The crypto marketplace faced a convulsive downturn, with Ethereum breaking beneath the $3,100 level portion Bitcoin mislaid the captious $100,000 mark, triggering wide liquidation and fear-driven selling. Panic rapidly rippled crossed the market, and sentiment flipped sharply bearish arsenic traders rushed to trim exposure, terms targets vanished from societal media, and hazard assets saw a cascade of exits. In moments similar these, emotions often outweigh fundamentals — and this week was a wide reminder of that dynamic.

However, adjacent successful periods of crisp fear, not each marketplace participants behave the same. Some notable players person begun shifting their stance, hinting that strategical positioning whitethorn already beryllium underway beneath the panic. Among them is the well-known Anti-CZ Whale — a trader who gained attraction aft aggressively shorting ASTER instantly pursuing Changpeng Zhao’s nationalist station announcing helium bought ASTER. That commercialized paid disconnected massively arsenic ASTER surged concisely and past retraced sharply, delivering this whale tens of millions successful unrealized profit.

Now, successful a notable shift, this trader has flipped from shorting Ethereum to going long, signaling renewed condemnation contempt the market’s affectional breakdown. As fearfulness peaks, blase players whitethorn already beryllium preparing for the adjacent signifier — raising the question: is this capitulation… oregon opportunity?

Whale Rotates Into ETH Long arsenic Market Panic Peaks

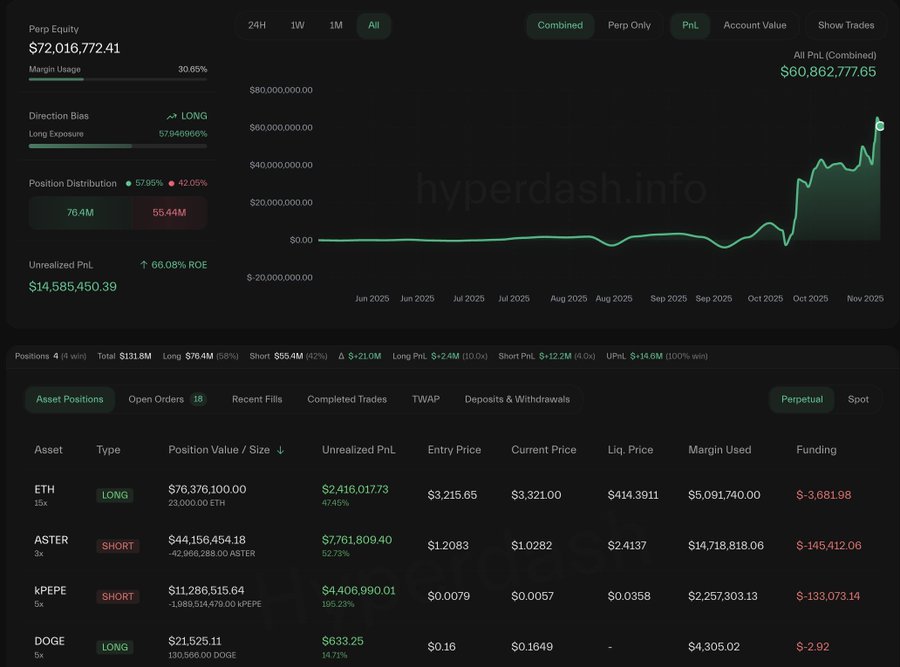

According to Lookonchain, the well-known Anti-CZ Whale has executed a notable portfolio shift, flipping from shorting Ethereum to taking a agelong presumption worthy 32,802 ETH (~$109 million). Now, the whale is maintaining a 58.27M ASTER abbreviated (~$59.7M), signaling condemnation that ASTER’s weakness whitethorn proceed contempt caller volatility.

Anti-CZ Whale Portfolio | Source: Lookonchain

Anti-CZ Whale Portfolio | Source: LookonchainAlongside this, the whale holds a 1.99B kPEPE abbreviated (~$11.3M), a stake against speculative memecoin flows during uncertainty. Meanwhile, a tiny 130,566 DOGE agelong (~$21.5K) appears much symbolic than directional, apt serving arsenic a hedge oregon sentiment gauge alternatively than a large condemnation play.

The standout determination is intelligibly the ETH long, signaling the whale views Ethereum’s driblet beneath $3,100 arsenic oversold alternatively than structurally bearish. Taking specified a presumption during highest fearfulness suggests an anticipation of betterment erstwhile forced liquidations chill and liquidity stabilizes. While broader sentiment remains fragile, this displacement implies blase superior whitethorn already beryllium positioning for an eventual rebound — reinforcing ETH’s relation arsenic a halfway plus adjacent amid assertive marketplace stress.

ETH Price Technical Outlook: Testing Key Support arsenic Panic Selling Eases

Ethereum is attempting to stabilize aft a steep breakdown beneath the $3,500 region, with terms present reacting astir the $3,300 zone. This level aligns intimately with the 200-day moving mean (red line), making it a captious enactment country for bulls to defend. The caller candle operation shows dense volatility and precocious sell-side volume, confirming panic-driven liquidations arsenic the superior unit down the determination — alternatively than a cardinal displacement successful trend.

ETH investigating captious request | Source: ETHUSDT illustration connected TradingView

ETH investigating captious request | Source: ETHUSDT illustration connected TradingViewThe assertive flush followed a bid of little highs passim October, signaling weakening momentum earlier the breakdown. The 50-day and 100-day moving averages (blue and green) are trending down and presently overhead, adding unit and reinforcing the short-term bearish structure. A betterment supra the 50-day MA would beryllium an aboriginal motion of strength, but Ethereum indispensable reclaim the $3,500 portion to regain bullish control.

Volume has spiked dramatically, suggesting capitulation behaviour — often adjacent rhythm pivot points. The wick adjacent $3,150 hints that buyers stepped successful aggressively astatine lows, accordant with accumulation dynamics observed among blase traders. If ETH holds supra the 200-day MA and builds a basal here, it could acceptable up a alleviation rally. A sustained interruption beneath $3,150, however, risks further downside toward $2,900 arsenic liquidity pockets stay bladed beneath existent levels.

Featured representation from ChatGPT, illustration from TradingView.com

3 months ago

3 months ago

English (US)

English (US)