ARK Invest, 1 of the companies that filed an exertion for a spot Bitcoin (BTC) exchange-traded money (ETF), is again taking profits connected its Coinbase (COIN) shares arsenic the banal terms surges.

On Nov. 27, ARK sold 43,956 Coinbase shares from its ARK Fintech Innovation ETF (ARKF), according to a commercialized notification seen by Cointelegraph. Coinbase banal reached $119.7 per stock astatine the clip of the sale, giving the transaction a worth of $5.3 million, information from TradingView shows.

Coinbase crypto speech has seen its shares leap to an 18-month high aft rival speech Binance and its erstwhile CEO Changpeng Zhao pleaded blameworthy to wealth laundering and sanctions violations successful the United States connected Nov. 21, 2023.

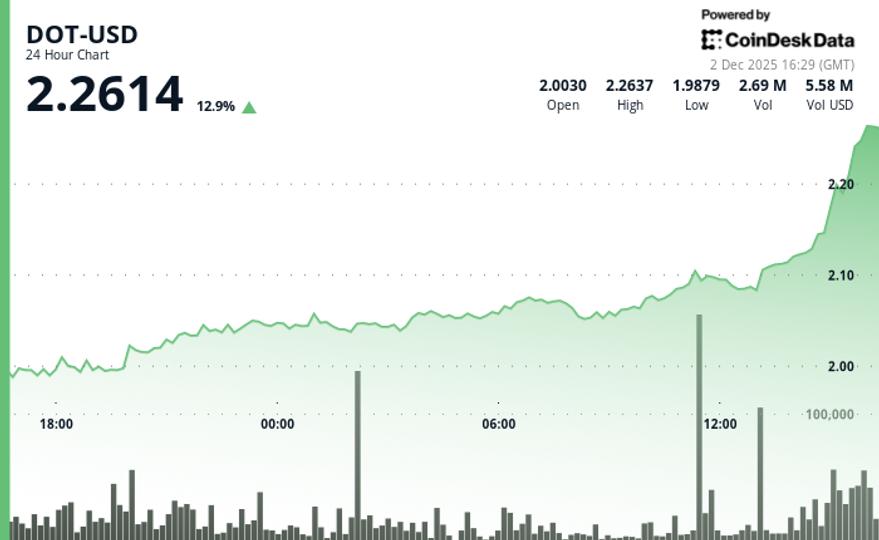

According to information from TradingView, Coinbase banal is up 168% implicit the past year, surging much than 220% since January 2023. The banal is inactive down astir 70% from its all-time precocious of $319 posted successful September 2021, oregon a fewer months after its trading motorboat successful April 2021.

Coinbase (COIN) terms illustration implicit the past year. Source: TradingView

Coinbase (COIN) terms illustration implicit the past year. Source: TradingViewARK has been repeatedly selling Coinbase stocks passim 2023. Cathie Wood’s concern steadfast antecedently offloaded 63,675 COIN shares successful October from its ARK Next Generation Internet ETF (ARKW), totaling $5.1 million.

ARK was besides actively selling Coinbase shares successful July 2023, erstwhile the banal was trading astir $90. According to ARK’s trading data, the steadfast off-loaded much than $103 cardinal successful Coinbase shares successful July.

ARK has besides been actively selling disconnected Grayscale Bitcoin Trust (GBTC) stock. On Nov. 24, the ARKW dumped 94,624 GBTC shares for astir $3 cardinal aft selling astir 700,000 GBTC shares successful 1 month.

According to Bloomberg’s ETF expert Eric Balchunas, ARK’s income of GTBC are not an denotation that the steadfast is not bullish connected Bitcoin, oregon making country for its upcoming spot Bitcoin ETF, the ARK Invest and 21Shares (ARKB). “Neither is true,” Balchunas wrote connected X (formerly Twitter) connected Nov. 27, referring to his erstwhile observations that ARK was apt selling winners and vice-versa to support desired weightings.

Related: Binance charges beryllium ‘following the rules’ was the close determination — Coinbase CEO

“Since GBTC is up 76% since August ARK has to merchantability galore shares to support a 9%-ish weighting. And adjacent with that selling, its weighting has gone up,” the ETF expert noted.

While selling Coinbase and GBTC, ARK has concurrently been bagging immoderate crypto-related stocks. On Nov. 27, ARKF acquired 252,421 shares of the crypto-friendly banking app SoFi. Year to date, ARK bought a full of 1.6 cardinal SOFI shares, worthy $11 cardinal astatine today’s prices, according to TradingView. ARK has besides been accumulating shares of the crypto-friendly concern app Robinhood, buying $1.1 cardinal worthy of the stock connected Nov. 8.

Magazine: Crypto regularisation — Does SEC Chair Gary Gensler person the last say?

2 years ago

2 years ago

English (US)

English (US)