Bitcoin’s perpetual futures marketplace backing complaint tin play a cardinal relation successful short-term terms movement. So wherever bash things basal now?

The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Options And Derivatives Update

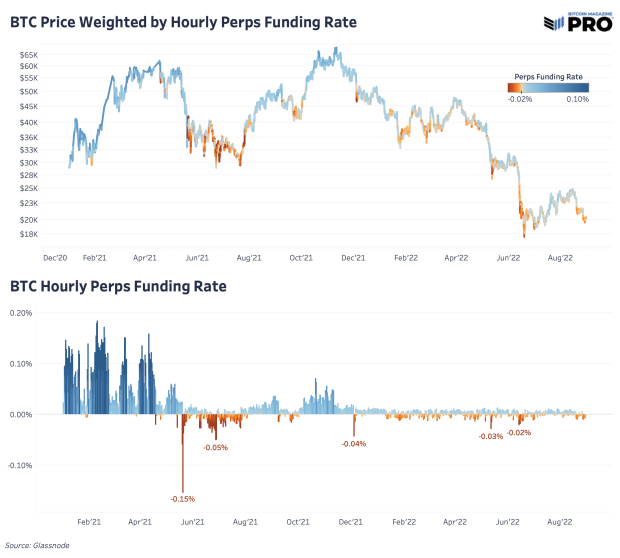

One dynamic and illustration we’ve covered extensively earlier is bitcoin’s perpetual futures marketplace backing complaint compared to price. In the erstwhile 2021 bull run, the perpetual (perps) futures marketplace played a cardinal relation successful moving short-term prices to some the upside and downside with excessive leverage. It’s worthy reviewing the authorities of the derivatives marketplace and the system’s existent leverage arsenic bitcoin terms has breached down from its latest rally, pursuing U.S. equities connected a imaginable way towards caller lows.

Since the apical successful November 2021, the perpetual futures marketplace has been consistently biased towards the downside (neutral backing complaint is 0.10%). Simply put, much of the marketplace participants were and inactive are biased abbreviated implicit the past 8 months. Even during the latest carnivore marketplace rally move, that hasn’t changed. We didn’t spot the backing complaint spell supra neutral territory showing a wide motion that agelong speculators and hazard appetite person not returned to the market.

With the palmy motorboat of a bitcoin futures ETF successful U.S. markets past fall, on with a wide unwind successful speculative enactment crossed the bitcoin/cryptocurrency market, perp backing rates person been teetering from a neutral to abbreviated bias with overmuch little explosive moves successful backing rates. Although derivatives marketplace dynamics person changed, it’s inactive worthy watching for an actionable awesome from the perps marketplace wherever the shorting bias gets heavy offside arsenic it's shown to bash passim past marking important bottoms. It’s worthy noting that successful erstwhile carnivore marketplace cycles (where caller incoming spot request was diminished by consenting sellers) backing could enactment antagonistic for agelong periods of times, owed to deficiency of request to speculate/leverage the plus from the bulls.

In erstwhile bitcoin carnivore markets, backing could enactment antagonistic for agelong periods of times owed to deficiency of request to speculate/leverage BTC.

In erstwhile bitcoin carnivore markets, backing could enactment antagonistic for agelong periods of times owed to deficiency of request to speculate/leverage BTC.

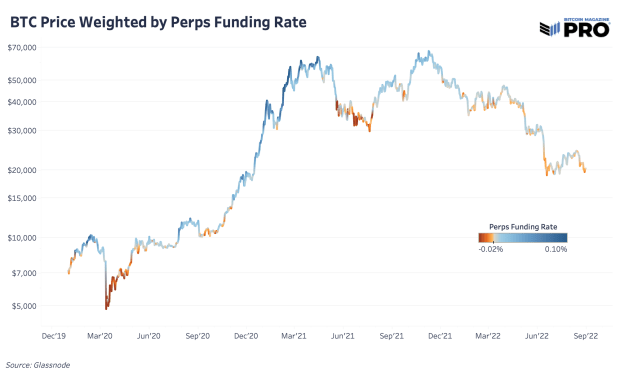

The bitcoin terms weighted by the perpetual backing complaint is present astir its December 2020 levels.

The bitcoin terms weighted by the perpetual backing complaint is present astir its December 2020 levels.

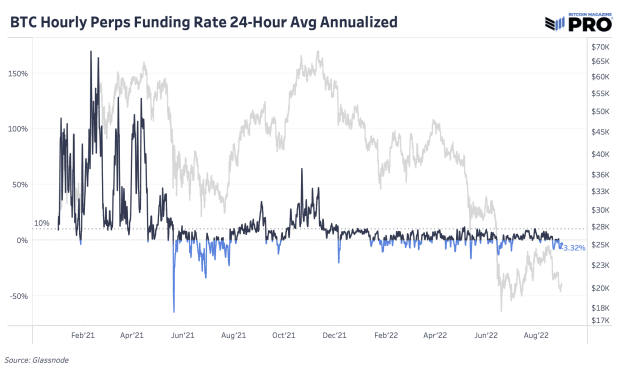

Another mode to visualize the backing complaint is to look astatine an annualized worth with the existent antagonistic backing rates yielding an estimated 3.32% for taking a agelong against the bulk of shorts. Since the breakdown successful November 2021, the marketplace has yet to get backmost implicit the annualized neutral backing rate.

An annualized worth with the existent antagonistic backing rates yields an estimated 3.32%.

An annualized worth with the existent antagonistic backing rates yields an estimated 3.32%.

Price has moved with the inclination of declining futures marketplace unfastened involvement successful USD since the marketplace top. That’s easier to spot successful the 2nd and 3rd charts beneath which conscionable shows the perps futures marketplace stock of each futures unfastened interest. The perps marketplace accounts for the lion’s stock of unfastened involvement of implicit 75% and has grown substantially from astir 65% astatine the commencement of 2021.

With the magnitude of leverage disposable successful the perps market, it makes consciousness wherefore perps marketplace enactment has specified a ample interaction connected price. Using a unsmooth calculation of the full perps marketplace measurement from Glassnode of $26.5 cardinal per time (7-day moving average) versus Messari’s existent spot volume (7-day moving mean adjusting for inflated speech volumes) of $5.7 billion, the perps marketplace trades astir 5 times the measurement to spot markets. On apical of that, regular spot measurement is down astir 40% from past year, a statistic to assistance recognize conscionable however overmuch liquidity has near the market.

Given the measurement of the bitcoin derivative contracts comparative to spot markets, 1 whitethorn get astatine the decision that derivatives tin beryllium utilized to suppress bitcoin. We really disagree, fixed the dynamically priced involvement complaint associated with bitcoin futures products, we judge that connected a agelong capable clip framework the effect of derivatives is nett neutral connected price. While bitcoin apt exploded overmuch higher than it different would person owed to the reflexive effects of leverage, those positions yet were forced to close, frankincense an adjacent antagonistic absorption was absorbed by the market.

3 years ago

3 years ago

English (US)

English (US)