Last month, the NFT marketplace saw a spike successful trading measurement connected April 5th, followed by a important 50% driblet by the extremity of the month. The fig of NFT sellers exceeds the fig of buyers, indicating a imaginable oversupply successful the market.

As these markets germinate and grow, investors and traders indispensable enactment abreast of the latest developments and trends. By examining the cardinal factors driving the cryptocurrency and NFT markets, we tin amended recognize the opportunities and risks associated with these emerging trends.

Data from this study was obtained from Footprint’s NFT probe page. An easy-to-use dashboard containing the astir captious stats and metrics to recognize the NFT industry, updated successful real-time, you tin find each the latest astir trades, projects, fundings, and much by clicking here.

Key Findings

Crypto Macro Overview

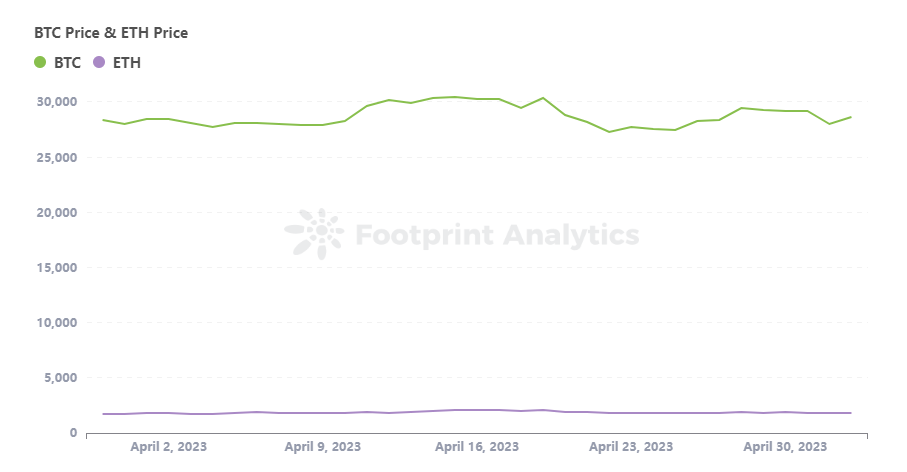

- The cryptocurrency marketplace experienced ups and downs successful April, with Bitcoin rising to $30,506 and Ethereum breaking done $2,100 connected affirmative economical data.

- Despite immoderate volatility, the cryptocurrency marketplace stabilized towards the extremity of April, with Bitcoin pushing backmost towards $30,000 and affirmative sentiment prevailing.

NFT Market Overview

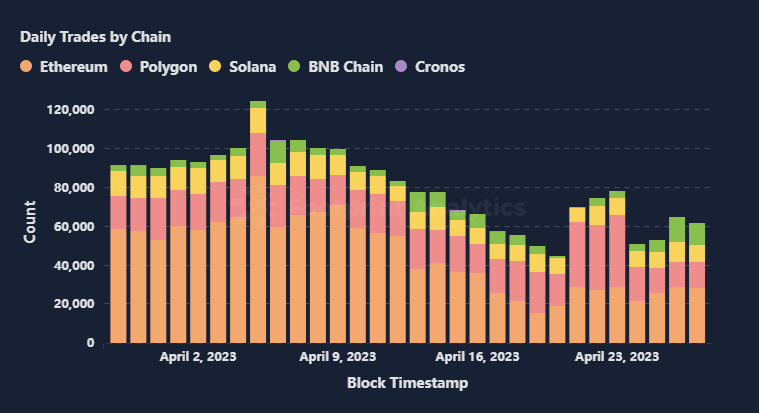

- The NFT marketplace saw a spike successful trading measurement connected April 5th but experienced a important 50% driblet by the extremity of the month.

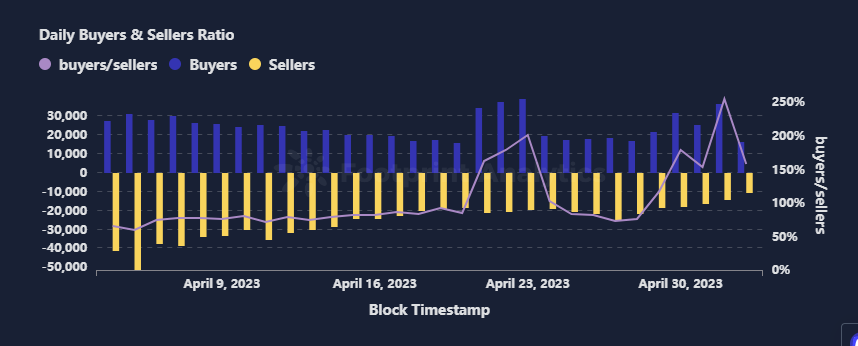

- The fig of NFT sellers exceeds the fig of buyers, indicating a imaginable oversupply successful the market.

Chains & Marketplaces for NFTs

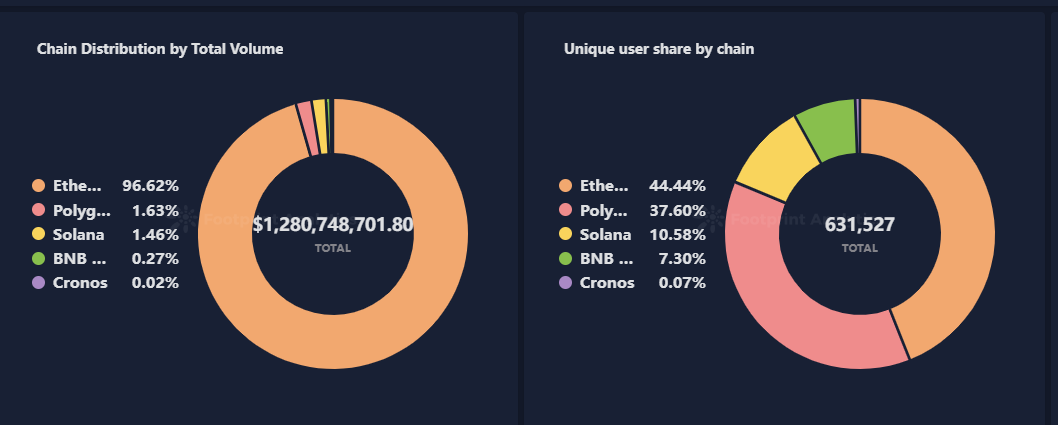

- Ethereum dominates the NFT marketplace volume, but web congestion and fees whitethorn thrust users to alternatives specified arsenic Polygon.

- Blur and OpenSea cater to high-end and retail traders, but some encroach connected each other’s territory and whitethorn integrate.

NFT Investment & Funding

- Despite a flimsy summation successful the fig of NFT projects, the alteration successful backing indicates investors’ caution astir investing.

- Platform gathering and scalability solutions are indispensable for NFTs, arsenic demonstrated by Flow’s $3 cardinal effect backing of its NFT marketplace.

Hot Topics of the Month

- Integrating AI and NFT exertion emphasizes the value of NFT provenance for copyright extortion and the worth of quality creativity successful creator look to onslaught a equilibrium for sustainable development.

Crypto Macro Overview

In April, the cryptocurrency marketplace experienced immoderate ups and downs. On April 14th, astir cryptocurrencies traded higher owed to better-than-expected U.S. economical data, with Bitcoin rising to $30,506, portion ETH broke done $2,100 connected April 16th.

BTC Price & ETH Price

BTC Price & ETH PriceOn the macro front, authoritative ostentation roseate to 5% successful March, somewhat beneath the statement of 5.1%. However, capitalist absorption has shifted to imaginable recessionary risks aft the banking situation exposed the fragility of the market’s fiscal system. Recent information besides points to a macroeconomic slowdown, arsenic the ISM Purchasing Managers’ Index fell to its lowest since May 2020.

Despite the volatility, bitcoin pushed backmost to 30,000 successful precocious April, with affirmative sentiment crossed the crypto market.

NFT Market Overview

The NFT marketplace attracted overmuch attraction astatine the opening of 2021 arsenic galore projects launched their ain NFT collections. However, the NFT marketplace has shown signs of weakness this year.

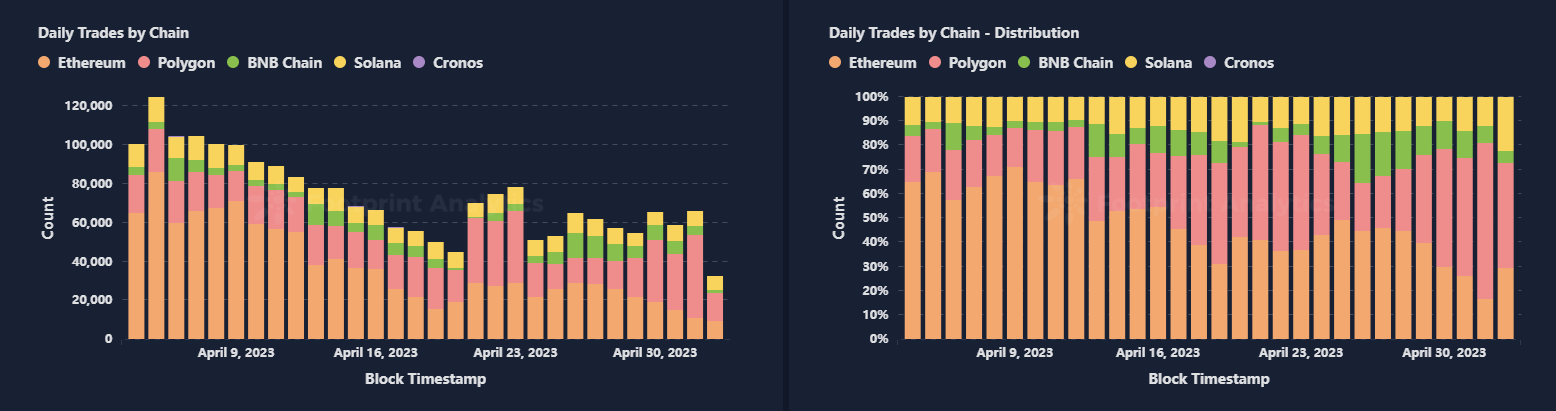

Daily Trades by Chain

Daily Trades by ChainAccording to Footprint Analytics, the NFT marketplace peaked successful trading numbers connected April 5, but regular trades had dropped by 50% by the extremity of the month. This diminution successful trading enactment suggests a increasing consciousness of caution among investors arsenic the archetypal enthusiasm for the NFT marketplace appears to beryllium fading.

Daily Buyers & Sellers

Daily Buyers & SellersIn addition, according to Footprint Analytics, the fig of NFT sellers successful the marketplace continues to transcend the fig of buyers, suggesting that determination whitethorn beryllium insufficient underlying demand.

The archetypal hype astir the NFT marketplace was driven by the cryptocurrency marketplace and personage endorsements, starring to a unreserved of radical entering the market. However, the fig of radical who recognize NFTs is comparatively small, starring to oversupply. It remains to beryllium seen whether the fundamentals of NFTs tin yet enactment marketplace maturation and unfastened up caller opportunities.

Chains & Marketplaces for NFTs

Volume & Users Share by Chain

Volume & Users Share by ChainAccording to Footprint Analytics, Ethereum holds the lion’s stock of NFT transaction volume, with a monolithic 96% marketplace share. However, erstwhile it comes to progressive users, Ethereum lone accounts for 44%, portion Polygon’s progressive idiosyncratic basal is adjacent down astatine 37%.

While Ethereum remains the level of prime for astir mainstream NFT projects, its web congestion and precocious transaction fees whitethorn thrust immoderate users to alternate platforms. As a result, Ethereum whitethorn look challenges successful maintaining its ascendant presumption successful the NFT market.

Daily Trades by Chain

Daily Trades by ChainPolygon’s regular trades are catching up with Ethereum, with transaction measurement not high. Still, the fig of trades is comparable, indicating that it’s much suitable for tiny traders owed to little barriers to entry. Polygon’s debased barriers to introduction marque it much suitable for tiny transactions and plus exchanges, meaning that its marketplace whitethorn beryllium much decentralized and multi-domain. However, gathering high-value and high-quality NFT projects and assets is besides much difficult. Therefore, it takes longer to physique a bully ecosystem and accumulate assets.

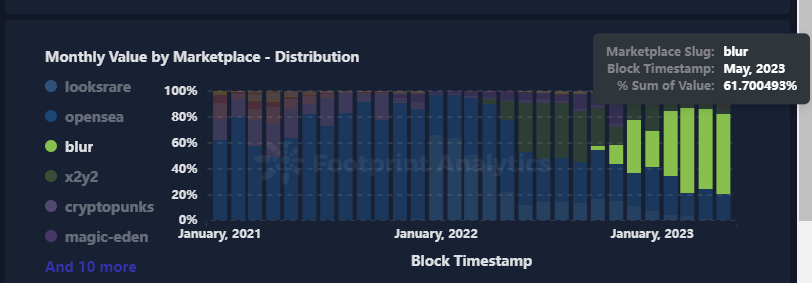

Monthly Value by Marketplace – Distribution

Monthly Value by Marketplace – DistributionFrom a marketplace perspective, Blur inactive has an implicit vantage regarding transaction volume. However, successful presumption of the fig of transactions, OpenSea inactive has the precocious hand. Blur’s ascendant presumption suggests it’s much suitable for high-value assets and nonrecreational users with larger transaction sizes. On the different hand, OpenSea’s transactions are looser and much dispersed, with smaller transaction sizes, making it much suitable for retail users and tiny regular transactions.

Blur and OpenSea correspond high-end and tiny traders, respectively. However, with the market’s wide development, some are encroaching connected each other’s territory, and the contention is becoming much intense. The aboriginal inclination whitethorn beryllium further integrating high-end and tiny markets, creating a definite synergy effect. Continued monitoring of the show of some platforms volition beryllium indispensable to foretell their aboriginal development.

NFT Investment & Funding

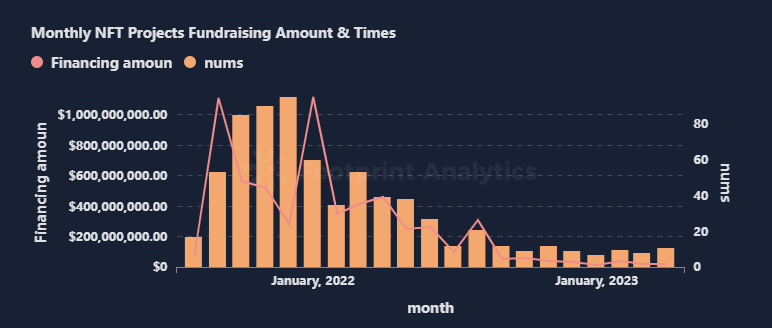

Monthly NFT Projects Fundraising Amount & Times

Monthly NFT Projects Fundraising Amount & TimesWhile the fig of NFT backing projects somewhat accrued from 8 to 11 compared to past month, the magnitude of backing has decreased, indicating a much cautious attack by investors.

Many builders are moving connected the NFT marketplace. Flow, which secured $3 cardinal successful effect backing to physique a rollup-centric NFT ecosystem, highlights the increasing request for furniture 2 and scalability solutions to code Ethereum web issues. Also, the introduction of ample companies specified arsenic Amazon into the NFT marketplace is expected to summation marketplace visibility and size but besides summation manufacture risks.

In addition, the euphony and amusement industries are exploring NFT, arsenic evidenced by Muverse and Daniel Allan Entertainment, which received backing this month, opening up caller opportunities for NFT applications.

Hot Topics of the Month

As Chatgpt became famous, radical started talking astir integrating AI and NFT, arsenic NFT is simply a large illustration of a originative system successful the crypto world.

KOL 6529 provided a typical treatment connected this topic. On the 1 hand, arsenic the magnitude of AI-generated contented increases, the value of NFT provenance exertion is further highlighted. NFT provenance tin assistance separate the root and ownership of contented and support the copyright of contented creators.

Conversely, the proliferation of AI-generated contented makes archetypal quality contented much valuable. The uniqueness of quality instauration is hard to wholly regenerate by AI, making archetypal works much scarce and valuable. Therefore, the quality of creators to physique their reputations is particularly important successful an epoch of integer contented overload. Only by allowing much radical to recognize and admit their enactment tin creators basal retired successful the fierce contention for content.

Commercial contented instauration is much easy replaced by AI, portion creator instauration is hard to replace. Commercial contented is usually completed astir a definite request and tin beryllium efficiently generated by AI technology, making it much easy replaced by machines. In contrast, the worth of artwork lies successful the author’s thoughts and affectional expression, which is hard for AI to execute and requires the unsocial position and creativity of quality artists.

Although AI instauration is increasing, quality creativity remains irreplaceable successful the signifier of creator expression. Striking a equilibrium betwixt copyright protection, originative tools, and quality look is cardinal to the sustainable improvement of NFT and encryption technologies.

Closing Thoughts

The satellite of NFTs is rapidly evolving, with caller trends and developments emerging each month. April was nary exception, arsenic the marketplace for these integer assets experienced important fluctuations and caller developments. While the spike successful trading measurement astatine the opening of the period followed a driblet towards the end, the NFT marketplace remains a dynamic and promising sector.

As the NFT marketplace grows and matures, it is important to enactment abreast of the latest trends and developments. By knowing the opportunities and risks associated with this emerging technology, investors and traders tin marque informed decisions and capitalize connected the imaginable of NFTs.

This portion is contributed by Footprint Analytics community,

We’re thrilled to invitation institutions and projects to physique retired your customized probe pages like this. With our help, you tin easy ain your information website for probe without immoderate coding acquisition oregon method input. Simply capable successful this form to use for the waitlist and get started today.

The Footprint Community is wherever information and crypto enthusiasts worldwide assistance each different recognize and summation insights astir Web3, the metaverse, DeFi, GameFi, oregon immoderate different country of the fledgling blockchain world. Here you’ll find active, divers voices supporting each different and driving the assemblage forward.

- Footprint Website: https://www.footprint.network

- Discord: https://discord.gg/3HYaR6USM7

- Twitter: https://twitter.com/Footprint_Data

The station April Monthly NFT Report: Navigating the volatile NFT market appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)