Japan’s caller Prime Minister, Sanae Takaichi, announced a bundle of economical stimulus measures connected Tuesday to easiness the interaction of ostentation connected households. The move, immoderate crypto observers say, could thrust much superior into Bitcoin.

The stimulus measures see subsidies for energy and state charges, arsenic good arsenic determination grants to easiness terms unit and promote tiny to medium-sized businesses to rise wages.

BitMEX co-founder Arthur Hayes viewed the improvement arsenic a precursor to much fiat wealth printing by Japan’s cardinal bank, a determination that could catalyze Bitcoin’s (BTC) emergence to $1 million.

“Translation: let’s people wealth to manus retired to folks to assistance with nutrient and vigor costs,” said Hayes successful a Tuesday X post, adding that this dynamic whitethorn spot Bitcoin emergence to $1 million, portion triggering a emergence successful the Japanese yen.

Meanwhile, the yen fell to a one-week debased connected Tuesday aft Takaichi took bureau arsenic Japan's first pistillate premier minister, which was seen by investors arsenic a mixed awesome for the incoming involvement complaint determination successful the country, Reuters reported.

Related: $19B marketplace clang paves mode for Bitcoin’s emergence to $200K: Standard Chartered

Takaichi’s “pro-stimulus” stance reignites hopes for QE pivot by Bank of Japan

Hayes antecedently predicted that the Bank of Japan’s pivot to quantitative easing (QE) whitethorn beryllium the adjacent important catalyst for Bitcoin and hazard assets.

QE refers to cardinal banks purchasing bonds and injecting wealth into the system to little involvement rates and stimulate spending during challenging fiscal conditions.

The BOJ’s adjacent monetary argumentation gathering is acceptable for Oct. 29. Most analysts expect the cardinal slope to present a 0.75% involvement complaint hike by aboriginal 2026, with nary wide statement connected the nonstop timeline, Reuters reported connected Monday.

The cardinal slope is presently engaged successful quantitative tightening, with nary wide reversal plans to power to QE until it reaches its people ostentation complaint of 2%.

However, Takaichi’s “pro-stimulus stance” whitethorn soon “push Japan into easing,” arsenic 80% of planetary banks already prosecute QE efforts, according to macro concern assets Milk Road Macro’s Oct. 8 X post.

Related: SpaceX moves $257M successful Bitcoin, reignites questions implicit its crypto play

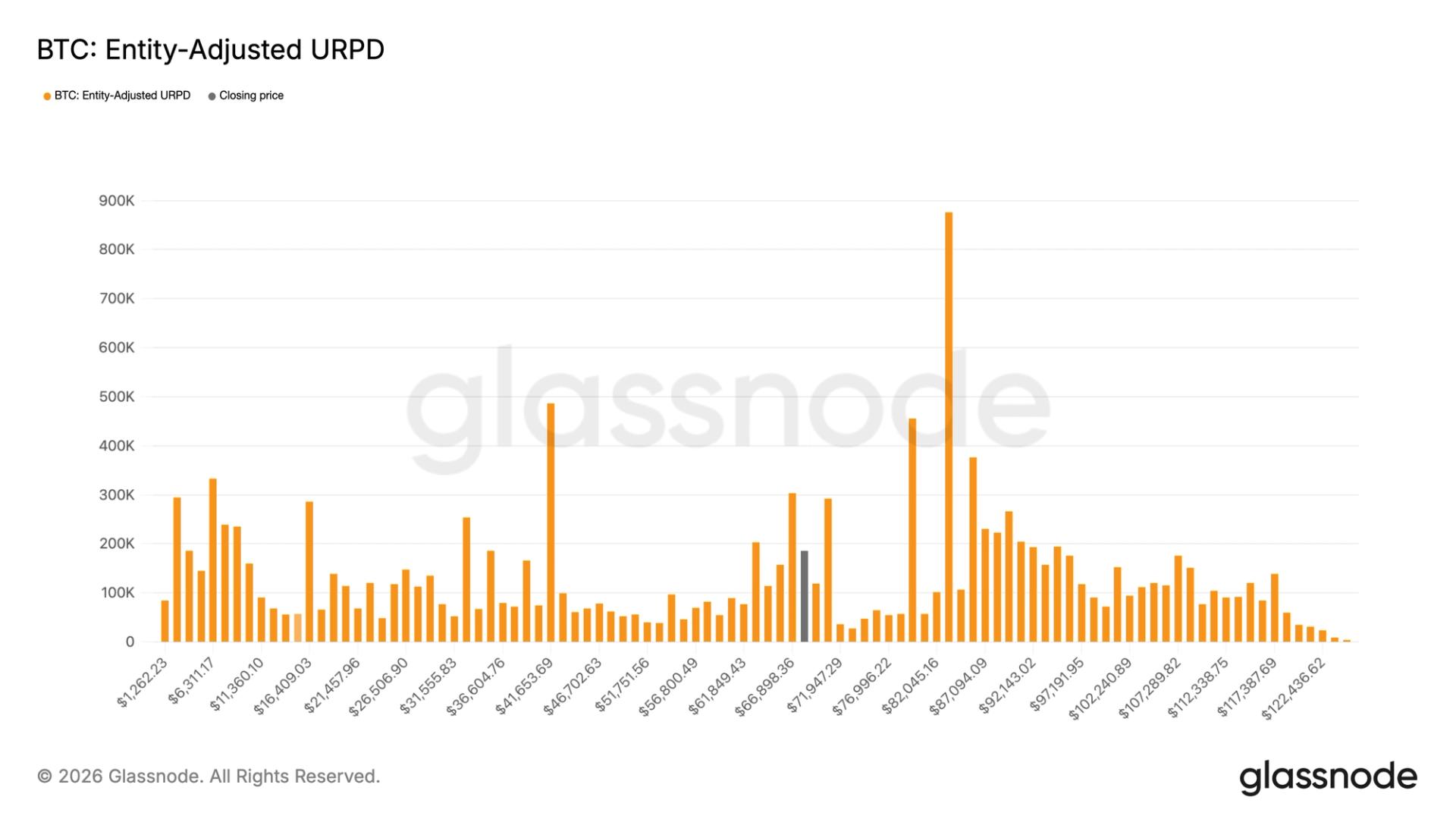

Bitcoin whales crook bullish with caller agelong positions aft Bitcoin “flush” to $104,000

Meanwhile, whales, oregon ample cryptocurrency investors, are signaling renewed appetite for Bitcoin, arsenic Bitcoin’s terms is recovering from its dip to a four-month low of $104,000 connected Friday.

Three whales returned to decentralized speech Hyperliquid connected Wednesday, depositing tens of millions of dollars to initiate leveraged agelong positions, which usage “borrowed” funds to summation the size of the investment.

Notably, whale wallet “0x3fce” accrued his Bitcoin agelong presumption to $49.7 million, portion whale wallet “0x89AB” opened a 6x leveraged agelong presumption worthy $14 million, wrote blockchain information level Lookonchain, successful a Wednesday X post.

Magazine: Bitcoin to spot ‘one much large thrust’ to $150K, ETH unit builds

4 months ago

4 months ago

English (US)

English (US)