Arthur Hayes, the co-founder of BitMEX, contiguous expressed a bleak outlook for the Bitcoin price’s contiguous future. On his X profile, Hayes revealed his idiosyncratic marketplace maneuver, stating, “BTC is heavy, I’m gunning for sub $50k this weekend. I took a cheeky short. Pray for my soul, for I americium a degen.”

Why Hayes Possibly Expects A Bitcoin Price Crash

While Hayes refrained from providing explicit reasons for his prediction, the timing of his connection intimately aligns with important US economical indicators acceptable to beryllium released this Friday. The US jobs information has been a captious origin for marketplace analysts lately. The Kobeissi Letter analysts, commenting connected the situation, noted the expanding power of unemployment information connected Federal Reserve policies.

They explained via X that, “Prediction markets are present pricing successful 4 complaint cuts successful 2024, oregon 100 bps of cuts, for the archetypal clip since the August 5th crash, according to Kalshi. Over the past 2 days, prediction markets person priced-in an further complaint chopped successful 2024. This comes arsenic labour marketplace information has deteriorated astir the board. It’s wide that unemployment information is rapidly becoming the superior operator of Fed policy, on with inflation.”

According to the analysts, today’s jobs study volition beryllium the cardinal origin successful determining if the US Federal Reserve (Fed) volition chopped involvement rates by 50 bps oregon 25 bp. The adjacent FOMC meeting takes spot from September 17-18, 2024. “If the jobs study is in-line with expectations, oregon better, we judge a 25 bps complaint chopped is coming. Interest complaint expectations look to beryllium shifting excessively dovish again,” The Kobeissi analysts believe.

Notably, the deteriorating labour marketplace script was conscionable highlighted by information released earlier successful the week. US occupation openings, arsenic reported by the JOLTs survey, fell to 7.67 cardinal successful July from the erstwhile 7.91 cardinal successful June, marking the lowest level since January 2021. Analysts had anticipated a fig astir 8.09 million, making the existent information a important miss from expectations.

Since March 2022, occupation openings person declined by an alarming 4.51 million, oregon 38%, a simplification that The Kobeissi Letter describes arsenic “MASSIVE.” They added, “The astir notable driblet was seen successful operation openings which fell to 248,000 successful July, their lowest since October 2020. Meanwhile, the ratio of occupation vacancies to unemployed workers fell to 1.07 successful July, successful enactment with 2018 levels.”

This backdrop of weakening occupation information and revised economical forecasts has undoubtedly contributed to the atrocious sentiment connected the Bitcoin market. Hayes seems to expect much atrocious macro data, which helium believes could propulsion the Bitcoin terms beneath $50,000.

Is $46,000 The Bottom?

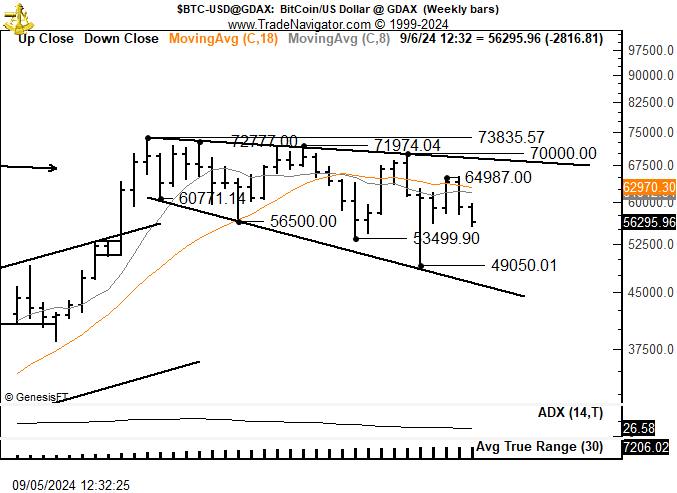

Adding to the chorus of bearish outlooks, renowned trader Peter Brandt besides provided his method analysis, observing what helium presumption an “inverted expanding triangle oregon a megaphone” signifier successful Bitcoin’s play chart. Brandt highlighted the imaginable for Bitcoin to trial a little bound astir $46,000, underscoring a dominance of selling unit implicit buying involvement successful the market.

Bitcoin terms analysis, play illustration | Source: X @PeterLBrandt

Bitcoin terms analysis, play illustration | Source: X @PeterLBrandtHe pointed out, “This is called an inverted expanding triangle oregon a megaphone. A trial of the little bound would beryllium to 46,000 oregon so. A monolithic thrust into caller ATHs is required to get this bull marketplace backmost connected way BTC. Selling is stronger than buying successful this pattern.”

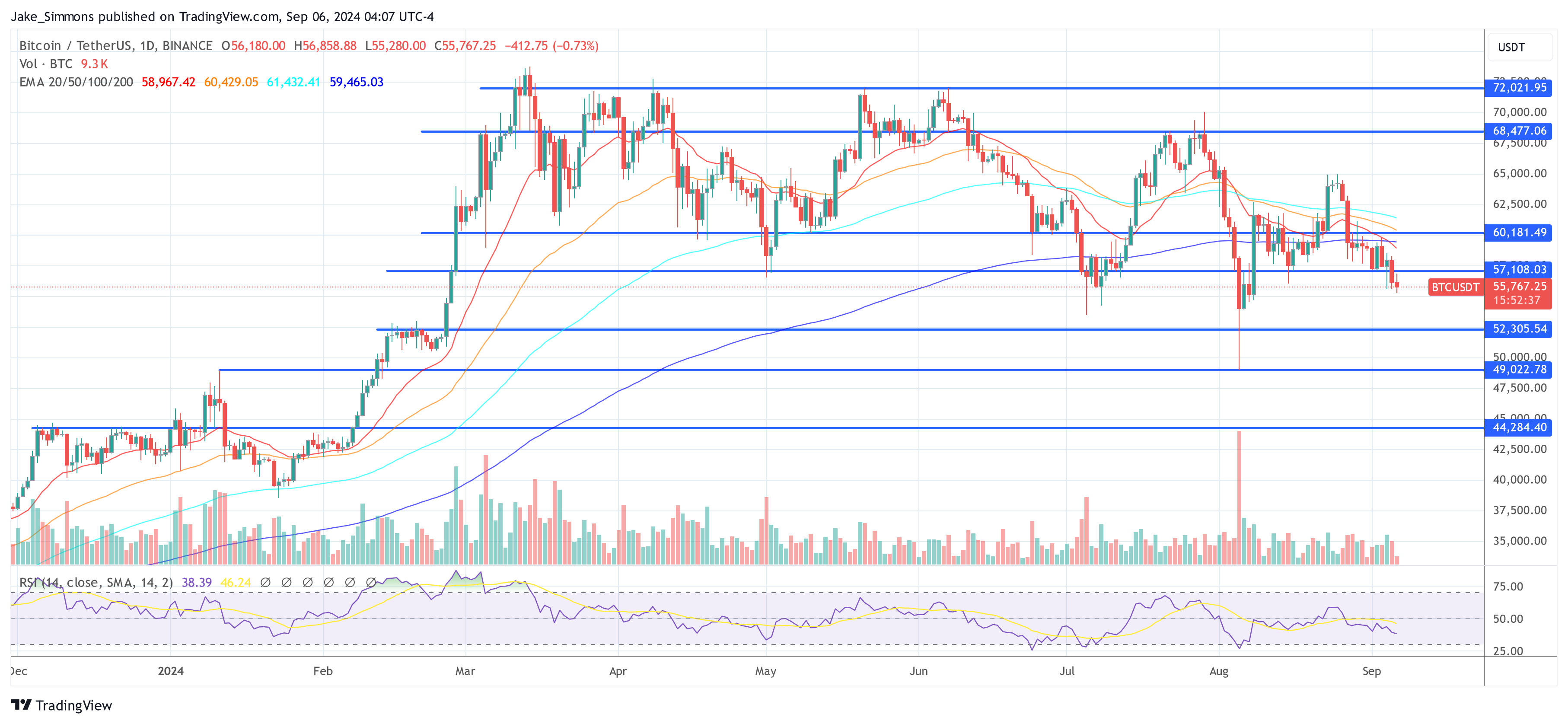

At property time, BTC traded astatine $55,767.

Bitcoin drops beneath cardinal support, 1-day illustration | Source: BTCUSDT connected TradingView.com

Bitcoin drops beneath cardinal support, 1-day illustration | Source: BTCUSDT connected TradingView.comFeatured representation from YouTube, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)