Wrapped Bitcoin is the starring signifier of Bitcoin “wrapped” successful a astute declaration connected the Ethereum network. This allows it to beryllium utilized successful Ethereum-based decentralized concern (DeFi) applications. WBTC is backed 1:1 to the worth of Bitcoin, truthful 1 WBTC is theoretically equivalent to 1 BTC.

BitGo is the main WBTC issuer, meaning they are liable for the BTC backing and custody. Alameda Research, Sam Bankman-Fried’s Prop Fund, was a WBTC apical merchant, which means they would judge BTC from customers and nonstop it to BitGo to mint WBTC.

While being a merchant does not supply entree into the custody, pursuing the fear, uncertainty, and uncertainty (FUD) of FTX’s collapse, WBTC started to depeg nether the presumption that its reserves were incomplete. This nonfiction analyzes WBTC on-chain indicators and the FUD astir the asset’s depeg.

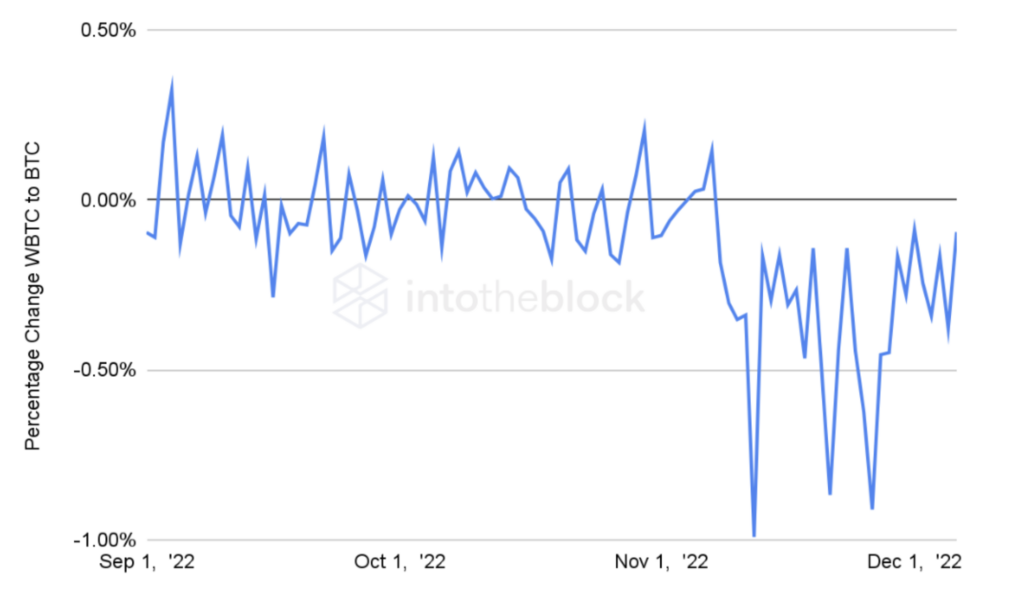

Source: IntoTheBlock & CoinGecko

Source: IntoTheBlock & CoinGeckoWBTC’s terms dropped by 1.5%, portion FUD astir its custody emerged. Small depegs tin contiguous important concerns arsenic they tin pb users to suffer assurance successful the pegged plus and the issuer. A depeg plus whitethorn beryllium perceived arsenic a little unchangeable and reliable store of value, which tin origin radical to suffer assurance successful it and perchance pb to a alteration successful demand.

This tin marque it much hard for the issuer to support the peg and pb to further redemptions and nonaccomplishment successful value.

Additionally, successful the lawsuit of WBTC, wide utilized arsenic a mean of speech crossed DeFi, its nonaccomplishment of worth tin origin disruptions successful the full ecosystem. In this case, arbitrageurs could process redemptions and bring the terms backmost to parity, arsenic the BitGo team confirmed its implicit backing of reserves and processed the redemptions submitted.

Moreover, volatility besides affected the markets during this clip arsenic traders sought to safeguard their assets from uncertainty.

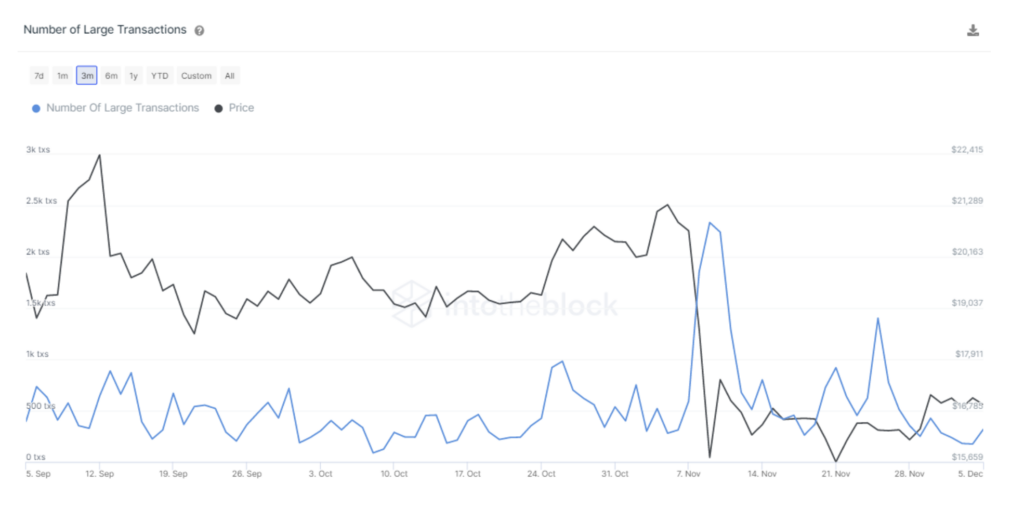

Source: IntoTheBlock’s WBTC’s Analytics

Source: IntoTheBlock’s WBTC’s AnalyticsThe indicator supra shows the fig of transactions greater than $100,000. Since this sum of wealth is not disposable to the mean retail trader on-chain, the metric acts arsenic a proxy to the fig of whales and organization traders that processed a transaction.

This helps recognize large token holders’ behavior. As it tin beryllium seen, November 25th was the 2nd highest recorded fig of transactions aft the day successful which FTX collapsed successful a 3-month spam. Transactions, successful this case, tin bespeak users selling oregon transferring an plus to beryllium sold.

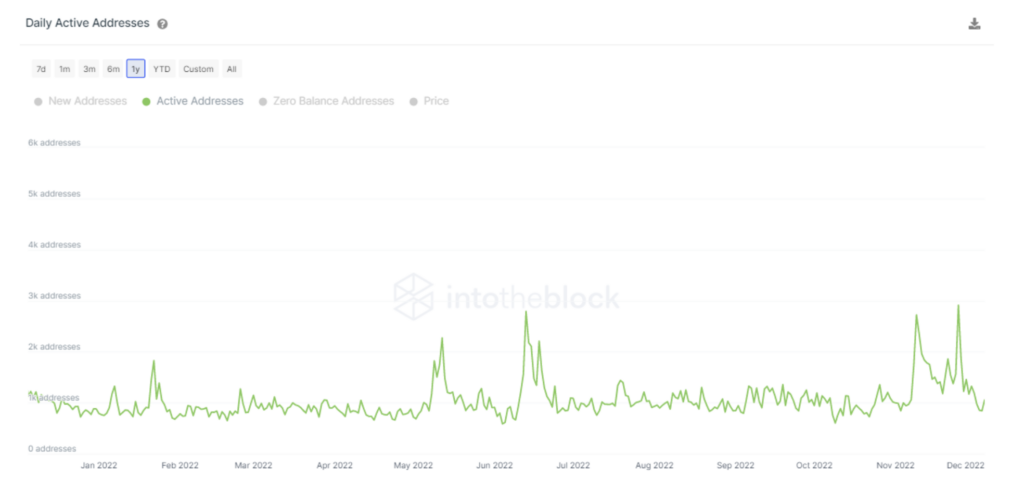

Whales and institutions were not the lone ones disquieted astir the underlying worth of WBTC, arsenic the fig of “active addresses” connected November 25th was the highest recorded successful much than 1 year.

Source: IntoTheBlock’s WBTC’s Analytics

Source: IntoTheBlock’s WBTC’s Analytics“Active addresses” basal arsenic addresses that marque 1 oregon much on-chain transactions connected a fixed day. This helps amusement the web activity. In this case, it illustrates however radical took precautionary measures towards the plus depeg.

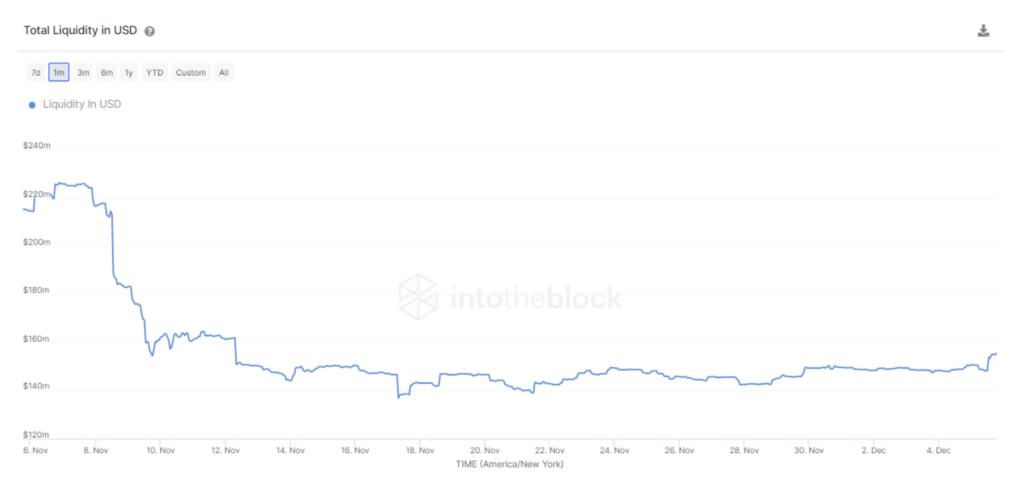

Despite galore WBTC holders transferring and selling their assets, on-chain information reveals that Curve’s Tricypto2 excavation liquidity was unaffected by these events. Rather than being affected by the BitGo FUD, the excavation experienced dense withdrawals during the FTX collapse. Tricypto2 presently stands arsenic the biggest market, successful presumption of liquidity deposited, for trading WBTC on-chain.

Source: IntoTheBlock’s WBTC’s Analytics

Source: IntoTheBlock’s WBTC’s AnalyticsLiquidity is an important origin successful the functioning of a DEX, arsenic it determines however easy users tin bargain and merchantability assets connected the platform. A DEX excavation with precocious liquidity volition person a ample fig of assets disposable for trading, which makes it easier for users to bargain and merchantability the assets they want.

This tin summation the attractiveness of the DEX excavation to traders and marque it much wide used. In this case, the greater the liquidity successful the excavation the much disposable for users wanting to exit their WBTC positions.

Overall, if a pegged plus starts to suffer its value, it tin make respective problems for some the issuer and the holders. Loss of assurance successful its issuer tin pb users to uncertainty the worth of the pegged asset. Furthermore, its depeg tin origin large disruptions crossed the DeFi ecosystem. In this case, BitGo was capable to clarify the misconception that had been dispersed astir tweeter and supply impervious of the custody reserves.

The station Analyzing the WBTC FUD aft the FTX illness and its depeg appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)