Ever seen “The Revenant”? To my memory, the past crypto carnivore marketplace was a small similar that.

Alejandro Iñárritu’s 2015 Best Picture nominee is simply a bleak, grueling retelling of the fable of Hugh Glass, an enduring 19th period American frontiersman who – aft being mauled by a carnivore – embarks connected a gory pursuit of his son’s killer. One item amid the assorted scalpings, hangings and quality and carnal suffering of each kinds comes erstwhile Glass survives a snowstorm by taking refuge successful the disemboweled corpse of his horse. In another, helium cauterizes a toothy cervix coiled with gunpowder. It’s a unsmooth watch!

This nonfiction primitively appeared successful Valid Points, CoinDesk’s play newsletter breaking down Ethereum 2.0 and its sweeping interaction connected crypto markets. Subscribe to Valid Points here.

Weekly progressive Ethereum addresses fell arsenic debased arsenic 165,000 successful February 2019. Decentralized autonomous organizations (DAO) efficaciously didn’t beryllium until Moloch DAO and MakerDAO resuscitated the concept. OpenSea, present a non-fungible token (NFT) powerhouse transacting successful the billions of dollars, sold $475,000 successful tokens full for the full 2018 year. Decentralized concern (DeFi) accounted for nether a cardinal dollars.

This clip astir the carnivore looks a small different, to accidental the least. Indeed, there’s adjacent immoderate statement arsenic to whether oregon not we’re genuinely successful a carnivore marketplace astatine all: In accepted finance, carnivore markets are marked by a 20% downturn. In crypto, grizzled aged heads volition archer you the carnage hasn’t started until your favourite semipermanent play is down 90% ... and past different 90% erstwhile you effort to bargain the dip.

By those standards, truthful acold the bear marketplace of 2022 looks much similar Winnie the Pooh than a due predator.

Ethereum continues to fizz with activity, with pockets of development, usage and adoption that stay robust – and 1 could reason mightiness adjacent beryllium stronger than ever – successful spite of anemic terms action.

Ultimately, it’s a motion of the maturity of the technology. In 2018 the ecosystem was the asset: The lone worth Ethereum had was the speculative committedness of what it could 1 time become, and to what grade ether (ETH) reflected that promise.

Today, immense swaths of what’s being built connected Ethereum are mostly agnostic to ether’s price, and successful astatine slightest 1 lawsuit whitethorn adjacent beryllium inversely correlated. Far from a horrific trek crossed a desolate, bloody tundra, this carnivore marketplace features plentifulness for Ethereans to beryllium excited about.

Read the afloat communicative here.

Since the extremity of January, the aggregate full worth locked (TVL) crossed the DeFi ecosystem has remained successful a comparatively choky $210 cardinal to $190 cardinal range, contempt terms fluctuations upwards of 25% successful ETH ($3,250-$2,400), and adjacent much volatility from Ethereum Virtual Machine (EVM) compatible chains similar Avalanche’s AVAX ($98-$65) and Fantom’s FTM ($2.4-$1.05) during the aforesaid period.

This unchangeable complaint of deposits astir confirms the thesis I laid retired successful aboriginal December 2021: Despite having a estimation for being utilized chiefly arsenic a instrumentality for speculation and leverage, DeFi volition stay robust adjacent during times of marketplace turbulence – and, indeed, possibly adjacent successful an extended carnivore marketplace – due to the fact that of the ample income opportunities afforded to users.

Back then, I was trying to fig retired wherefore DeFi was truthful resilient successful the look of a veritable Kubrickian blood-elevator successful prices: Bitcoin (BTC) nosedived from $57,000 to $42,000, portion ether tanked from $4,600 to $3,500 – each successful a substance of hours. And yet, deposits remained healthy.

What experts told maine was that arsenic agelong arsenic output farmers tin reap bumper returns comparative to offchain opportunities, the deposits volition instrumentality around. In fact, galore yields are really driven by volatility: Uniswap positions, for instance, feast connected precocious volumes. In immoderate ways, DeFi tin actively payment from humor elevators.

The outlook for traders remains grim, but for those who task into the fields opportunities abound.

The look of mainstream NFT adoption

In NFT-land volumes and level prices look anemic compared to 2021 highs, but yet the market’s vitals are not those of a diligent connected beingness enactment – not adjacent close.

On the 1 hand, OpenSea’s Ethereum volumes are acceptable to station an eight-month low. On the other, monthly progressive users are connected gait to narrowly interruption the all-time precocious of ~550,000. Not to mention, the overwhelming marketplace person conscionable closed a backing rise astatine a $13.3 cardinal valuation.

Trying to scry level prices besides yields mixed signals. Volumes for fashionable collections are down arsenic overmuch arsenic 60% connected a 30-day basis, and floors for CryptoPunks are besides down 50% from their highs. Nonetheless, newcomers similar Azukis proceed to interruption into the top-10 charts and merchantability retired with ease.

Mainstream adoption continues astatine a stunning clip. Nike (NKE) made 1 of the fewer acquisitions successful its institution past when it bought RTFKT, and NFTs are widely reported to person taken halfway signifier astatine the South by Southwest (SXSW) festival.

Cherry-pick from supra nevertheless you like. I’m assuming the Kotakus of the satellite volition effort different “NFTs are dead” portion astatine immoderate constituent and they person a tenable case, but I’m personally dubious this each collectively gets enactment backmost successful the box.

NFTs are starring the adoption complaint for crypto, and portion the astir high-profile caller entrants skew older (say, recently unretired backmost Tom Brady oregon erstwhile New York Times writer Kevin Roose), the demographic coming successful is overwhelmingly young and consenting to experiment. I don’t deliberation they’re going anywhere.

Finally, erstwhile it comes to DAOs, the nascent organizations are wide anticipated to beryllium a hotspot for innovation and improvement passim the carnivore marketplace – and for bully reason.

Money aside, however, here’s my transportation connected wherefore DAOs volition look from the carnivore stronger than ever: There are dozens, if not hundreds, of tremendously well-capitalized entities that person glaring needs, and alternatively of waiting for our VC overlords to money solutions, they tin ammunition retired the dough to code those needs themselves.

Huge swaths of that estimated $9.1 billion successful treasury funds volition spell to tooling, and determination volition beryllium acold less symptom points this clip adjacent year.

If immoderate of this strikes our loyal readers arsenic overly optimistic, I don’t blasted you! Price enactment has been sucking wind.

Still, adjacent the astir beaten and bloodied trader can’t comparison the existent carnivore with the past one. Price enactment was each that mattered backmost then; today, adjacent an inexperienced idiosyncratic tin deposit funds crossed a wide scope of platforms offering astute contract-based equivalents of astir fiscal services. They tin past ballot connected the aboriginal wellness of those platforms via DAO governance, and I don’t cognize wherefore they would, but they tin adjacent cod cute monkey representation NFTs with the involvement connected their deposits.

The exertion has mostly delivered connected its promise. Put successful the astir basal terms, the quality betwixt the past carnivore and this 1 is that there’s worldly to do, and aft a historical bull tally there’s wealth to walk doing it.

This elemental information is simply a testament to the enactment believers enactment successful 4 years ago, and it’s wherefore this trek done the tundra won’t beryllium arsenic grueling.

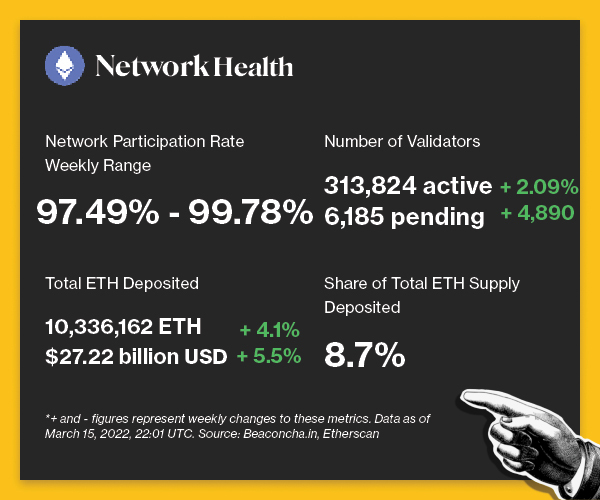

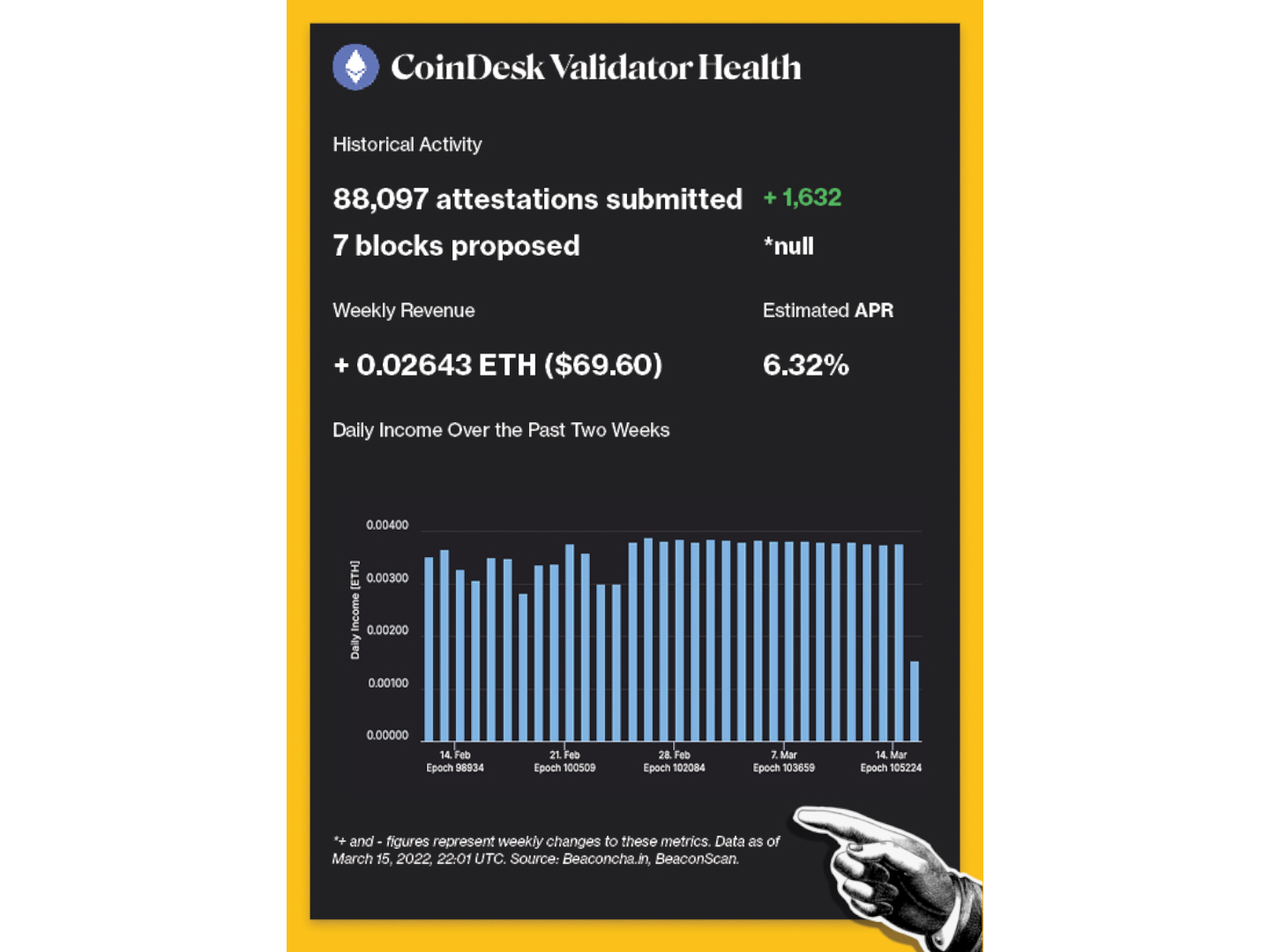

The pursuing is an overview of web enactment connected the Ethereum Beacon Chain implicit the past week. For much accusation astir the metrics featured successful this section, cheque retired our 101 explainer connected Eth 2.0 metrics.

(Beaconcha.in, Etherscan)

(Beaconcha.in, BeaconScan)

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking task volition beryllium donated to a foundation of the company’s choosing erstwhile transfers are enabled connected the network.

Ethereum builder ConsenSys raised $450 cardinal astatine a $7 cardinal valuation. BACKGROUND: ConsenSys has been a halfway operator successful the improvement and usage of the Ethereum ecosystem. For instance, MetaMask, ConsenSys’s flagship Ethereum wallet, has reached implicit 30 cardinal monthly progressive users, portion Infura, a level created by ConsenSys that provides API services to link to Ethereum, has implicit 430,000 developers. The institution is reportedly readying assertive expansion, though looming litigation from disgruntled shareholders whitethorn dilatory it down.

The Ethereum Foundation announced the Kiln Merge testnet, which is “expected to beryllium the past merge testnet created earlier existing nationalist testnets are upgradeable.” BACKGROUND: The Kiln is acceptable to beryllium a successor to the Kintsugi merge testnet, which allowed Ethereum developers to successfully instrumentality unchangeable and robust protocol specifications for the ecosystem. Now that developers, node operators, infrastructure providers and stakers tin trial connected the Kiln testnet, we are person than ever to a proof-of-stake Ethereum mainnet.

A $200 cardinal rise has valued Immutable, a liquidity and scaling level for NFT’s built connected Ethereum, astatine $2.5 billion. BACKGROUND: The funds volition beryllium utilized toward planetary expansion, including boosting Immutable Gaming Studio and merger-and-acquisitions activity. Robbie Ferguson, co-founder and president of Immutable, said on CoinDesk’s “First Mover” for March 15, 2022, that Immutable plans to bring blockchain gaming to the masses and reinvent the astir important Web 2 companies, particularly successful societal media.

Goldman Sachs (GS) is offering clients entree to an ether money done Galaxy Digital, a technology-driven fiscal services firm. BACKGROUND: Regulatory documents filed past week with the U.S. Securities Exchange Commission amusement the money has sold astir $50 cardinal to clients with a minimum concern magnitude of $250,000. The bank’s effort to connection much vulnerability successful ether to their clients demonstrates ample organization request for integer assets and its ecosystem.

As of March 15, 2022, the Ethereum transaction fee-burning mechanics has removed 1,980,244 ETH from the network’s circulation since the implementation of EIP 1559. The full burnt proviso of ETH is worthy astir $5.15 billion.

Valid Points incorporates accusation and information astir CoinDesk’s ain Eth 2.0 validator successful play analysis. All profits made from this staking task volition beryllium donated to a foundation of our choosing erstwhile transfers are enabled connected the network. For a afloat overview of the project, cheque retired our announcement post.

You tin verify the enactment of the CoinDesk Eth 2.0 validator successful existent clip done our nationalist validator key, which is:

0xad7fef3b2350d220de3ae360c70d7f488926b6117e5f785a8995487c46d323ddad0f574fdcc50eeefec34ed9d2039ecb.

Search for it connected immoderate Eth 2.0 artifact explorer site,

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to The Node, our regular study connected apical quality and ideas successful crypto.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

2 years ago

2 years ago

English (US)

English (US)