ARK Invest Chief Executive Officer (CEO) and Chief Information Officer (CIO) Cathie Wood, has expressed her optimism astir Bitcoin’s capabilities to perchance emergence supra gold, referring to the cryptocurrency arsenic ‘the integer gold.’

Bitcoin Versus Gold

Appearing successful a caller interrogation connected ARK Invest’s official YouTube channel, Wood and ARK Invest’s Chief Futurist, Brett Winton, delved into a lengthy treatment astir Bitcoin’s humanities and astir caller terms movements successful narration to gold.

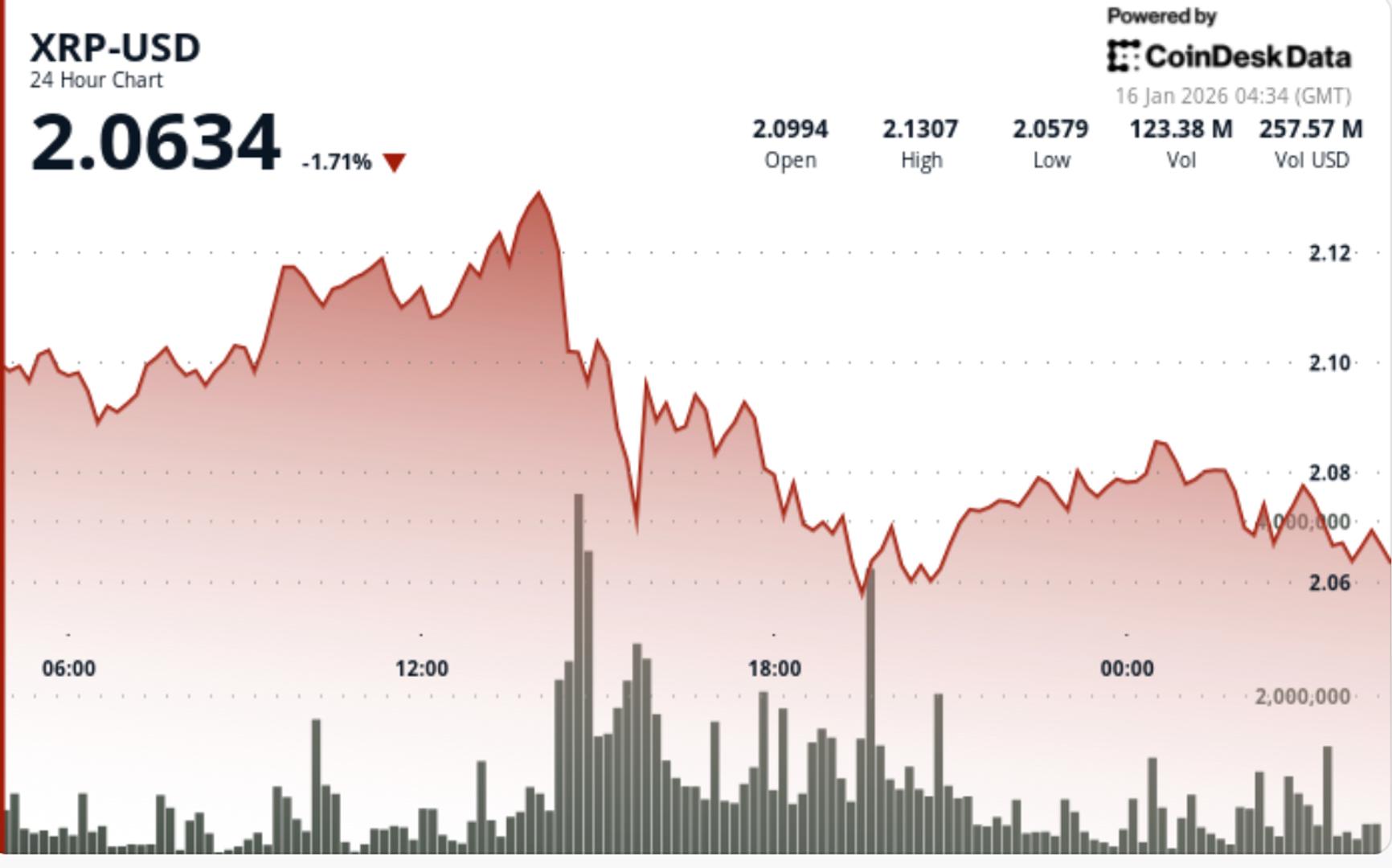

Describing Bitcoin arsenic some a “store of value” and a “risk disconnected asset,” Wood emphasized the cryptocurrency’s notable rise, peculiarly erstwhile compared to gold. She shared a illustration illustrating a Bitcoin to golden terms ratio which revealed a robust and sustained upward inclination for Bitcoin. This upward trajectory hints astatine the anticipation of the cryptocurrency overtaking golden as a much invaluable concern successful the future.

Wood besides discussed Bitcoin’s show amid past economical crises. She highlighted a humanities terms signifier observed during the determination bank crisis successful March 2023, noting that Bitcoin roseate arsenic precocious arsenic 40% portion the determination slope index, represented by KRE, was imploding.

Currently, the determination slope scale is experiencing a akin crisis, and according to Wood, Bitcoin is pursuing the aforesaid signifier by maintaining a dependable ascent. She attributes this uptrend to the support and instauration of 11 Spot Bitcoin ETFs into the cryptocurrency market.

As a result, Wood has categorized Bitcoin arsenic a “flight to safety” concern asset, providing a abstraction for individuals to store their funds against ostentation and the effects of the economic crisis.

Spot Bitcoin ETFs Expected To Fuel Bitcoin Surge

After the approval and motorboat of Spot Bitcoin ETFs connected January 10, 2024, Bitcoin faced an unexpected decline, relinquishing a important information of the gains accumulated during the pre-approval excitement. The cryptocurrency dropped from a 2023 all-time precocious of implicit $45,000 to beneath $40,000.

Wood explained that Bitcoin’s descent aft the instauration of ETFs resulted from aggravated anticipatory buying earlier the motorboat of ETFs, with a consequent “sell connected the news” event driven by opportunistic traders.

Looking ahead, the ARK Invest CEO anticipates Bitcoin’s continued rise, propelled by the broader accessibility facilitated by Spot Bitcoin ETFs. She highlighted that Spot Bitcoin ETFs offered an easier and much inclusive avenue to entree Bitcoin, attracting important inflows into the cryptocurrency arsenic organization investors actively enactment successful the market.

Featured representation from Seeking Alpha, illustration from Tradingview.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)