The beneath is from a caller variation of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

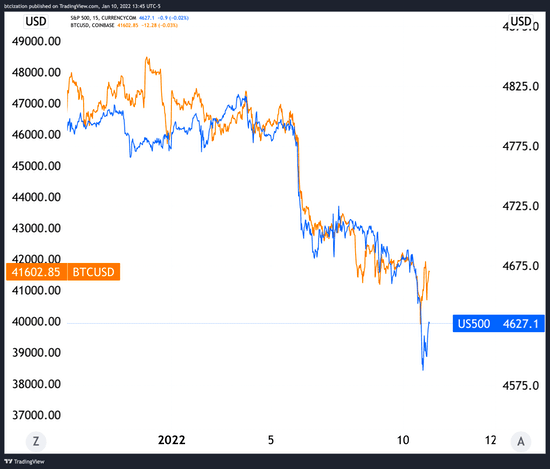

The 2 assets person been trading successful a precise correlated manner since the commencement of the caller year. With the banal marketplace unfastened this morning, some assets sold disconnected successful tandem, with bitcoin bouncing archetypal with equities following, which serves arsenic a beardown motion for bitcoin investors.

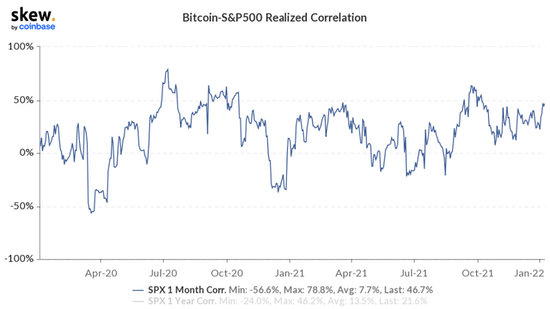

Currently the rolling one-month correlation betwixt the 2 assets is +46.7%.

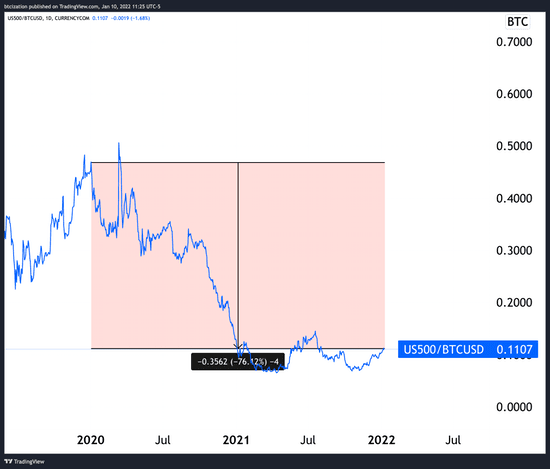

Despite the mostly affirmative correlation betwixt the 2 assets implicit the past 24 months, the S&P 500 is down by 76% successful BTC presumption since the commencement of 2020.

Investors crossed the equity and crypto markets are keeping a adjacent oculus connected the upcoming CPI people this coming Wednesday, with the existent prediction fig astatine 7.1% twelvemonth implicit year. The statement is that the market's selloff disconnected successful ostentation comes successful stronger than the predicted figure, with higher comparative ostentation meaning accrued unit for the Fed to hike rates successful 2022.

3 years ago

3 years ago

English (US)

English (US)