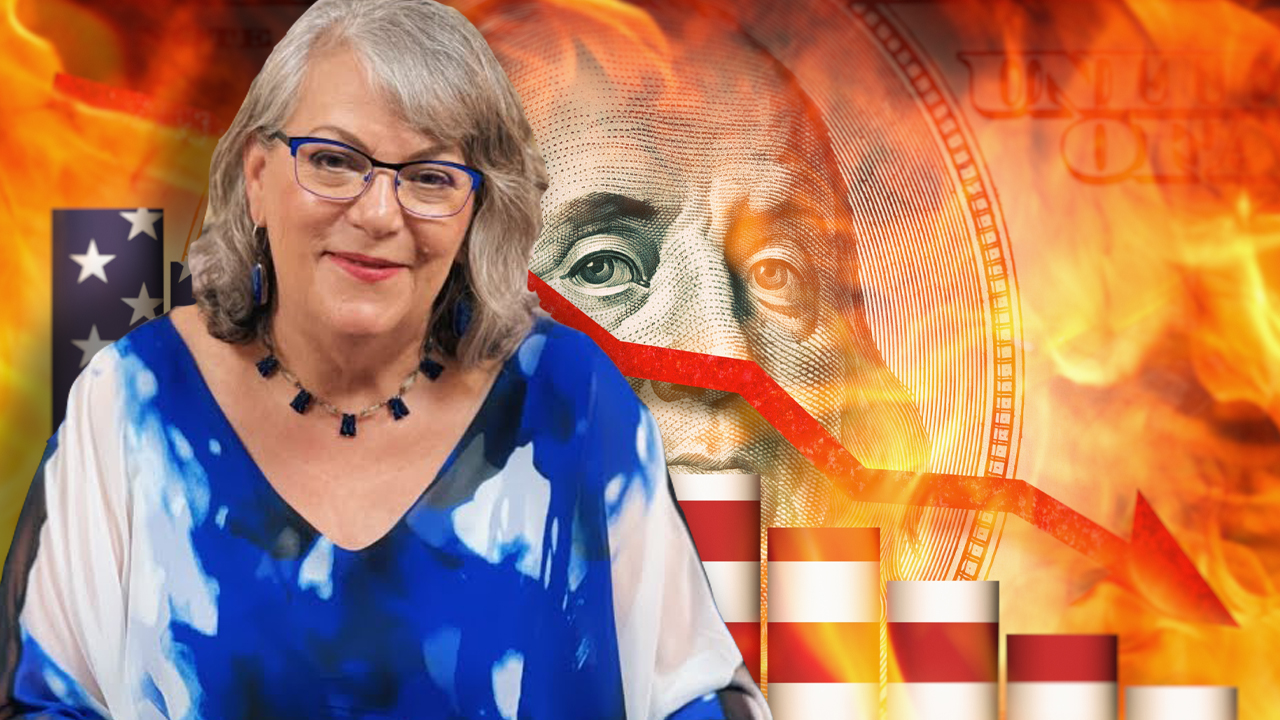

According to Lynette Zang, main marketplace expert astatine ITM Trading, U.S. banks person the ineligible authorization to confiscate people’s funds owed to authorities passed by Congress. In a caller interview, Zang discussed however the purchasing powerfulness of the U.S. dollar has dwindled to “roughly 3 cents,” her content that cardinal slope integer currencies (CBDCs) volition reenforce a “surveillance economy,” and the unalterable quality of the World Economic Forum’s proposal, known arsenic the Great Reset.

The Consequences of Bank ‘Bail-Ins,’ CBDCs, and the Great Reset

In a precocious published video interview, Lynette Zang, the main marketplace expert astatine ITM Trading, sat down with Michelle Makori, pb anchor and editor-in-chief astatine Kitco News. Zang discussed however the U.S. dollar and astir large fiat currencies are adjacent their end.

“People don’t recognize that everything has a beingness cycle,” Zang told Makori. “I’m astatine a antithetic constituent successful my beingness astatine 68 than my granddaughter who is astir to crook eight. Currencies are nary different. There are recognizable patterns that we tin spot each on the way,” Zang emphasized. The expert continued:

But there’s not a uncertainty successful my caput … I mean, archetypal of all, there’s astir 3 cents near of the [original] dollar’s worthy of purchasing powerfulness … So, what happens erstwhile you scope zero? You person to spell negative, and they instrumentality your principal.

Zang besides informed the big that the Dodd-Frank authorities transforms depositors into “unsecured creditors.” She emphasized that the laws alteration fiscal institutions to easy person deposits into equity. Instead of “bailouts,” Zang predicts determination volition beryllium “bail-ins,” wherever depositors’ savings are utilized to forestall a slope from collapsing.

“People person the presumption that erstwhile they marque a deposit, it’s their money,” Zang stated. “But it’s not. When you marque a deposit, legally, you’re lending your wealth to the bank. In 1995, they passed Regulation D, which legalized and allowed banks to determination your deposits into sub-accounts that are successful the bank’s name.”

Then they usage that arsenic collateral for loans, and you know, frankly, astir of the gross that banks make present is trading revenue, according to the Office of the Comptroller of the Currency. So, that conscionable allows them to trim their reserves and usage your wealth to gamble with. You don’t adjacent recognize it due to the fact that it’s invisible.

During the interview, Zang forecasted that astir everyone volition acquisition a “bail-in” owed to excessive wealth printing causing liquidity issues. The expert pointed to cracks successful the U.S. Treasury market, which is the instauration of the American economy. According to caller meetings, she stated that the Federal Deposit Insurance Corporation (FDIC) is alert of the imaginable for a important occupation successful the U.S. fiscal system. “They’re laughing astatine us,” she said. “[They maintain] that the mean retail clients don’t request to recognize there’s truly nary wealth successful the FDIC deposit security fund, and that they should expect to beryllium bailed in.”

During the interview, Zang warned astir the imaginable dangers of cardinal slope integer currencies (CBDCs). She believes that these integer currencies volition let for casual tracking of a user’s funds and spending habits, arsenic good arsenic the quality to frost those funds. Zang views CBDCs arsenic portion of the World Economic Forum’s projected Great Reset. She argued that wealthiness ne'er disappears, but simply shifts location, and if 1 does not ain it, idiosyncratic other does. “You whitethorn person nothing,” Zang said, “but I’m beauteous definite you won’t beryllium blessed due to the fact that you’ll beryllium renting everything,” she added.

Tags successful this story

American Economy, bail-in, Bail-ins, Bailouts, bank collapse, CBDC dangers, CBDCs, central slope integer currencies, chief marketplace analyst, collateral, confiscation authority, Congress, deposit, depositors, Dodd-Frank legislation, excessive wealth printing, FDIC, Federal Deposit Insurance Corporation, fiat currencies, frozen funds, funds tracking, Gambling, Great Reset, ITM Trading, Kitco News, Legislation, liquidity issues, loans, Lynette Zang, Michelle Makori, Purchasing Power, Regulation D, revenue, Savings, significant problem, sub-accounts, surveillance economy, trading, U.S banks, U.S. dollar, U.S. fiscal system, U.S. Treasury market, unsecured creditors, wealth shift, World Economic Forum

What bash you deliberation astir the warnings raised by Lynette Zang? Share your thoughts successful the comments below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)