The beneath is from a caller variation of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

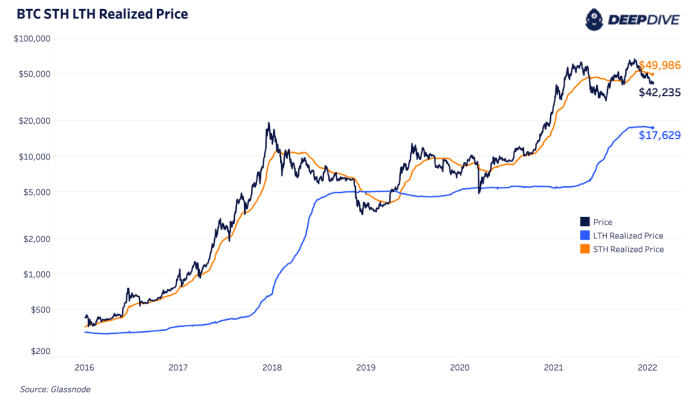

The existent short-term holder outgo ground has been a cardinal terms enactment to ticker implicit the past mates months arsenic it’s dropped from astir $53,000 to $49,986. Price beneath the short-term outgo ground is simply a reasonably cautious marketplace motion arsenic caller marketplace buyers are down 15.5% connected average. During the summertime of 2021, terms sustained beneath the short-term holder outgo ground for astir 3 months.

At the aforesaid time, we’re seeing small question successful the semipermanent holder realized terms with astir nary alteration since November. A rising semipermanent holder realized terms is typically a bullish motion with semipermanent holders selling older coins with a little outgo basis.

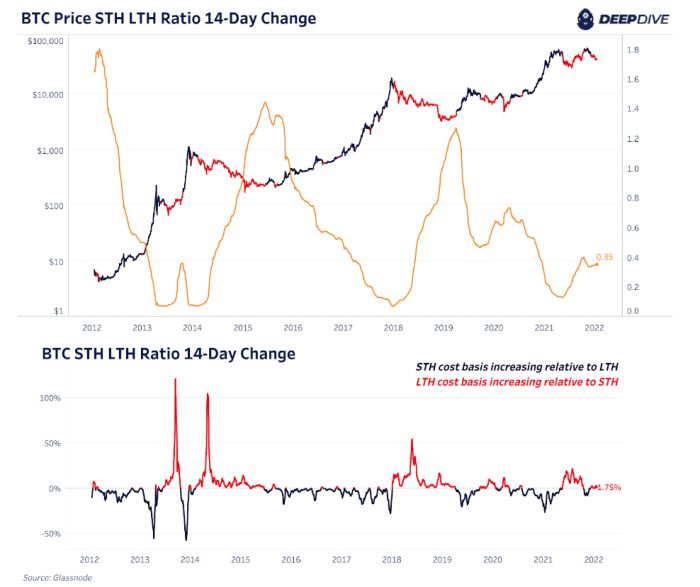

A amended mode to presumption this narration successful tandem is utilizing the Short-Term:Long-Term Cost Basis Ratio. We sermon the ratio much in-depth successful The Daily Dive #103 - Short-Term Holder Dynamics.

As the short-term holder outgo ground has fallen and the semipermanent holder outgo ground has remained reasonably neutral, the ratio is showing immoderate signs of a imaginable uptrend. An upward-sloping ratio is simply a much bearish marketplace sign.

Below, we item erstwhile the 14-day alteration successful the ratio is accelerating oregon decelerating. Dark bluish shows erstwhile the STH outgo ground is expanding comparative to the LTH outgo basis. Red shows erstwhile the LTH outgo ground increases comparative to the STH outgo basis. Historically this has been a prime awesome to measure tops and bottoms.

Short-term holders relationship for 18.23% of outstanding circulating supply, a fig that is adjacent five-year lows, with 93% of said abbreviated word holders presently sitting successful loss.

3 years ago

3 years ago

English (US)

English (US)