Ark Invest’s continued accumulation of the Ark 21Shares Spot Bitcoin ETF (ARKB) has elevated the plus to a top-five presumption wrong the firm’s Ark Next Generation Internet ETF (ARKW) portfolio.

The firm’s latest trading file seen by CryptoSlate showed that it acquired 267,804 shares of ARKB, worthy $12.3 million, based connected the Jan. 24 closing terms of $46.27.

Conversely, it liquidated 282,975 ProShares Bitcoin Strategy (BITO) shares, valued astatine an estimated $5.4 cardinal based connected the closing terms of $19.11.

This trading enactment follows Ark Invest’s caller inclination of divesting from BITO and actively accumulating its BTC-based spot ETF. Recent reports by CryptoSlate revealed however the concern steadfast has made important purchases of its ARKB shares since the money went unrecorded this month.

As a effect of these strategical moves, ARKB has present secured the 5th presumption among the assets successful ARKW’s portfolio.

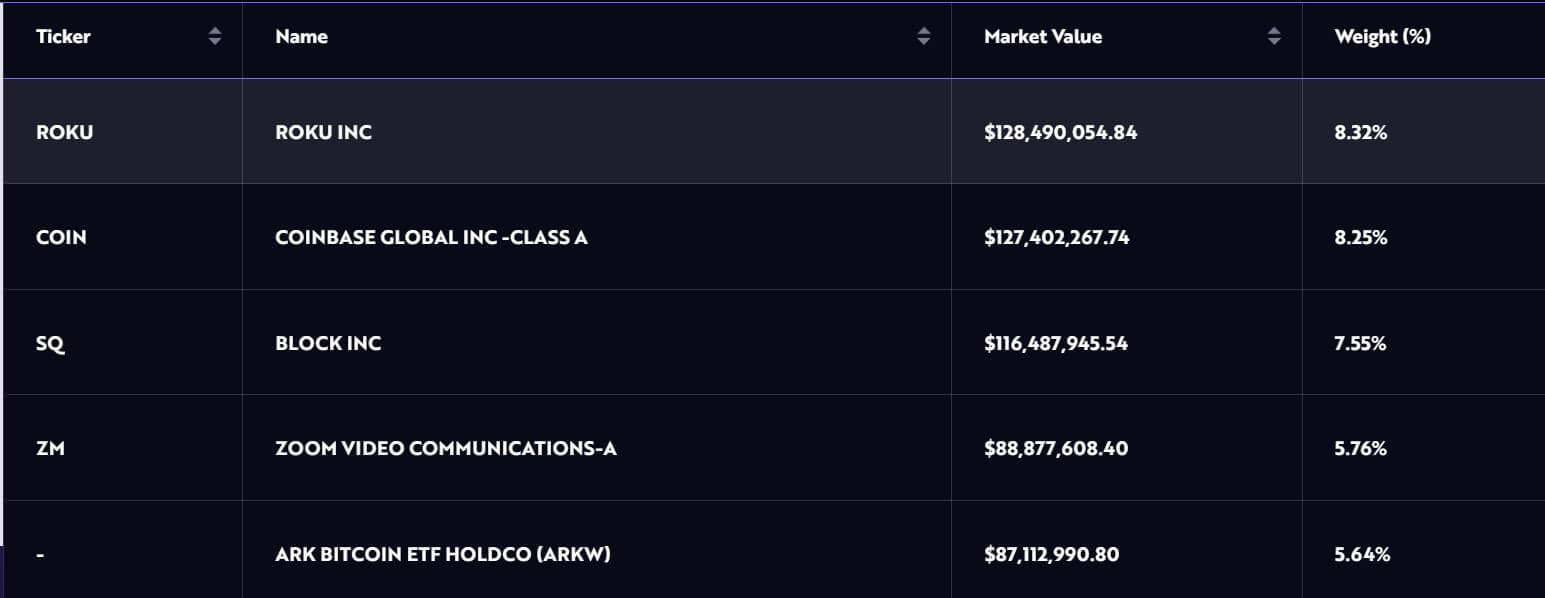

The ARKW money presently holds 2.1 cardinal ARKB shares, valued astatine implicit $87 million, comprising 5.64% of the full portfolio. Notably, ARKB surpasses holdings successful well-known entities specified arsenic Tesla, Robinhood, and DraftKings, though it trails down crypto-focused firms Block and Coinbase wrong the ARKW portfolio.

ARKW’s Ark 21 Shares Bitcoin ETF Holding (Source: Ark Fund)

ARKW’s Ark 21 Shares Bitcoin ETF Holding (Source: Ark Fund)In contrast, Ark Invest’s holding successful BITO has decreased to 566,285 shares, valued astatine $10.8 million. BITO is the archetypal BTC futures ETF successful the US, launched successful October 2021.

Meanwhile, the Cathie Wood-led firm’s strategic reallocation of funds aligns with marketplace expectations, arsenic observers anticipated the steadfast would displacement distant from BITO and redirect the superior into ARKB to heighten the fund’s plus base.

These maneuvers person propelled the Ark 21Shares Bitcoin ETF to 3rd spot among the “Newborn nine” spot Bitcoin ETFs, trailing BlackRock’s IBIT and Fidelity’s FBTC. According to Bloomberg Intelligence data, the fund’s assets nether absorption present transcend $500 million.

The station Ark Invest’s assertive accumulation of its Bitcoin ETF propels it into apical 5 of ARKW portfolio appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)