The driblet successful bitcoin terms means mining rigs are connected merchantability and prospective buyers whitethorn spot large discounts earlier the summertime ends.

One crushed wherefore miners often wage adjacent attraction to bitcoin’s terms is due to the fact that mining machines person a beardown affirmative correlation to its fluctuations. And arsenic bitcoin’s dollar-denominated worth has dropped precipitously this month, mining hardware prices followed.

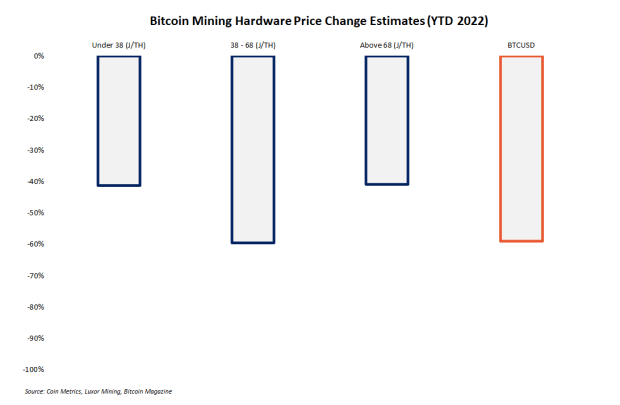

At its caller lows, bitcoin was trading adjacent $17,000, a driblet of over 60% twelvemonth to date. Over the aforesaid period, prices for the astir businesslike mining machines fell by 41%, arsenic elaborate below.

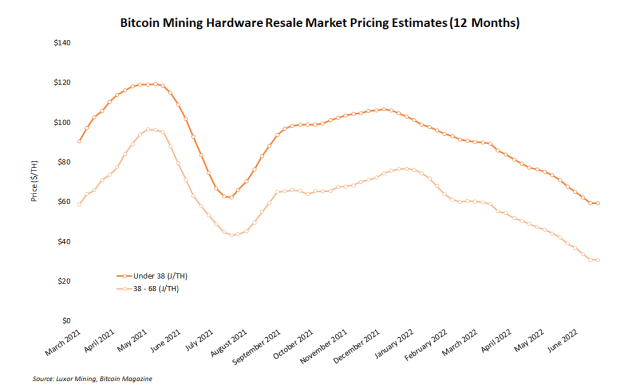

Observing the narration betwixt prices for bitcoin and bitcoin mining machines offers utile penetration into the mining sector’s absorption to bitcoin terms volatility and timing for accumulating discounted hardware.

This nonfiction overviews existent marketplace pricing information for bitcoin mining machines, its correlative narration to bitcoin itself, and discusses however and erstwhile miners mightiness see engaging with the summertime hardware selloff arsenic buyers.

Inside The Latest Bitcoin Mining Hardware Pricing Data

The most- and least-efficient tranches of mining hardware person seen the smallest year-to-date terms declines, according to marketplace information curated by Luxor Mining. Machines with efficiencies supra 38 joules per terahash (J/TH) and beneath 68 J/TH person seen astir 40% declines since January. Over the aforesaid period, bitcoin has dropped astir 60%.

Bitcoin mining rig terms alteration by efficiency.

Bitcoin mining rig terms alteration by efficiency.

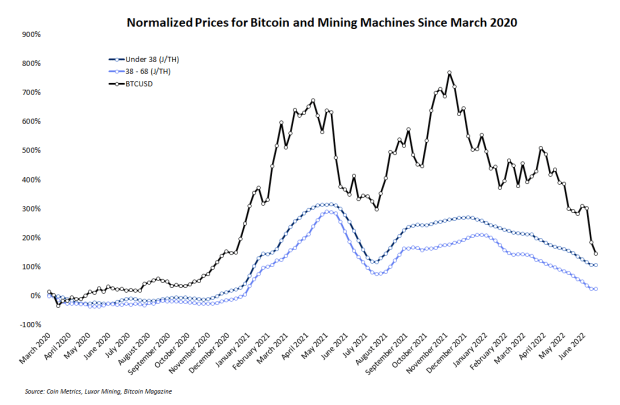

Even though caller terms declines for bitcoin and immoderate mining machines person been akin connected a percent basis, the downward trends did not commencement oregon advancement afloat successful sync with each other. The enactment illustration beneath shows 2 peaks successful bitcoin’s terms during April 2021 and November 2021. Readers volition announcement that prices for the mining machines (data shown for the top-two ratio tiers) didn’t highest until astir a period aboriginal successful some cases.

Bitcoin mining rig prices thin to way the bitcoin terms changes.

Bitcoin mining rig prices thin to way the bitcoin terms changes.

Even though instrumentality prices are intimately correlated to bitcoin’s price, they inactive lag down it. The pursuing conception gives a little mentation for why, but prospective buyers tin often usage fluctuations successful bitcoin’s terms arsenic a near-term indicator of wherever instrumentality prices are apt to.

Why Mining Machine Prices Follow Bitcoin Price

Prices for bitcoin mining hardware are intimately correlated to bitcoin’s terms for 2 cardinal reasons.

For 1 thing, since hash complaint generally follows oregon lags down bitcoin’s terms movements, the prices of bitcoin mining hardware — the root of hash complaint — besides lagging down should beryllium expected. The crushed for this is easy explained: For example, erstwhile bitcoin is successful a sustained downward terms trend, immoderate miners that are facing dwindling profits take to unplug and adjacent liquidate their hardware, which introduces much merchantability unit connected the mining hardware market.

This aforesaid script reverses during bullish periods erstwhile miners – incentivized by climbing mining gross – accumulate and deploy caller machines. Of course, marketplace movements successful each inclination (up oregon down) ne'er hap this cleanly, but successful general, this investigation explains the incentives that origin instrumentality prices to travel bitcoin’s price.

Since hash complaint mostly follows bitcoin's price, prices of bitcoin mining rigs besides lagging down should beryllium expected.

Since hash complaint mostly follows bitcoin's price, prices of bitcoin mining rigs besides lagging down should beryllium expected.

Mining hardware prices besides thin to lag bitcoin due to the fact that of their basal relation arsenic “money printers,” which makes their owners, who are inherently semipermanent bullish, reluctant to hastily merchantability them. Between the operating costs, superior expenditures and wide bullish ideology required to adjacent commencement mining, this assemblage of the Bitcoin system is ever the astir heavily-leveraged long, by a important margin. When the terms goes up, miners are anxious to bargain much hash rate. But erstwhile the bitcoin terms starts to dip, miners with bladed nett margins and poorly-planned operations — contempt their bullish philosophies – are forced to halt hashing and often to liquidate their hardware. In short, the net wealth printers are valuable, and cipher is anxious to merchantability theirs.

It's worthy noting that flimsy dips successful bitcoin’s terms are usually insufficient unit to portion a miner from their machines. But sustained downward terms enactment similar miners person seen for the past respective weeks tin yet unit less-profitable miners to rise currency by selling hardware.

Where To Buy Bitcoin Mining Hardware

The marketplace for mining hardware is present larger and much blase than astatine immoderate different clip successful Bitcoin’s past acknowledgment successful ample portion to galore companies that person built hardware marketplaces to work retail miners. Many of these resale markets, however, are besides often utilized by ample organization buyers that aren’t moving straight with manufacturers, similar Bitmain oregon MicroBT.

Some of the starring mining hardware markets are tally by Kaboomracks, MiningStore, Upstream Data and Compass Mining. Other marketplaces exist, but the hardware marketplace is rife with scams. The effects of bitcoin terms drops are already seen successful the instrumentality marketplace, with monolithic lots of little ratio hardware being listed by miners done Kaboomracks, for example. The institution adjacent published a notice that its availability for accepting older machines similar Antminer S9s is limited, presumably to ward disconnected a imaginable deluge of miners looking to liquidate.

Mining pools like Foundry and Luxor besides connection hardware brokerage services for superior miners. But beyond the institution names listed successful this article, each prospective purchaser should beryllium abundantly cautious earlier sending immoderate funds to anyone posing arsenic a seller of hardware.

Retail miners (aka., the plebs) tin bargain straight from manufacturers, too. Sometimes website buys are restricted oregon unavailable for tiny quantities (usually during times of red-hot purchaser request successful a bull market), which leaves lone organization buyers who person nonstop entree to the manufacturer’s squad capable to spot orders. But successful the existent market, manufacturers person steeply discounted dollar-denominated instrumentality prices, and their website listings are abundant.

How Will Bitcoin Mining Machine Prices Change From Here?

If bitcoin’s terms starts to reverse people and rebound significantly, mining instrumentality prices volition yet follow. Further selloffs volition besides resistance hardware prices lower. And successful that scenario, precisely however debased and for however agelong mining instrumentality prices volition driblet is intolerable to predict.

More downward terms movements from bitcoin, however, are definite to besides trigger much instrumentality proviso connected the resale marketplace arsenic less-efficient mining operations volition beryllium forced to liquidate immoderate assets. In either case, bitcoin’s terms volition often enactment arsenic an indicator for mining hardware prices, and successful general, miners tin program their instrumentality purchases accordingly.

This is simply a impermanent station by Zack Voell. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)