While the decentralized concern (defi) level Anchor Protocol’s autochthonal integer plus ANC has gained much than 180% implicit the past month, the full worth locked (TVL) successful Anchor has accrued a large woody during that clip arsenic well. Anchor Protocol is presently the second-largest defi lending level successful presumption of TVL, and implicit the past month, Anchor’s TVL has accrued by 40.13%.

Anchor TVL Surges More Than 40% successful 30 Days, Protocol’s TVL Rivals Aave’s Lead

The Terra-based token anchor protocol (ANC) has accrued successful worth importantly against the U.S. dollar during the past month. At the clip of writing, 14-day metrics amusement ANC has gained 82.7%, and 30-day stats bespeak ANC is up 182.4%.

Anchor is simply a lending protocol built with the Terra blockchain network, and it gathers liquidity from lenders and borrowers. Moreover, lenders depositing the stablecoin terrausd (UST) stitchery a stabilized output astatine adjacent to 20% APY.

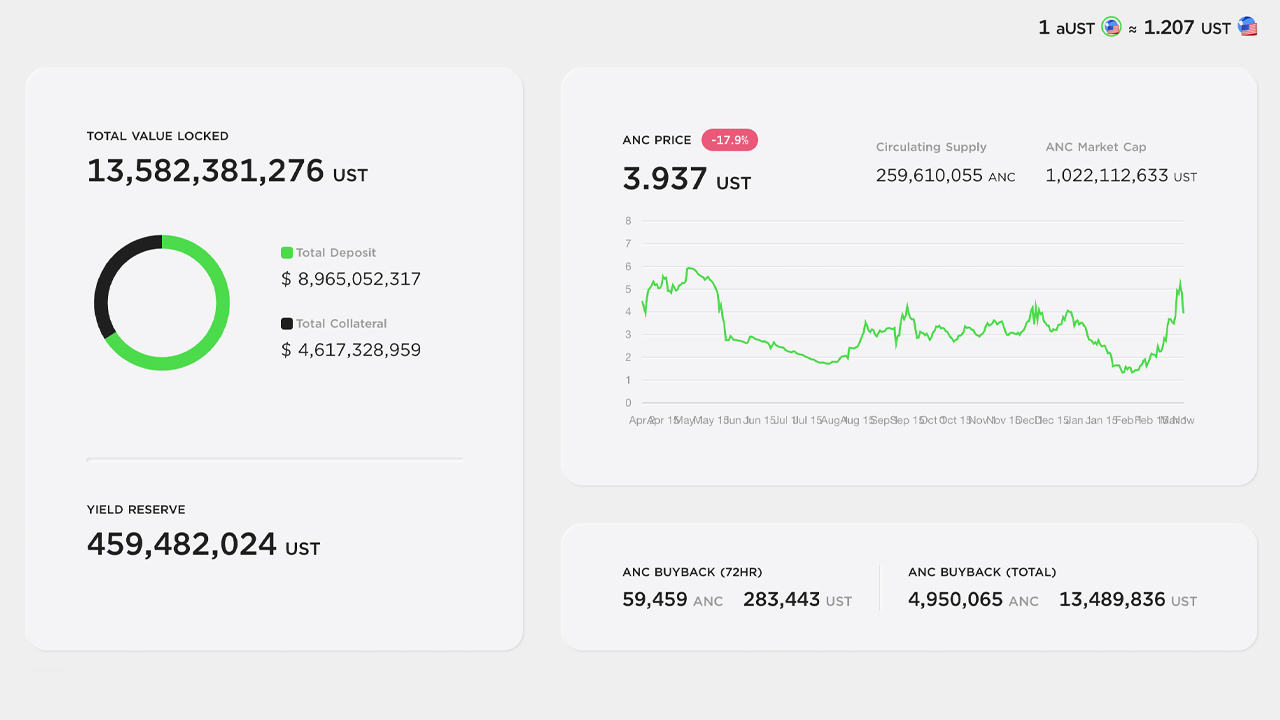

Anchor protocol dashboard statistic connected March 7, 2022.

Anchor protocol dashboard statistic connected March 7, 2022.In bid to stitchery yield, Anchor uses a liquid-staking mechanism. Anchor and Orion Money besides connection Ethanchor, which allows depositors to stitchery output connected Ethereum-based stablecoins successful opposition to Anchor’s UST functionality.

Currently, Anchor is the sixth-largest defi exertion today, retired of each the defi applications successful beingness according to defillama.com metrics. Anchor’s TVL has accrued 5.55% implicit the past week, but monthly statistic bespeak the protocol’s TVL jumped 40.13% since past month. Much of Anchor’s TVL summation to $11.5 cardinal occurred during the past 30 days.

In presumption of the 124 lending applications, Anchor is present the second-largest defi lending protocol nether Aave. The lending protocol Aave is conscionable a hairsbreadth supra Anchor arsenic Aave presently has a TVL of astir $11.6 billion.

Below Anchor, successful presumption of lending defi apps by TVL, see protocols similar Compound ($6.48B), Justlend ($1.86B), Venus ($1.62B), Banqi ($1.11B), and Iron Bank ($1.06B) respectively.

Anchor metrics besides amusement determination is $2.46 cardinal borrowed by borrowers contiguous and radical successful indebtedness person to leverage bonded LUNA oregon bonded ETH for collateral. Anchor’s documentation says that the defi lending protocol has 3 audits.

One audit published by Cryptonics goes implicit Anchor’s astute contracts and different audit by Cryptonics reviews Anchor’s organisation of ANC and astute contracts. Furthermore, past July an Anchor audit report was published by the squad astatine Solidified.

Tags successful this story

$11.5 billion, $2.46 cardinal borrowed, 20% APY, Aave, ANC, Anchor, anchor protocol, Anchor Protocol (ANC), Anchor TVL, APY, Bonded Ether, Bonded Luna, Cryptonics, decentralized finance, DeFi, defi application, defi lending, Defi protocol, Ethanchor, Liquid Staking Mechanism, Solidified, Stable Yield, Stablecoin UST, Terra, terra (LUNA), UST

What bash you deliberation astir Anchor moving up the ladder to the second-largest defi lending exertion today? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

![Best Bitcoin & Crypto Wallets [November 2025]: Self-Custody Just Got Smarter](https://static.news.bitcoin.com/wp-content/uploads/2025/11/best-bitcoin-crypto-wallets-november-2025-768x432.png)

English (US)

English (US)