Nasdaq filed a 19b-4 Form connected Jan.16 to database and commercialized the spot Litecoin (LTC) exchange-traded money (ETF) registered by Canary Capital. Bloomberg elder ETF expert Eric Balchunas sees this arsenic the archetypal altcoin-related ETF support successful 2025.

Following an update successful the S-1 Form filed by Canary, Balchunas stated that its Litecoin ETF “has each the boxes checked.” He added:

” don’t spot immoderate crushed wherefore this would beryllium withdrawn either fixed SEC gave comments connected the S-1, Litecoin is seen arsenic commodity and there’s caller SEC sheriff successful town.”

Earlier connected Jan. 16, Bloomberg expert James Seyffart highlighted that the amendment connected the S-1 Form was nary warrant of approval. Yet, it is simply a motion that the US Securities and Exchange Commission (SEC) is engaging with the matter.

After the Nasdaq filing news, Seyffart stated that it mightiness instrumentality a mates of weeks to corroborate the support odds, arsenic the SEC inactive has to admit the Litecoin ETF application.

He added that portion caller Solana (SOL) filings were not acknowledged, a Litecoin ETF mightiness much apt person the regulator’s attention. Seyffart reasoned that LTC is not taxable to the SEC’s accusations that it is simply a security, which boosts its odds.

Litecoin’s terms soared by astir 24% successful the past 24 hours, sitting astatine $129.49 arsenic of property time, according to CryptoSlate data. This is the largest regular summation wrong the 25 largest crypto by marketplace cap.

Wave of approvals

Seyffart and Balchunas predicted a question of ETF approvals would deed the marketplace successful 2025. The astir apt products to person SEC support were the mixed ETFs, tracking Bitcoin (BTC) and Ethereum (ETH).

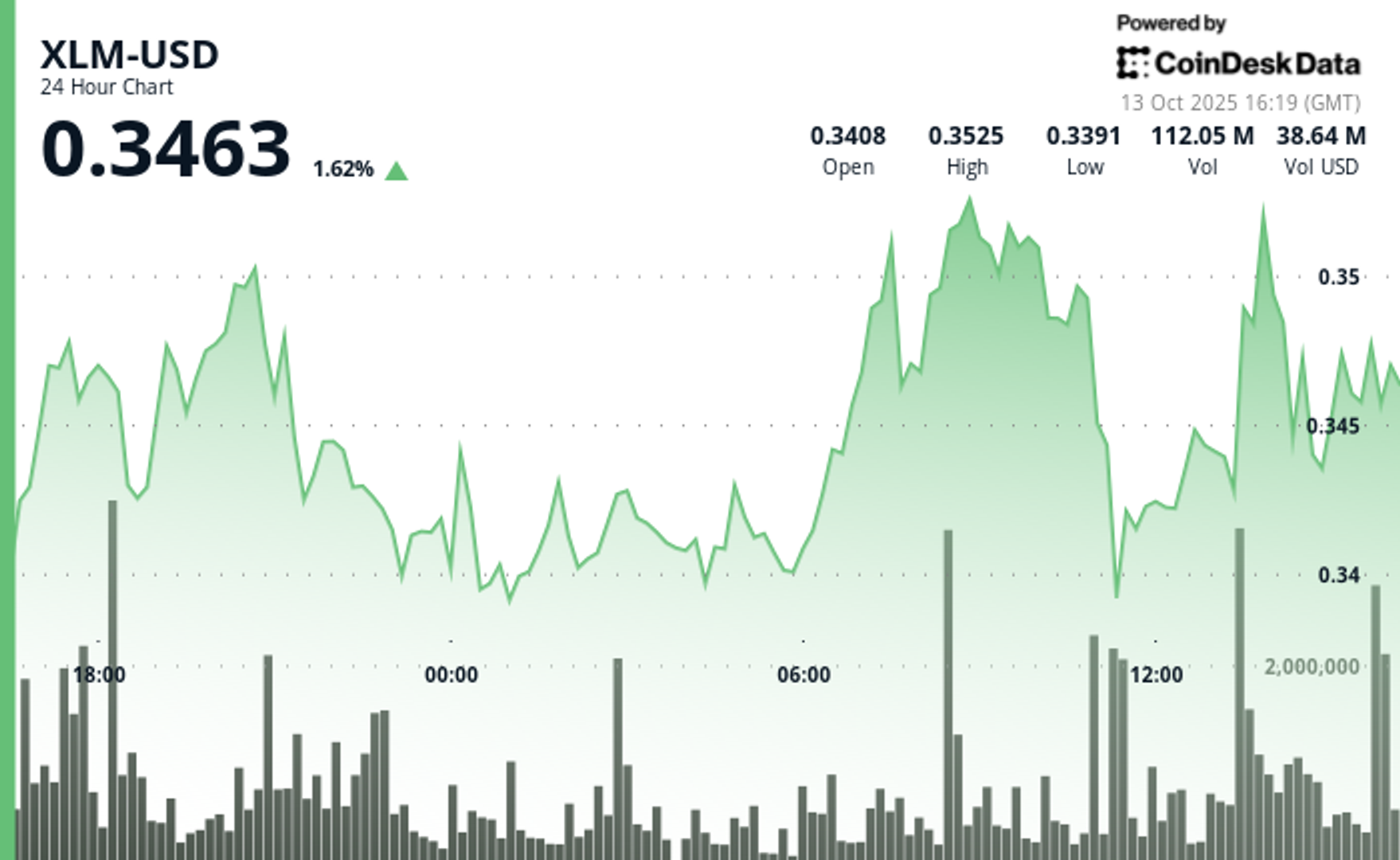

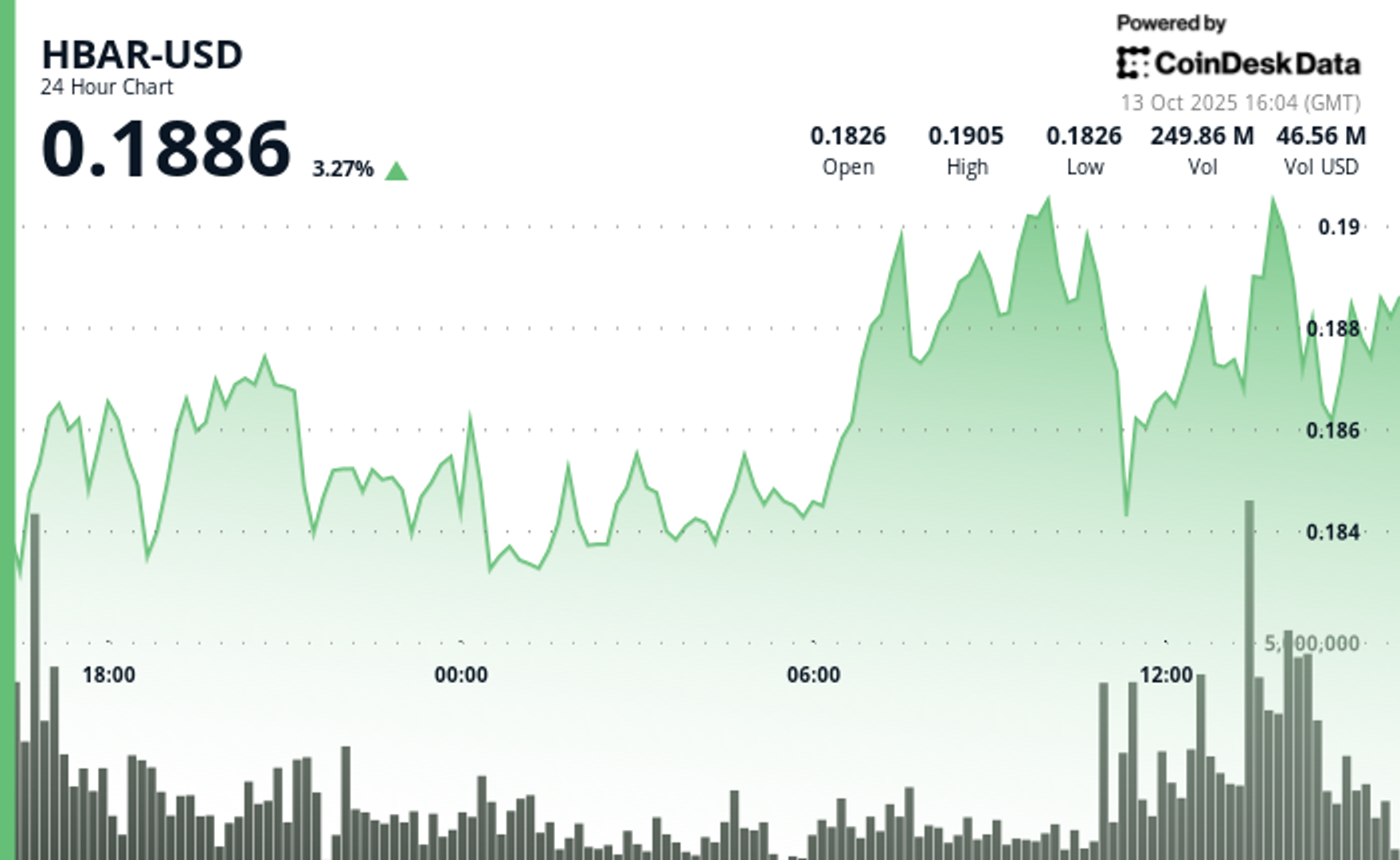

These products received their archetypal approvals successful 2024 erstwhile the regulator approved Hashdex and Franklin Templeton filings. The pursuing products connected the enactment are Litecoin and Hedera (HBAR), and the prediction is close connected track.

Funds tied to XRP and SOL are besides connected the list, though analysts judge they mightiness endure delays owed to the SEC lawsuits that see these crypto arsenic securities.

However, President-elect Donald Trump is reportedly considering including XRP, SOL, and USD Coin (USDC) successful the US National Reserve. This would favour the likelihood of support for spot XRP and SOL ETFs.

The station Analysts judge spot Litecoin ETF apt to beryllium the archetypal altcoin support arsenic Nasdaq files listing application appeared archetypal connected CryptoSlate.

8 months ago

8 months ago

English (US)

English (US)