Looking astatine antithetic metrics tin assistance find bitcoin’s spot successful the accepted marketplace rhythm and however macroeconomics tin interaction the bitcoin price.

Watch This Episode On YouTube oregon Rumble

Listen To The Episode Here:

In this occurrence of the “Fed Watch” podcast, Christian and I beryllium down with Dylan LeClair, caput of marketplace probe at Bitcoin Magazine Pro. Each week, helium and Sam Rule constitute near-daily updates for subscribers, and erstwhile a period they merchandise a ample Bitcoin marketplace report. Bitcoin Magazine Pro’s “May 2022 Report” is what we are covering for the astir portion successful today’s episode.

You tin find the descent platform we usage for this episode here, oregon you tin spot each the charts astatine the extremity of this post.

“Fed Watch” is the macro podcast for Bitcoiners. Each episode, we sermon existent macro events from crossed the globe, with an accent connected cardinal banks and currency matters.

Market Cycle

Before we get into the awesome charts that LeClair brought, I privation to get an thought of wherever helium sees bitcoin successful its marketplace rhythm timing. I ask, somewhat facetiously, if we are successful a carnivore market, due to the fact that we are decidedly not successful a emblematic 80-90% drawdown.

LeClair responds by saying we are successful a classical carnivore market, not needfully a classical bitcoin carnivore market. He points retired that the upswing of this rhythm didn’t person the emblematic parabolic blow-off apical we’ve seen antecedently successful bitcoin, arsenic good arsenic determination being much method and cardinal enactment successful the mid-$20,000s up to $30,000 — truthful drawdown unit volition besides apt beryllium limited. LeClair besides adds that the mean idiosyncratic outgo ground was deed by the wick to the caller lows. All successful all, determination is important enactment nether the existent terms and it remains to beryllium seen if determination is capable carnivore momentum to interruption to caller lows.

Lastly, connected the market-cycle timing questions, LeClair points retired a precise underappreciated marketplace development: the collateral benignant connected exchanges has mostly switched from bitcoin successful erstwhile cycles to present being stablecoins similar Tether (USDT) and USDC. In different words, the ascendant trading pairs and currency deposits connected exchanges person changed from bitcoin to stablecoins. In the past, the astir important trading brace for immoderate altcoin was versus BTC, which has changed to being versus a stablecoin similar USDT. This is simply a monumental displacement successful marketplace dynamics and volition apt pb to overmuch much unchangeable prices for bitcoin, due to the fact that little bitcoin volition beryllium forced to liquidate successful the hyper-speculative shitcoin bubbles.

Bitcoin Magazine Pro Charts

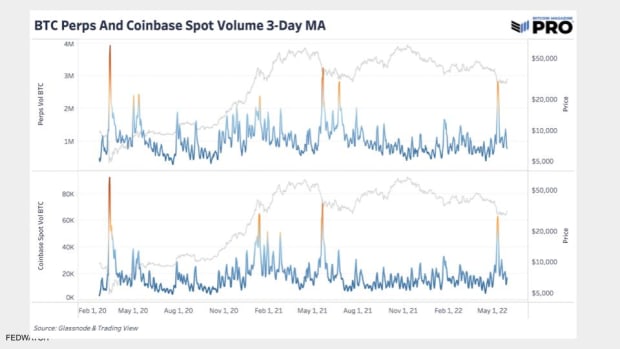

“This is Coinbase spot volume, being the ascendant American exchange, and the Perp [perpetual futures] measurement aggregated implicit a clump of antithetic derivatives exchanges. What we tin spot is assorted measurement spikes. Historically, erstwhile bitcoin is trading hands successful that size, it signals immoderate benignant of marketplace apical oregon bottom, immoderate important alteration successful marketplace structure.” – Dylan LeClair

Bitcoin perpetual futures and Coinbase spot volume

Bitcoin perpetual futures and Coinbase spot volume

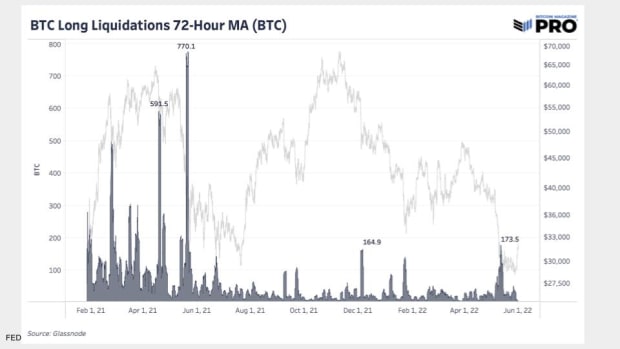

The adjacent illustration shows the quality successful marketplace operation owed to stablecoins. LeClair says that 70% of the derivative marketplace was inactive collateralized by bitcoin astir the 2021 summertime sell-off. Today, it is overmuch much smaller than that. Therefore, we should expect determination to beryllium less liquidations successful bitcoin erstwhile shitcoin bubbles pop, and that’s precisely what we see.

Bitcoin agelong liquidations are shrinking owed to stablecoin collateralization

Bitcoin agelong liquidations are shrinking owed to stablecoin collateralization

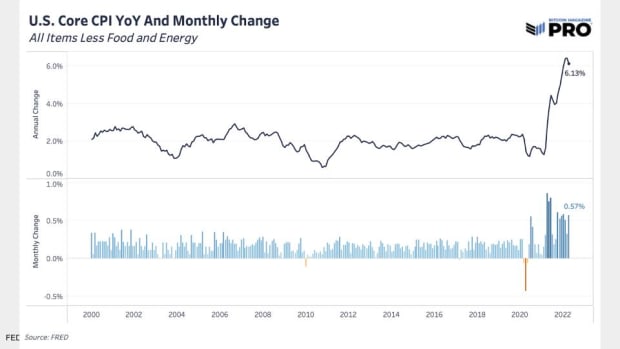

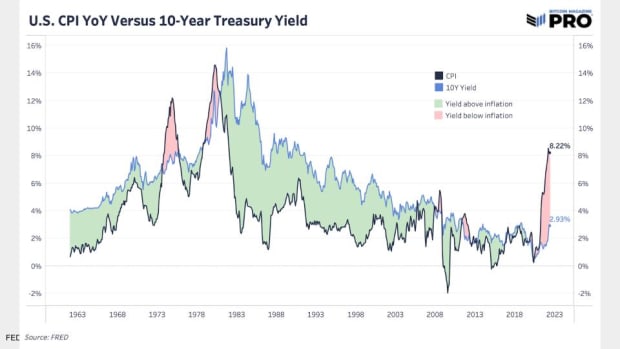

What is large astir the Bitcoin Magazine Pro newsletters is they not lone look astatine the bitcoin marketplace but besides however macro could beryllium affecting bitcoin. The adjacent 2 charts are astir CPI and involvement rates. LeClair does a large occupation breaking these down during the podcast.

Cunsumer terms scale year-over-year and the monthly change

Cunsumer terms scale year-over-year and the monthly change

Cunsumer terms scale year-over-year versus the 10-year Treasury yield

Cunsumer terms scale year-over-year versus the 10-year Treasury yield

I inquire LeClair astir his reasoning connected the Federal Reserve monetary policy, and helium focuses his investigation astir existent involvement rates. He says existent rates volition person to enactment antagonistic successful bid to erode the monolithic planetary indebtedness burden. Therefore, if the Fed hikes adjacent to 3.5%, for existent rates to enactment antagonistic the CPI volition person to enactment supra that.

Next up is CK’s favourite indicator, the Mayer Multiple, oregon the 200-day moving mean terms divided by existent price. When the terms is beneath the 200-day moving average, this ratio is beneath 1, and has historically been a bully mode to clip the market.

Bitcoin terms weighted by Mayer Multiple

Bitcoin terms weighted by Mayer Multiple

One of the astir dense informational charts connected Bitcoin Magazine Pro is up next, and that is Reserve Risk.

“The Reserve Risk illustration fundamentally weighs Hodler conviction, whether beardown oregon weak, with price.”

Bitcoin terms weighted by reserve risk

Bitcoin terms weighted by reserve risk

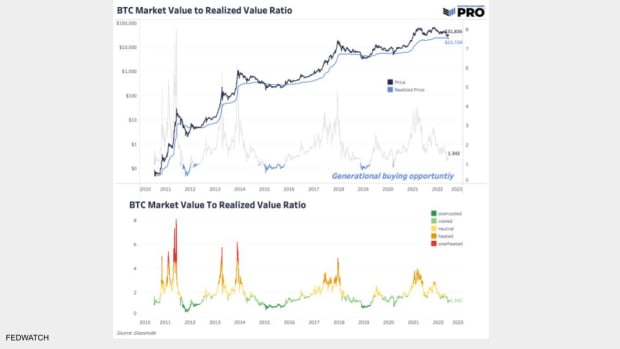

Our past illustration for the time is Realized Price, and this is LeClair’s favorite. It is simply a large mode to portion retired overmuch of the sound and volatility of the bitcoin terms and ore connected the trend.

“One of the chill things astir the transparency of this web is, we tin spot erstwhile each azygous bitcoin has ever moved, oregon was ever mined. We tin besides [assign each UTXO a terms of erstwhile it past moved] to travel with what we telephone Realized Price. [...] We tin spot erstwhile everyone is underwater connected average.” – LeClair

Bitcoin realized worth ratio

Bitcoin realized worth ratio

Bitcoin Regulation from Senator Lummis

At the extremity of the amusement we wrapper up with a treatment connected the precocious proposed draught legislation, by Senator Lummis, that outlines a caller model for bitcoin and what the measure calls “digital assets.” In fact, they don’t usage the presumption bitcoin, Ethereum, blockchain oregon adjacent cryptocurrency successful the draught astatine all.

Suffice it to say, we tease retired immoderate opinions from LeClair and spell backmost and distant with the livestream crew, but you’ll person to perceive to get that full insightful discussion! We dive into the effects connected the bitcoin market, exchanges and a aboriginal bitcoin spot ETF!

That does it for this week. Thanks to the readers and listeners. If you bask this contented delight subscribe, reappraisal and share!

This is simply a impermanent station by Ansel Lindner. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)