Nearly each publicly-traded bitcoin mining companies person failed to outperform bitcoin twelvemonth to day arsenic the carnivore marketplace continues.

Public bitcoin mining companies person been an unusually salient fixture of the crypto marketplace for the past mates of years arsenic investors, media and regulators observe their fiscal maturation and operational expansions. While share prices for astir each of these companies importantly outperformed bitcoin during the latest bullish marketplace trend, the other effect is intelligibly successful play present arsenic nationalist miners effort to upwind the on-going carnivore cycle. In fact, nary of these companies person managed to outperform bitcoin truthful acold successful 2022.

This nonfiction explores a clump of information applicable to the show of nationalist mining companies, antithetic strategies from these companies successful existent marketplace conditions, and wherefore the nationalist mining marketplace matters to the broader bitcoin economy.

Public Bitcoin Mining Company Data Overview

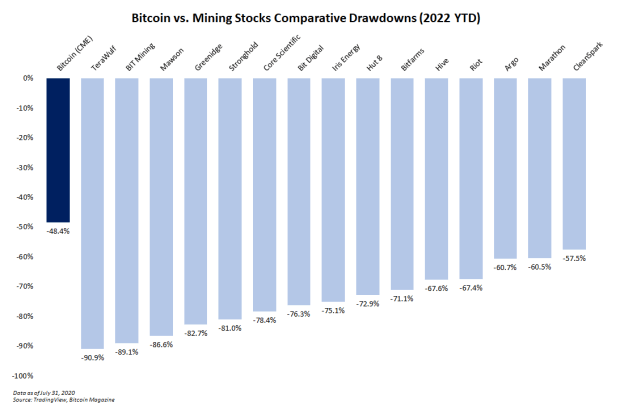

Bitcoin has had a pugnacious twelvemonth truthful far. But nationalist mining companies person had an adjacent tougher year. The barroom illustration beneath visualizes the brutality with bitcoin’s year-to-date drawdown alongside drawdowns for 15 starring nationalist mining companies implicit the aforesaid clip period.

Bitcoin's year-to-date drawdown alongside the drawdowns of the starring nationalist bitcoin mining companies demonstrates the brutality of this carnivore market.

Bitcoin's year-to-date drawdown alongside the drawdowns of the starring nationalist bitcoin mining companies demonstrates the brutality of this carnivore market.

There’s nary productive crushed for overemphasizing the drawdowns. The numbers talk for themselves.

The 5 worst performers to day this twelvemonth that commercialized connected the Nasdaq are:

- TeraWulf (-90.9%)

- BIT Mining (-89.1%)

- Mawson (-86.6%)

- Greenidge (82.7%)

- Stronghold (-81%)

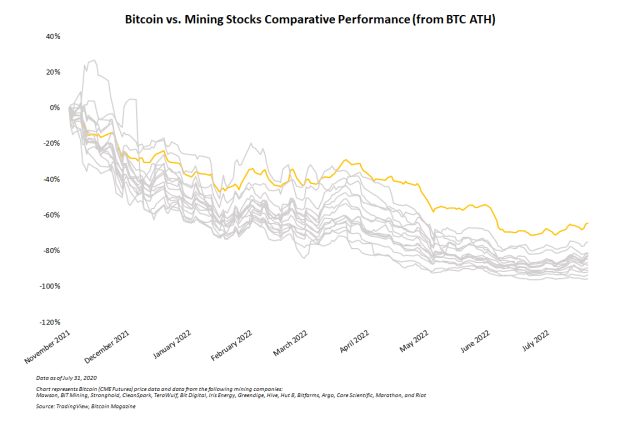

Of course, this benignant of show is not unexpected considering the existent marketplace environment. A much implicit representation of the comparative show from bitcoin and mining companies is shown successful the enactment illustration beneath that includes terms information from bitcoin’s all-time precocious successful precocious 2021 to the clip of penning (the extremity of July 2022). Bitcoin and each mining companies people trended down together, but not a azygous mining institution outperformed (or had a drawdown little than) bitcoin.

It's worthy noting that adjacent implicit this nine-month period, the tightened correlation betwixt each mining stocks is evident aft May 2022, compared to the still-close-but-noticeably-weaker correlations successful the preceding months.

The banal show for nationalist bitcoin mining companies is becoming progressively correlated.

The banal show for nationalist bitcoin mining companies is becoming progressively correlated.

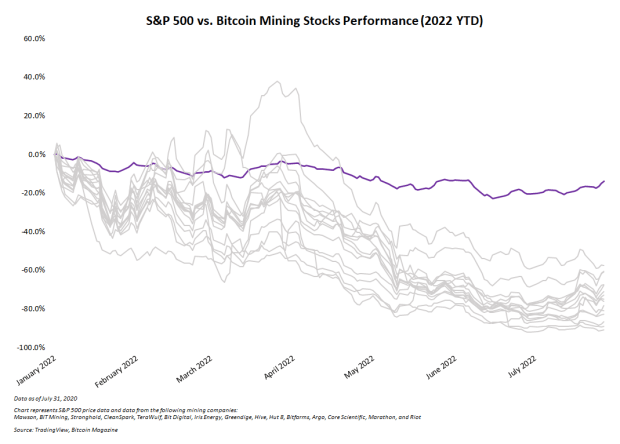

Even worse than comparing mining stocks to bitcoin’s drawdown is comparing them to the Standard and Poor's 500 banal marketplace index. The enactment illustration beneath shows this data, and it’s evident that the S&P 500 has trounced mining stocks truthful acold successful 2022.

Bitcoin mining institution banal show compared to the S&P 500's is adjacent worse than it is compared to the bitcoin price.

Bitcoin mining institution banal show compared to the S&P 500's is adjacent worse than it is compared to the bitcoin price.

Is this benignant of underperformance unusual? In bearish marketplace trends, no. Mining companies execute overmuch amended than bitcoin erstwhile bitcoin goes up. And erstwhile bitcoin goes down, mining companies autumn adjacent harder. It wouldn’t beryllium surprising, however, to spot 1 oregon 2 miners fare somewhat amended than bitcoin. But the marketplace has been brutal crossed the board, and nary of them person outperformed.

Summer Update On The Bitcoin Mining Sector

Setting speech the doom and gloom of the nonfiction up to this point, miners are inactive operating good contempt marketplace conditions. In galore cases, monthly bitcoin accumulation is growing, caller financing is being secured and enlargement plans are continuing.

Specifically connected monthly bitcoin production, for example, the past fewer months person seen:

- Iris Energy boost accumulation by 10% successful May

- Hive excavation over 278 BTC successful June

- Greenidge boost accumulation by 18% successful June

Some nationalist miners are continuing to merchantability larger-than-usual amounts of their regular bitcoin accumulation to upwind the carnivore market. Core Scientific and Argo are examples of this. Other miners are continuing to clasp galore oregon virtually each of the coins they mine, including Hut 8, which is expanding its holdings, and Marathon, which sold nary bitcoin successful Q2 2022.

And contempt the carnivore market, galore nationalist miners proceed readying enlargement projects.

Compared to six months ago, margins are inactive importantly tighter for miners. Hash price, bitcoin price, yada yada. But what is arguably 1 of the astir important sectors successful the bitcoin system is live and increasing adjacent arsenic the broader marketplace is somewhat battered and beaten down. Core Scientific secured $100 million successful caller financing and signed a 75 megawatt (MW) hosting deal. CleanSpark continues acquiring discounted mining hardware. Compute North and Compass Mining signed a 75 MW enlargement agreement. And Marathon secured a 200 MW hosting deal.

Bitcoin’s terms whitethorn inactive beryllium good disconnected its highs, but maturation successful the mining assemblage is inactive humming along.

Who Cares About Public Miners?

In galore Bitcoin circles, small-scale and at-home miners are the darlings, not organization mining entities. Even though each types and sizes of mining units person their spot successful Bitcoin, immoderate readers whitethorn wonderment wherefore the nationalist mining marketplace matters astatine all?

Share terms show for mining companies is simply a reasonably bully gauge for broader capitalist involvement successful bitcoin, speech from the bitcoin terms itself. As much accepted fiscal analysts are paying attention to the mining market, it’s progressively utile to gauge wide sentiment astir bitcoin.

Mining companies are besides a high-beta concern conveyance (or leveraged play) for bitcoin investors. So, if a peculiar capitalist is bullish connected bitcoin and wants to outperform bitcoin itself, they mightiness see investing successful a handbasket of mining stocks.

The authorities of the industry’s largest miners tin besides beryllium a awesome of the bitcoin economy’s health. Miners are ever the bulls of past edifice for bitcoin. And adjacent though occupation for nationalist miners doesn’t ever mean occupation for bitcoin, the inverse is often true. Good times for nationalist mining companies often awesome bully times for bitcoin.

Public Bitcoin Miners Are HODLing On

The existent bitcoin carnivore marketplace has been brutal for nationalist mining companies arsenic the charts successful this nonfiction show. Despite this, astir nationalist mining companies proceed to clasp bitcoin, unafraid caller hosting and financing deals, and hole for the adjacent bull marketplace and the rapidly approaching halving event. Whether the marketplace volition get worse earlier it gets amended is an unfastened question. But the mining assemblage is acold from dormant oregon beaten down. Bitcoin mining is weathering the carnivore marketplace arsenic good arsenic anyone could expect.

This is simply a impermanent station by Zack Voell. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)