Following the governance ballot that aimed to instrumentality a semi-dynamic gain complaint for the Anchor Protocol, the decentralized concern (defi) platform’s gain complaint adjusted downward for the archetypal clip this month. After holding dependable with a 19.4% yearly percent output (APY) since the task started, Anchor Protocol’s gain complaint is present astir 18% APY for the period of May.

Defi Lending Protocol Anchor’s Earn Rate Adjusts Downward

The lending level Anchor Protocol is the third-largest defi protocol contiguous with $16.5 cardinal full worth locked (TVL). Statistics amusement that during the past 30 days, Anchor’s TVL has accrued 9.25% since past month.

Around 45 days ago, the squad down the lending protocol announced that a connection had passed and the decentralized wealth marketplace would person a fluctuating gain rate. Before the proposal, Anchor users who deposited terrausd (UST) would get a dependable 19.4% APY gain complaint connected their UST deposits each month.

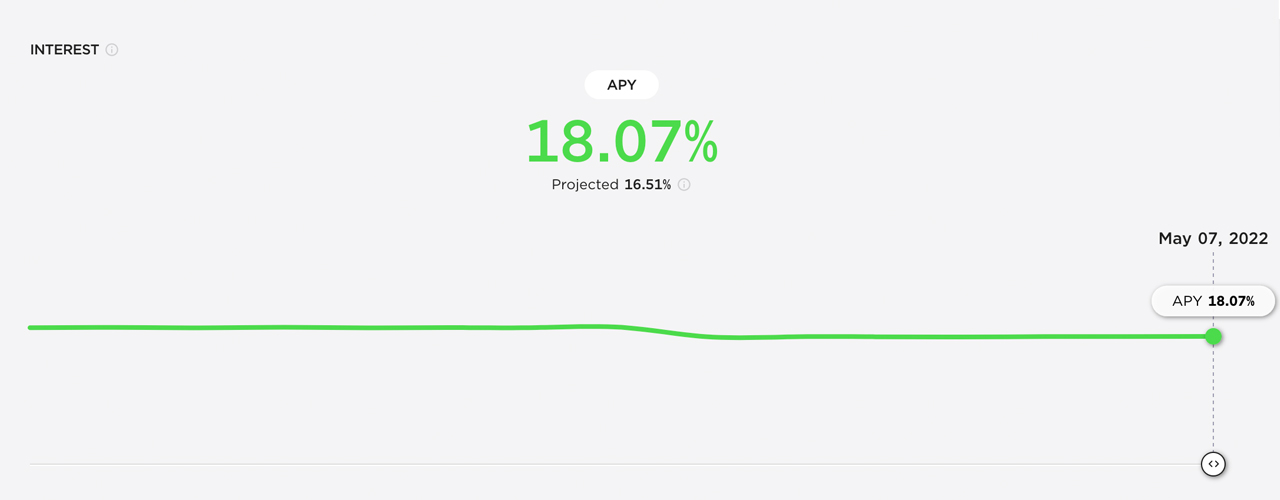

Anchor Protocol’s existent APY stats.

Anchor Protocol’s existent APY stats.Since the governance ballot passed, the archetypal semi-dynamic accommodation took spot astatine the commencement of May, and depositors contiguous are getting astir astir 18% APY. Since the alteration took place, the gain complaint tin summation oregon alteration per play to 1.5% depending connected the summation and decreases successful output reserves.

With the existent 18% APY, the alteration means this month, depositors volition beryllium getting little than they utilized to get anterior to the accommodation change. Furthermore, successful June the gain complaint could precise good alteration again depending connected the protocol’s output reserves.

Anchor Protocol present supports 2 blockchains, arsenic Avalanche enactment was precocious implemented. While $16.27 cardinal stems from Terra-based tokens, $202.48 cardinal worthy of Anchor’s TVL is comprised of Avalanche-based tokens. Currently, there’s $2.9 cardinal that’s been borrowed from the Anchor Protocol successful defi loans.

The Anchor gain complaint fluctuation follows the caller defi forex reserve purchases made by the Luna Foundation Guard (LFG). The non-profit enactment based successful Singapore leverages the reserves to backmost terrausd (UST) and LFG holds 80,394 BTC worthy $2.89 cardinal and $100 cardinal successful AVAX.

With Anchor Protocol changing its incentives to a semi-dynamic gain rate, it volition beryllium absorbing to spot if it affects the platform’s TVL, which has seen maturation period aft month. During the past 24 hours, Anchor’s TVL has dropped by 2.89% and this week it’s dipped by 0.66% successful the past 7 days.

Tags successful this story

Algorithmic stablecoin, Anchor, anchor protocol, Anchor’s TVL, Annual Percentage Yield, APY, Avalanche support, DeFi, defi lending, defi platform, earn rate, earn complaint change, Luna Foundation Gaurd (LFG), protocol’s output reserves, semi-dynamic gain rate, Stablecoins, Terra, TerraUSD, total worth locked, TVL, UST, UST deposits

What bash you deliberation astir the Anchor Protocol’s gain complaint adjusting? Do you deliberation it volition impact the defi protocol’s popularity? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)