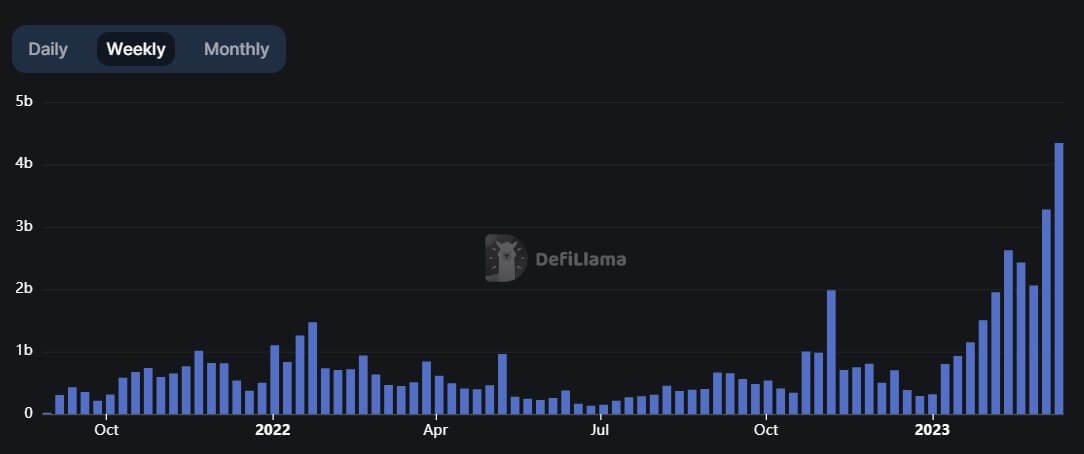

Arbitrum’s decentralized speech (DEX) transactions measurement roseate to a caller all-time precocious (ATH) successful each of the past 2 weeks, according to DeFillama data.

Over the past 7 days, DEX transactions accrued 32.41% to $4.34 billion. For the week starting March 5, transaction measurement connected Arbitrum had surged to $3.28 billion.

Arbitrum’s Weekly DEX Volume (Source: DeFillama)

Arbitrum’s Weekly DEX Volume (Source: DeFillama)Daily transaction measurement stood astatine $535 cardinal arsenic of March 20 — 2nd lone to Ethereum (ETH) and astir doubly that of Binance Smart Chain (BSC).

The apical 5 DEXs connected Arbitrum were Uniswap, SushiSwap, ZyberSwap, Camelot, and Balancer. In the past 7 days, trading measurement connected these platforms grew by an mean of implicit 40% — Camelot spiked the highest by 95% to $38.45 million, portion ZyberSwap saw the astir insignificant maturation of 2.84% to $61,41 million.

Meanwhile, Uniswap remains the ascendant DEX level connected Arbitrum, accounting for 48% of each trades connected the layer2 (L2) network.

Arbitrum’s TVL and stablecoin inflow rises

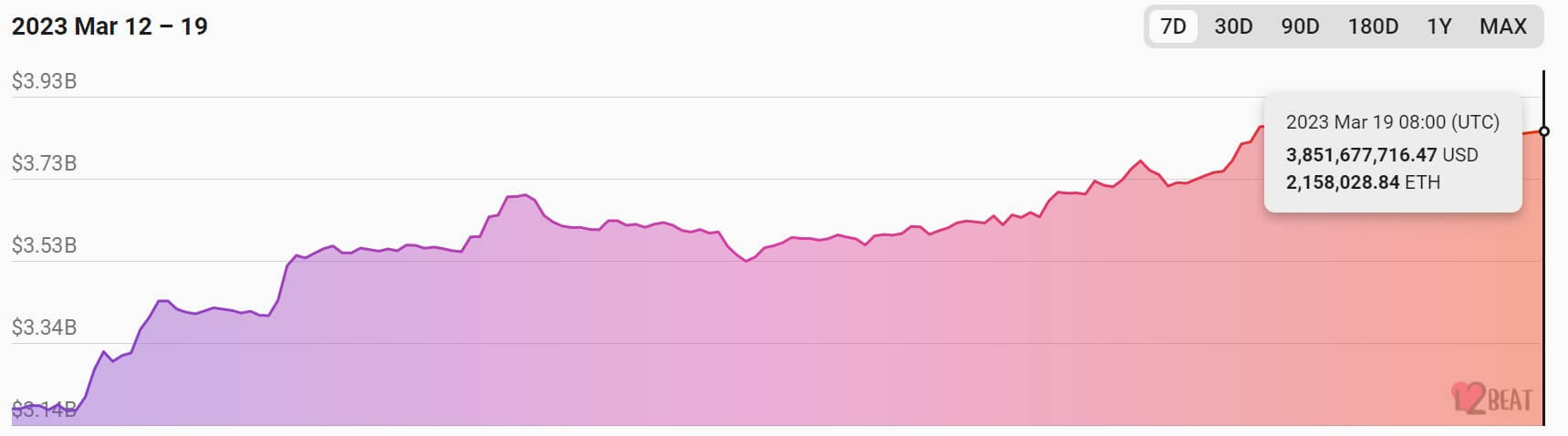

The full worth of assets locked connected Arbitrum has risen by much than 20% successful the past 7 days to $3.85 billion, according to L2beats. In presumption of ETH, 2.15 cardinal tokens person been locked connected the network.

Arbitrum’s TVL (Source: L2Beats)

Arbitrum’s TVL (Source: L2Beats)The rising TVL besides coincided with high-network enactment connected the L2 network. During the period, Arbitrum’s regular transaction per 2nd roseate 80.82% to 10.82.

DeFillama information shows that Arbitrum’s ascendant DeFi protocol is GMX — the task controls 28.27% of Arbitrum’s full TVL.

Meanwhile, the L2 solution has continued to witnesser an summation successful its stablecoin inflow. For context, Arbitrum’s USD inflow climbed 9% to $1.59 cardinal contempt the caller issues plaguing the ascendant stablecoin connected its ecosystem, USD Coin (USDC).

During the period, determination was much inflow of Tether’s USDT and algorithmic stablecoin DAI into the web arsenic against USDC.

The station Arbitrum’s play DEX measurement touches caller ATH appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)