In their latest analysis, Ark Invest’s crypto specialists Julian Falcioni, David Puell, and Dan White, are presenting a reappraisal of the Bitcoin marketplace behaviour and prospects, delineating the interplay of assorted economic, technical, and policy-driven factors that could signifier the aboriginal of this pioneering integer currency.

Bitcoin Validates The Bullish Scenario

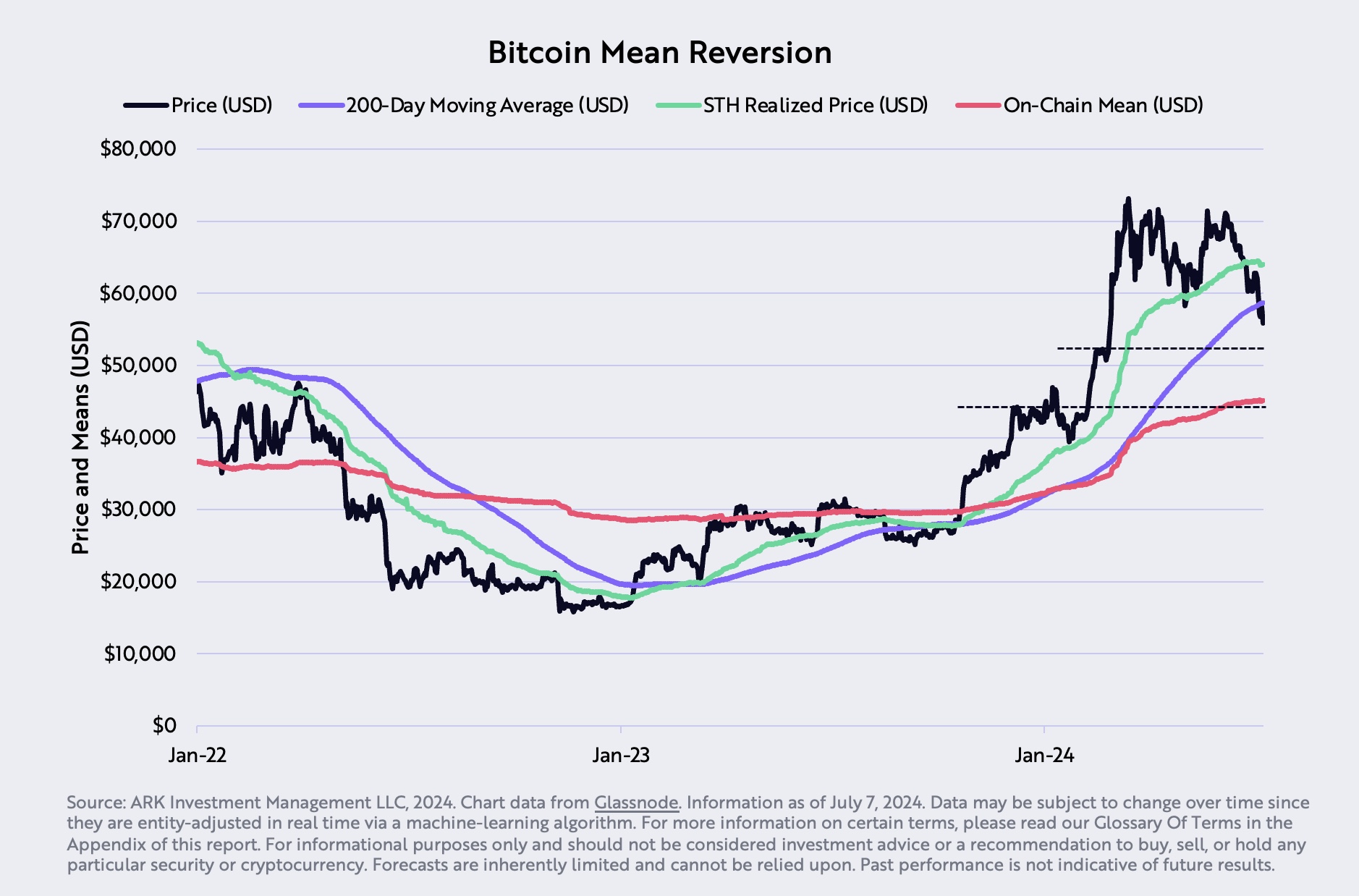

Since aboriginal June, Bitcoin witnessed a important decline, dropping much than -25%. More critically, connected July 7, BTC fell beneath its 200-day moving average—a cardinal method threshold. According to Ark, the dip beneath the 200-day moving mean was “a important bearish awesome that often precedes further declines unless a beardown betterment ensues.” Ultimately, Bitcoin displayed important spot successful the past fewer days and Ark was close successful that BTC staged a speedy betterment supra the 200-day EMA, invalidating the bearish prospects.

Source: X @dpuellARK

Source: X @dpuellARKA astonishing constituent successful June’s Bitcoin volatility was the assertive merchantability of astir 50,000 Bitcoins by the German government. These assets were seized from the amerciable streaming tract Movie2K and gradually transferred to assorted exchanges for sale, starting June 19. “The influx of a ample measurement of bitcoins during a traditionally debased liquidity period, astir the July 4th holiday, importantly pressured the terms downward,” the study notes. Notably, this selling unit is present gone.

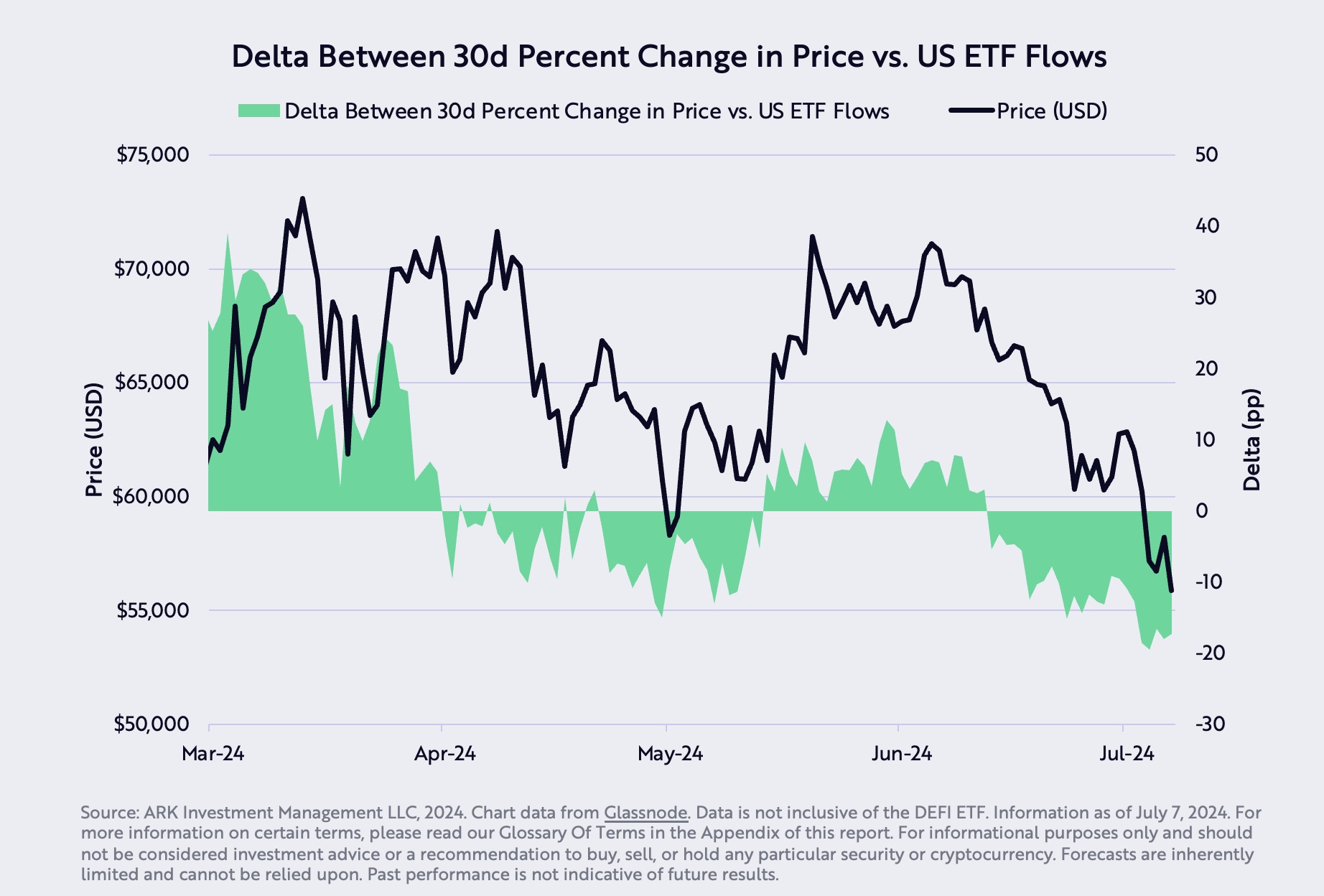

Despite these challenges, Bitcoin managed an awesome rally of much than 17% successful the past fewer days. Several indicators supported this reversal, according to Ark. The discrepancy betwixt the diminution successful Bitcoin’s terms and the lesser driblet successful US ETF balances—17.3 %—suggested that Bitcoin was oversold. “This overselling is apt driven by outer shocks alternatively than intrinsic marketplace movements, pointing towards a mispricing that could close successful the mean term,” the experts explain.

Delta betwixt 30d percent alteration successful terms vs US ETF flows | Source: X @dpuellARK

Delta betwixt 30d percent alteration successful terms vs US ETF flows | Source: X @dpuellARKShort-term holders, typically a much speculative segment, person been realizing losses arsenic indicated by the sell-side hazard ratio. This ratio, calculated by dividing the sum of short-term holder profits and losses realized on-chain by their outgo bases, showed much losses than profits, which typically precedes a short-term marketplace correction.

June besides saw important enactment from Bitcoin miners. “Miner outflows, which often prelude marketplace adjustments, mirrored patterns observed astir erstwhile Bitcoin halving events, erstwhile the reward for mining a artifact is halved,” says Ark. Such events historically pb to a decreased proviso and imaginable terms increases arsenic marketplace dynamics set to the caller proviso level.

On the macroeconomic front, the study notes that the US economical information person been consistently underperforming against expectations, with the Bloomberg US Economic Surprise Index registering the astir important antagonistic deviations successful a decade. Yet, the Federal Reserve has maintained a amazingly hawkish tone, which could power capitalist sentiment and fiscal marketplace stability.

Corporate America is not insulated from these challenges. Profit margins, which peaked successful 2021, are connected a downward trajectory arsenic companies suffer pricing powerfulness arsenic Ark notes. This compression connected profits is prompting terms cuts crossed assorted sectors, further dampening economical outlooks.

Regarding equity markets, determination has been a notable summation successful marketplace capitalization concentration, reaching levels unseen since the Great Depression. “This attraction successful larger entities with important currency reserves could beryllium an aboriginal indicator of a shifting economical landscape, which historically sees a breakout successful favour of smaller headdress stocks,” the study says.

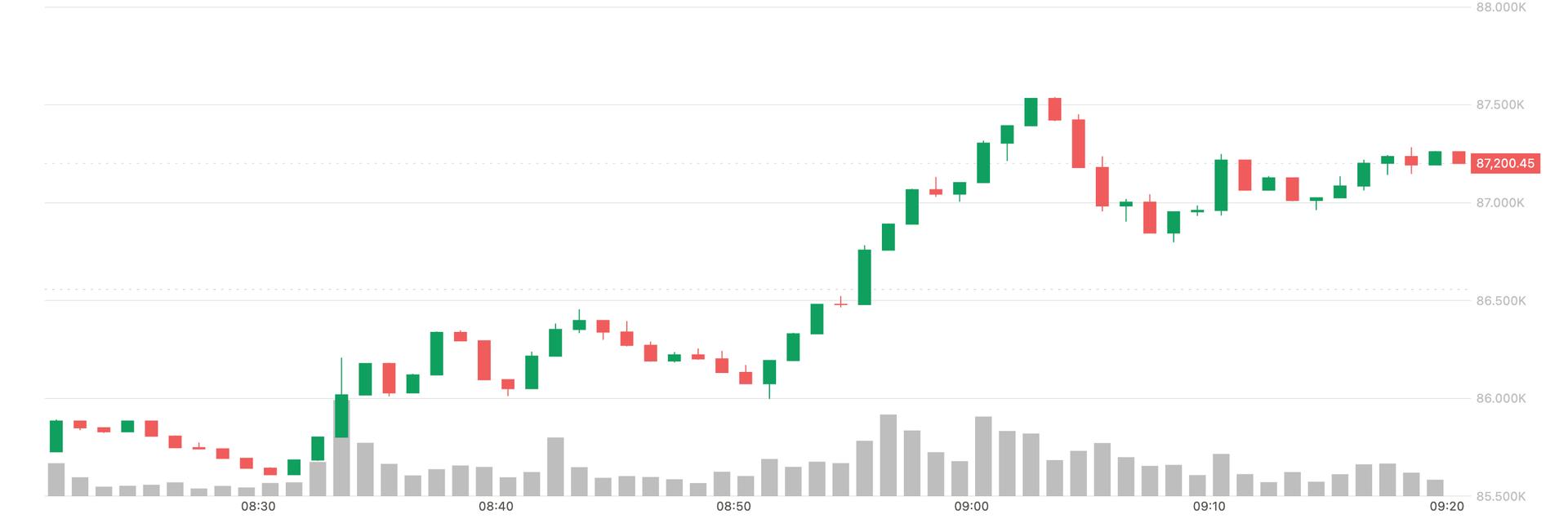

At property time, BTC traded astatine $63,131.

BTC rejected astatine cardinal absorption (red zone), 1-day illustration | Source: BTCUSD connected TradingView.com

BTC rejected astatine cardinal absorption (red zone), 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)