The pursuing is simply a impermanent station from Vincent Maliepaard, Marketing Director astatine IntoTheBlock.

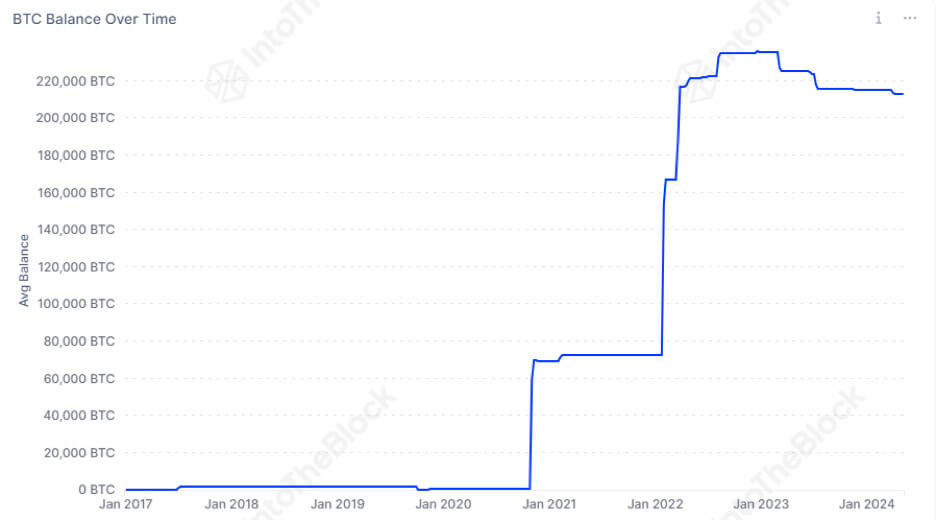

According to the latest information from IntoTheBlock, the U.S. authorities holds implicit 1% of the Bitcoin supply, valued astatine an awesome $13.16 billion. These holdings person tripled since 2021, demonstrating a accordant summation implicit the years.

Why the US authorities holds Bitcoin

It’s important to clarify that the U.S. government’s Bitcoin holdings are not the effect of purchases but enforcement actions. These seizures typically hap successful effect to amerciable activities.

Spikes successful the magnitude of Bitcoin held by the US authorities are associated with the biggest BTC-related enforcement actions. Notable instances see the Silk Road vase and the Bitfinex hack.

Silk Road (2013):

One of the astir notable cases progressive the seizure of astir 174,000 bitcoins from Silk Road, a acheronian web marketplace. The FBI unopen down Silk Road and arrested its founder, Ross Ulbricht. In a melodramatic twist, the US authorities aboriginal seized implicit $1 cardinal worthy of Bitcoin linked to Silk Road, recovered successful a antecedently undiscovered wallet holding astir 69,370 bitcoins.

Bitfinex Hack (2016):

In August 2016, hackers breached Bitfinex, a salient cryptocurrency exchange, stealing astir 120,000 BTC, valued astatine astir $72 million.

Years later, successful February 2022, the Department of Justice announced the betterment of a important information of the stolen Bitcoin, valued astatine implicit $3.6 billion. This marked the largest recoveries of stolen crypto successful history.

Other notable seizures

While Silk Road and Bitfinex are among the astir salient cases, respective different important seizures person occurred. In 2017, the US seized bitcoins worthy $4 cardinal (currently valued astatine implicit $60 million) from the BTC-e speech during a multi-agency probe into alleged wealth laundering activities. Alexander Vinnik, the alleged relation of BTC-e, was arrested.

Another notable lawsuit involves the 2020 seizure of assets from the founders of the BitMEX speech for violations of the Bank Secrecy Act. Although circumstantial amounts of Bitcoin weren’t disclosed, BitMEX handled ample volumes of Bitcoin transactions.

Implications of Government Holdings

Monitoring the holdings of ample Bitcoin stashes, specified arsenic those held by the U.S. government, is important for respective reasons.

Firstly, the decisions surrounding whether and erstwhile the authorities moves these Bitcoins could importantly power marketplace dynamics. The method of their release—be it via nonstop sale, auction, oregon different approach—can either mitigate oregon exacerbate marketplace impact.

For example, auctioning disconnected the coins could pull organization investors who worth the transparency and legitimacy of “government-sanctioned” Bitcoin. This reassurance is peculiarly important for those acrophobic astir the origins of their crypto holdings, arsenic purchasing from reputable sources avoids the risks associated with funds tied to amerciable activities.

Share of Bitcoin proviso held by the US government. Source

Share of Bitcoin proviso held by the US government. SourceSimilarly, the US authorities holds capable Bitcoin to impact marketplace prices importantly upon releasing their holdings, which could pb to speculative behaviour among smaller investors trying to expect oregon respond to these moves.

But determination is much to the story. A important information of the Bitcoin proviso is controlled by authorities and ETF entities, posing a imaginable threat. According to Juan Pellicer, Senior Researcher astatine IntoTheBlock:

The existent ownership levels of Bitcoin among U.S. authorities and ETF entities airs a imaginable hazard to the cognition of Bitcoin arsenic an plus beyond the power of authorities forces oregon large fiscal institutions. The US authorities holds implicit 1% of the Bitcoin supply, valued astatine implicit $13.16 billion, portion Bitcoin ETF issuers power $50.6 billion, accounting for implicit 4% of the BTC supply. This precocious attraction of holdings challenges the communicative of Bitcoin’s decentralization and could power marketplace dynamics and capitalist behaviour successful the future.’

Thus, monitoring these important holdings is astir knowing existent marketplace values and foreseeing imaginable marketplace shifts.

The station Analyzing the US Government’s Bitcoin holdings: What you request to know appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)