With elemental declaration interactions present costing successful the hundreds of dollars, Vitalik Buterin has shifted his absorption to scaling Ethereum. Demand for blockspace connected the mainnet has skyrocketed implicit the past year, and transaction fees are pricing galore users retired of utilizing the astir coveted decentralized concern (DeFi) and non-fungible token (NFT) ecosystem.

This nonfiction primitively appeared successful Valid Points, CoinDesk’s play newsletter breaking down Ethereum 2.0 and its sweeping interaction connected crypto markets. Subscribe to Valid Points here.

How is this being solved successful the abbreviated word without sacrificing decentralization? Buterin claims, “Rollups are successful the abbreviated and mean term, and perchance successful the agelong term, the lone trustless scaling solution for Ethereum.” Plenty of alternate furniture 1 blockchains person looked for expandable systems extracurricular of vertical rollups but person sacrificed liveliness, authorities maturation and more, thing the Ethereum developer assemblage has taken a beardown stance against.

Are existent furniture 2 companion networks inexpensive enough?

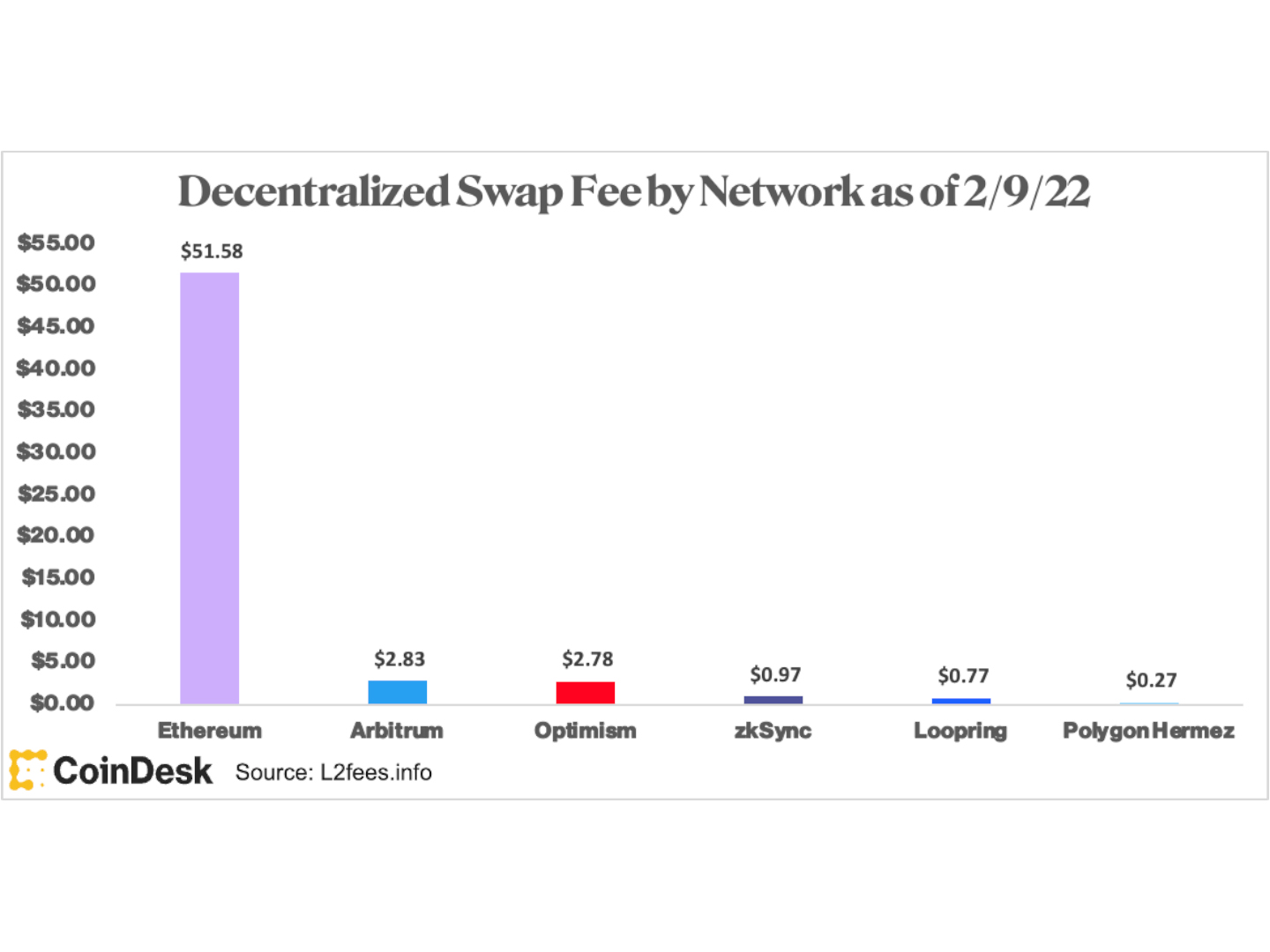

“Rollups are importantly reducing fees for galore Ethereum users: Optimism and Arbitrum often supply fees that are ~3-8x little than the Ethereum basal furniture itself, and ZK rollups, which person amended information compression and tin debar including signatures, person fees ~40-100x little than the basal layer,” said Buterin.

(l2fees.info)

Even without token subsidies, these rollups person seen important adoption and are highlighting the request for cheaper entree to Ethereum. Arbitrum, for example, presently has implicit $2 cardinal successful full worth locked (TVL) and is location to a DeFi ecosystem that is opening to amusement immoderate promise. However, Buterin believes rollup fees indispensable beryllium adjacent cheaper if they are going to promote adoption successful payments, gaming, and Web 3-focused products.

A aboriginal of 'blobs' and sharding connected Ethereum

While the merge to proof-of-stake is inactive respective months away, and sharding is apt adjacent further down the road, Buterin projected to instrumentality an facet of sharding earlier the upgrade is really incorporated into Ethereum. By introducing “blob-carrying transactions,” a benignant of data-intensive transaction that volition beryllium implemented nether sharding, rollups would person 1-2 MB of dedicated information abstraction for posting blocks to mainnet.

The other abstraction would make a abstracted interest market, allowing fees to beryllium substantially little portion lone a fewer rollups entree the system. This means the aboriginal implementation would lone amended scalability by a fraction of what is susceptible nether sharding, but it would supply abbreviated word alleviation to existent users of furniture 2s.

Of people determination are drawbacks to the implementation. First, rollup teams volition person to marque the power from utilizing calldata nether their existent format to blob-style transactions aft the upgrade. Also, the implementation would summation the size of the short-term execution payload, which could enactment mild accent connected the network’s validators. Buterin has besides suggested antagonistic proposals that would bring abbreviated word alleviation to precocious rollup transaction fees, similar EIP 4488, which would little the costs for transactions utilizing calldata alternatively of switching to a caller benignant of transaction entirely.

However, erstwhile sharding is implemented the aforesaid rollups would inactive person to marque this alteration to enactment competitory with different furniture 2s connected transaction fees. Regardless, the accrued load volition beryllium impermanent due to the fact that blob information would lone request to beryllium stored for 30 to 60 days earlier expiry. The upgrade would beryllium a large archetypal measurement successful making Ethereum accessible, thereby eliminating 1 of the largest arguments against the web astatine the moment. Cheap fees into perpetuity whitethorn conscionable beryllium capable to instrumentality marketplace stock backmost from the alternate furniture 1 ecosystems, but the combat for dominance is apt conscionable getting started.

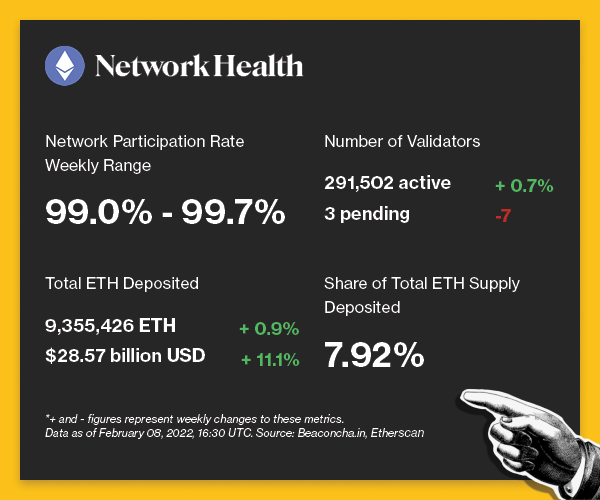

The pursuing is an overview of web enactment connected the Ethereum Beacon Chain implicit the past week. For much accusation astir the metrics featured successful this section, cheque retired our 101 explainer connected Eth 2.0 metrics.

(Beaconcha.in, Etherscan)

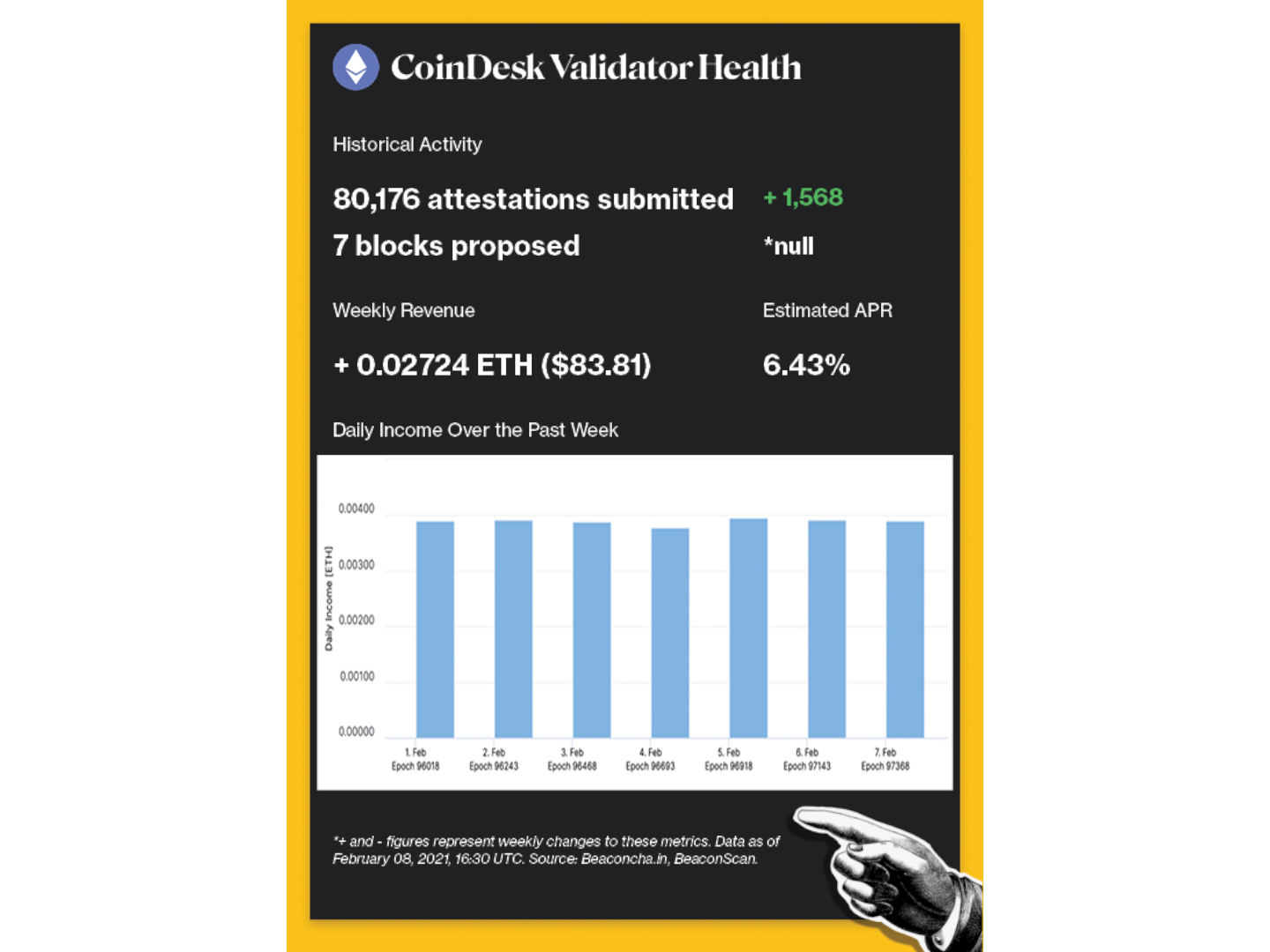

(Beaconcha.in, BeaconScan)

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking task volition beryllium donated to a foundation of the company’s choosing erstwhile transfers are enabled connected the network.

Vitalik Buterin, Peter Szilagyi and Emin Gun Sirer debated the cardinal differences successful scalability betwixt Ethereum and Avalanche. BACKGROUND: The Avalanche halfway squad has made respective claims that its statement exemplary has improved upon the “bottleneck” Ethereum is presently dealing with. Ethereum developers person agelong debated this, arguing the authorities maturation of the astir seven-year-old concatenation makes immoderate casual scaling implementation a menace to decentralization.

BuzzFeed News uncovered and revealed the identities of the Bored Ape founders. BACKGROUND: The founders of 1 of the largest NFT projects by some level terms and measurement had developed and launched the NFTs anonymously, similar galore different builders successful the crypto industry. The quality of open-source codification and decentralization makes this uniquely possible, but BuzzFeed News and others person called into question the ethos of anonymity and sparked a wider debate.

A U.S. Federal Reserve probe squad released a study connected the drawbacks of stablecoins. BACKGROUND: Just weeks aft the archetypal stablecoin study that looked astatine the imaginable for payments successful the aboriginal spoke highly of stablecoins, different cardinal slope probe squad argued against the integer assets. Locking dollars up to backmost the stablecoins could make liquidity issues wrong the system owed to the deficiency of “safe, liquid assets,” the study stated. DeFi projects person continued to look for ways to make non dollar-dependent stablecoins, utilizing collateralized crypto assets and algorithms to support the assets astatine peg.

Polygon raised $450 million from Sequoia Capital, Softbank and Tiger Global successful a discounted token sale. BACKGROUND: Polygon present has a warfare thorax to proceed gathering its existent ecosystem and simultaneously make Ethereum scaling products Hermez, Miden, Zero and Nightfall. The squad plans to usage the superior to onboard the adjacent cardinal users onto Ethereum and assistance support developer endowment astir adjacent during a sustained crypto carnivore market.

Valid Points incorporates accusation and information astir CoinDesk’s ain Eth 2.0 validator successful play analysis. All profits made from this staking task volition beryllium donated to a foundation of our choosing erstwhile transfers are enabled connected the network. For a afloat overview of the project, cheque retired our announcement post.

You tin verify the enactment of the CoinDesk Eth 2.0 validator successful existent clip done our nationalist validator key, which is:

0xad7fef3b2350d220de3ae360c70d7f488926b6117e5f785a8995487c46d323ddad0f574fdcc50eeefec34ed9d2039ecb.

Search for it connected immoderate Eth 2.0 artifact explorer site.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Valid Points, our play newsletter astir Ethereum 2.0.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)