The beneath is from a caller variation of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

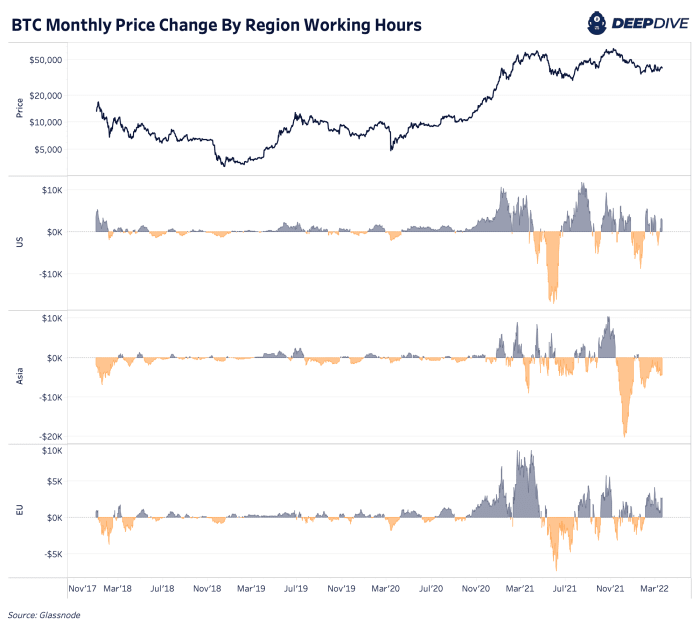

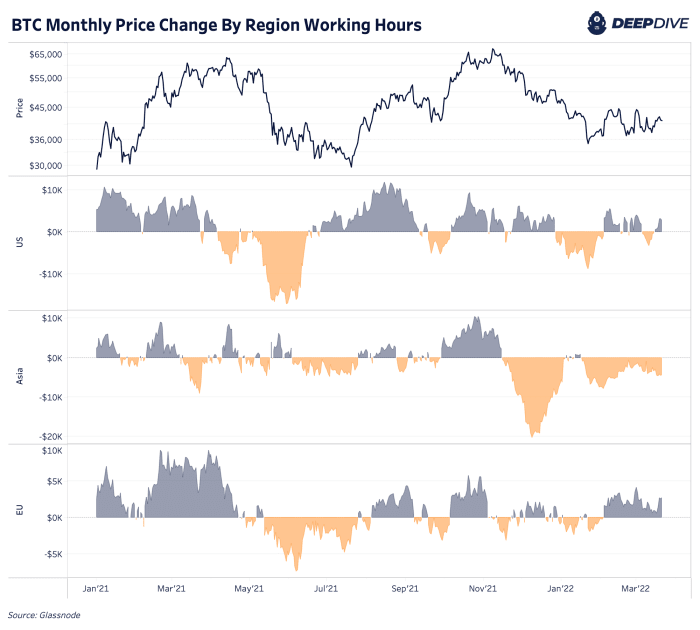

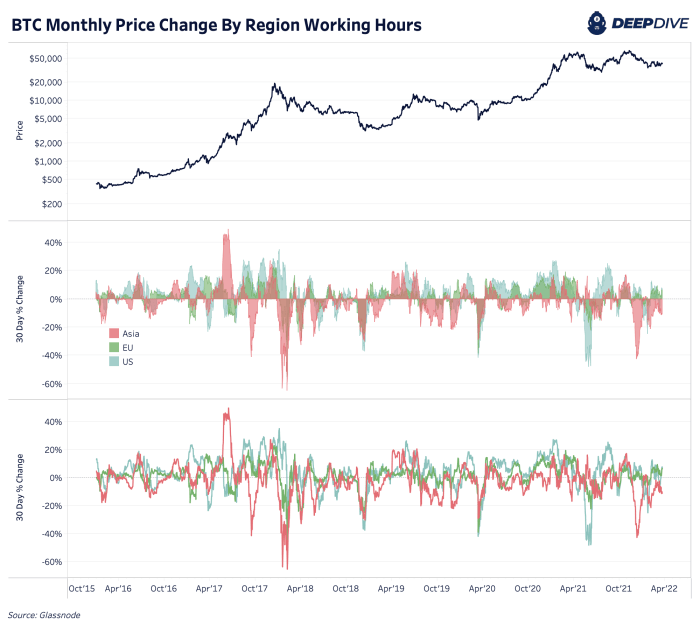

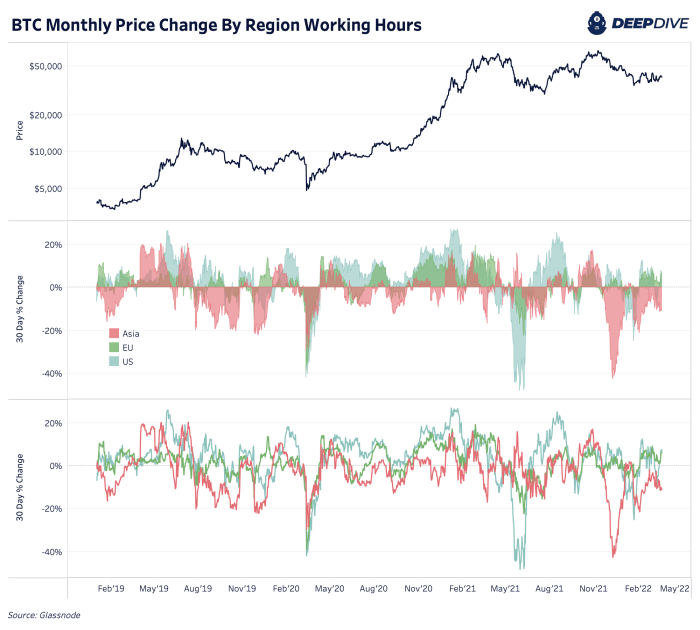

Thanks to Glassnode’s latest creativity and information engineering, we person a unsocial presumption of bitcoin’s terms changes crossed large determination moving hours. The charts beneath leverage their caller information which tracks the cumulative 30-day terms alteration during U.S., EU and Asian trading hours.

This provides america with an absorbing presumption of the market’s buy- and sell-side unit crossed geographic areas. The archetypal illustration beneath shows the implicit 30-day alteration successful terms since 2018. As terms progresses higher, the caller terms changes implicit the past twelvemonth basal retired much successful the archetypal chart. Below, we normalize this to a comparative percent alteration for easier humanities comparisons.

Over the past year, we tin spot that the July 2021 drawdown was heavy sold by the U.S. and moderately from the EU with comparatively tiny sell-side changes from Asia. Yet successful the existent drawdown from erstwhile all-time highs, Asia has dominated the sell-side unit successful the marketplace and continues to bash truthful successful bitcoin’s existent $35,000-to-$45,000 terms range. The latest terms momentum to the upside and hints of accrued request arsenic of precocious look to beryllium coming from U.S. and EU buyers.

We find the information easier to comparison connected a comparative percent ground successful the beneath charts. The much caller Asia selling unit (bitcoin terms alteration during China Standard Time moving hours) was immoderate of the strongest merchantability unit seen since the rhythm apical successful December 2017.

The strongest merchantability unit seen from the U.S. was from the 2 months anterior to the July 2021 section bottom. Some of the largest U.S. buy-side unit came close aft this bottommost with immoderate contiguous “buy the dip”-demand successful August 2021. As we basal today, the 30-day percent alteration successful bitcoin terms is up 6.4% during EU trading hours, up 7.1% successful the U.S. and down 11.1% successful Asia.

With specified a divergence successful bargain and merchantability unit crossed regions and persistent Asian-hours selling unit close now, it whitethorn beryllium clip for cautious optimism until we spot bitcoin prolong a breakout supra $45,000. From our view, we inactive look to beryllium successful a carnivore marketplace rally play for risk-on assets. Approximately $46,000 inactive reflects the latest short-term holder on-chain outgo basis.

3 years ago

3 years ago

English (US)

English (US)