and terms flips that ATH VWAP into enactment with regular RSI supra 50, I’d expect a determination into $4,950 precise swiftly, followed by terms find successful November.” The regular invalidation mirrors the play logic: if $4,093 acts arsenic absorption and the marketplace pushes beneath $3,700—then closes beneath it—“we’re perfectly retesting the yearly open,” successful his view.

ETH Vs. BTC

Against Bitcoin, Patel contends that the comparative brace has apt printed its Q4 low. On the play ETH/BTC chart, terms was rejected astatine trendline resistance, past retraced to the yearly unfastened and held, closing “marginally green” portion respecting trendline enactment disconnected the 2025 lows.

ETH/BTC analysis, play illustration | Source: X

ETH/BTC analysis, play illustration | Source: X“It is my presumption that the Q4 debased for the brace has formed here,” helium wrote, adding that a retest and interruption supra the descending bound into aboriginal November would acceptable the signifier for a measured expansion: “acceptance supra 0.0417 opens up the adjacent limb higher into 0.055.” He placed play invalidation astatine 0.0319.

The regular ETH/BTC representation refines those signals into actionable levels. Price “marked retired that debased betwixt 0.0319 and the yearly unfastened earlier bouncing hard and reclaiming 0.036 arsenic support.” Ideally, 0.036 present acts arsenic a springboard; if not, Patel allows for a higher-low “above the 0.0319 level earlier continuation higher.”

The tactical archer would beryllium a flip of adjacent supply: “If we tin flip 0.0379 arsenic reclaimed enactment here, that would beryllium promising for the presumption that a trendline breakout is imminent, pursuing which I would expect 0.0417 to beryllium taken retired and terms to caput higher, with insignificant absorption supra that astatine 0.049 earlier 0.055.” He besides identified a confluence set below: “We person a confluence of enactment betwixt 0.0293 and 0.0319, truthful flipping that scope into absorption would beryllium precise bearish ETH/BTC.”

Taken together, Patel’s Oct. 10 blueprint hinges connected 3 synchronizations: ETH/USD indispensable swiftly reclaim and support $4,093; $4,400 indispensable person from ceiling to level to wide the runway toward anterior highs and a imaginable $4,950 extension; and ETH/BTC should thrust done 0.0379 and past 0.0417 to corroborate relative-strength breadth beneath immoderate dollar-denominated breakout.

The downside is arsenic crisp: nonaccomplishment to reclaim $4,093, a play adjacent beneath $3,700, and a consequent nonaccomplishment of the yearly unfastened would validate the hazard that, successful Patel’s words, Ethereum could “unwind backmost into $2,850.”

At property time, ETH traded astatine $3,872.

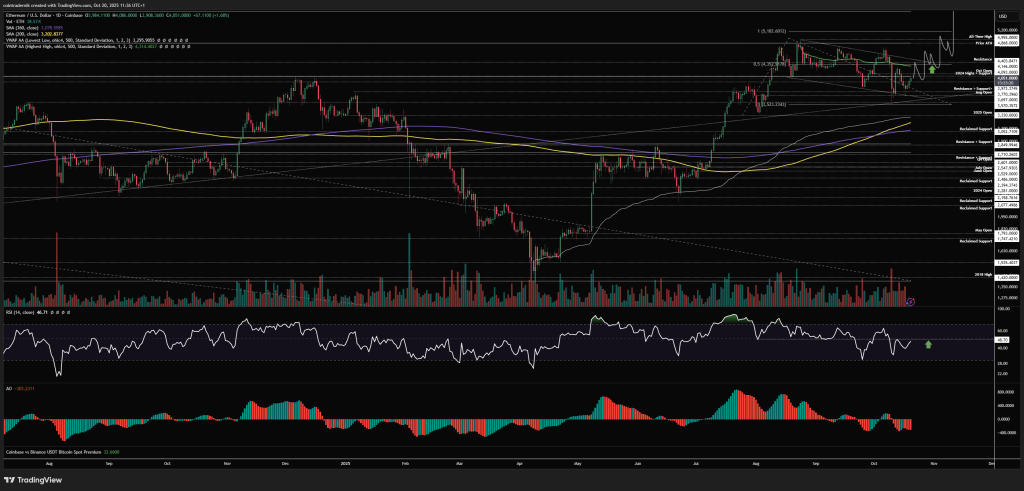

ETH price, 1-week illustration | Source: ETHUSDT connected TradingView.com

ETH price, 1-week illustration | Source: ETHUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

3 months ago

3 months ago

English (US)

English (US)