Macroeconomic crises processing successful Pakistan, Taiwan and China underscore the flaws successful macroeconomics and the request for Bitcoin.

“Fed Watch” is simply a macroeconomic podcast, existent to bitcoin’s rebel nature. In each episode, we question mainstream and Bitcoin narratives by examining existent events successful macroeconomics from crossed the globe, with an accent connected cardinal banks and currencies.

In this occurrence of “Fed Watch,” CK and I went done respective charts, giving marketplace updates connected bitcoin, the dollar (DXY) and the Hong Kong dollar. Next, we examined the deteriorating concern successful Pakistan, and asked the question, is it the adjacent Sri Lanka? Lastly, we discussed the Taiwan/China concern and I work respective important snippets, 1 from Chinese foriegn curate Wang Yi and the different from deliberation vessel adept Wang Wen.

Audio listeners tin travel on with the slides here.

Don’t hide to cheque retired the “Fed Watch Clips” channel connected YouTube.

Watch This Episode On YouTube oregon Rumble

Listen To The Episode Here:

Bitcoin And Other Currencies

We opened by looking astatine a play illustration of bitcoin. We’ve done this for the past fewer shows, due to the fact that it is simply a bully mode to anchor our speech successful bitcoin. As you tin spot below, the terms has been precise stable, sitting connected the obstruction successful regards to the volume-by-price indicator connected the right.

The bitcoin terms has been precise stable

The bitcoin terms has been precise stable

If we zoom out, the past play with play candles akin to contiguous was backmost successful September/October 2020, close earlier the monster rally from $10,000 to $40,000. Of course, we aren’t saying that it volition hap again precisely similar that, but it is possible.

The bitcoin terms contiguous looks akin to erstwhile it experienced a monster rally successful 2020.

The bitcoin terms contiguous looks akin to erstwhile it experienced a monster rally successful 2020.

The Dollar Index (DXY) is the different large currency we took a look at. I judge it is important to cheque the dollar astir each episode, due to the fact that it is the main contention for bitcoin.

It does look arsenic though it has peaked for the clip being, but determination is nary motion that it volition crash. Instead, the dollar is astir apt to signifier a caller elevated scope supra 100 for the adjacent fewer years. This is akin to however it formed a caller higher scope from 2015 to 2021.

Source for supra images: bitcoinandmarkets.com

Source for supra images: bitcoinandmarkets.comI’ll adhd that a beardown dollar is not bearish for bitcoin. Perhaps, initially, a beardown dollar is correlated to little bitcoin, but aft the dollar has stabilized successful a higher range, that is erstwhile bitcoin has traditionally rallied.

Below is simply a screenshot from the Hong Kong Monetary Authority’s website. Each month, it releases statistic connected its overseas currency reserves, which it uses to stabilize its peg. Last week, I speculated that maintaining the Hong Kong dollar (HKD) peg was rapidly draining its reserves. However, according to this property release, it lone utilized somewhat much than 1% of its reserves successful July to support the peg. That means the HKD is apt capable to support the peg (if it wants to) for respective years.

Source: HKMA

Source: HKMAPakistan On The Brink

The processing concern successful Pakistan has a batch of things successful communal with the caller illness successful Sri Lanka. In the podcast, I pointed to i5w engagement with the World Economic Forum (WEF). Pakistan has received hundreds of millions of dollars successful backing to revamp its cultivation assemblage and adhd nationalist parks.

Source: Twitter

Source: Twitter

Another similarity betwixt Pakistan and Sri Lanka is the important relation that Chinese backing has played successful the past decade. Sri Lanka mislaid power of its large larboard due to the fact that it couldn’t wage backmost Chinese loans, and present Pakistan is saddled with astir $20 cardinal successful high-interest loans to China and Chinese companies.

Pakistan has lone 2 months near successful the budget, and is desperately courting caller lenders. The Chinese person turned it down, the Arab States are reasoning twice, the lone spot to crook is backmost to the IMF. And that means harsh austerity.

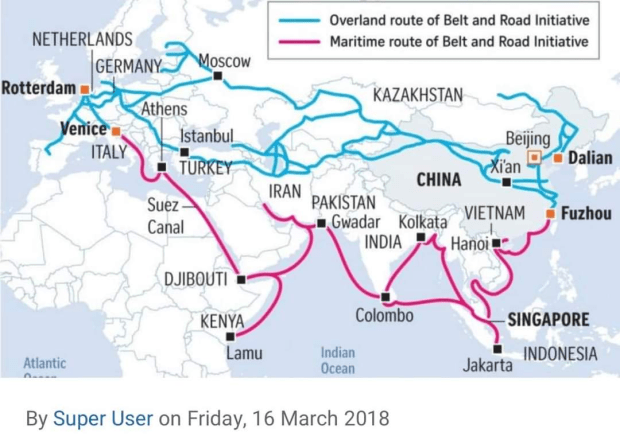

Perhaps, not surprising, that some Sri Lanka and Pakistan are important nodes successful the Belt and Road Initiative (BRI).

Source: Asia Green

Source: Asia Green

As I’ve said connected galore occasions, the BRI is doomed to failure. China is attempting to marque places and routes economically viable, wherever the agelong span of past hasn’t done so. No magnitude of wealth tin overturn millenia of civilization and eons of geography.

Well, erstwhile again, 1 of the important links successful the BRI has been bankrupted by the Chinese cardinal planners.

Taiwan/China Situation

Source: AZ Quotes

Source: AZ Quotes

I’ve been discussing the Pelosi concern and the Chinese effect for days connected my Telegram unrecorded streams.

In this occurrence of “Fed Watch,” I work immoderate excerpts from a noted Chinese curate and a Chinese deliberation vessel expert. You tin work Wang Yi’s afloat comments here. Suffice it to accidental for this article, helium repeated “One China” galore times, and called the U.S. the broadside trying to alteration the presumption quo. He besides had precise harsh words for Tsai Ing-wen, the sitting president of Taiwan. He said she “betrayed the ancestors.” In different translation, I heard Yi’s archetypal comments besides bespeak that she betrayed her ancestors (and her race).

The adjacent comments I work were from Wang Wen, enforcement dean of the Chongyang Institute for Financial Studies astatine Renmin University of China (RDCY) and the enforcement manager of the China-U.S. People-To-People Exchange Research Center. You tin work his comments and respective others here. He tries to explicate wherefore China’s effect was truthful weak, and that China should not provoke an equipped struggle with the U.S. until it tin “outperform the U.S. successful presumption of economical power, attain fiscal and subject spot comparable to that of the U.S., and make an overwhelming capableness to antagonistic planetary sanctions.”

Sounds a agelong mode off. I’ll simply counsel the scholar to not get caught up successful fear-baiting rhetoric astir Taiwan and China. They are disciples of Sun Tzu, who said, “appear beardown erstwhile you are weak.” Wen besides quoted Sun Tzu:

“A large subject clash with the U.S. is not the extremity of China's overseas policy, nor is it the way to a amended beingness for the communal people. Recall what Sun Tzu wrote successful ‘The Art Of War’: ‘Do not enactment unless determination is thing to summation 非利不动; bash not usage subject unit without the certainty of triumph 非得不用; bash not spell to warfare unless the concern is captious 非危不战.’”

We wrapped up the podcast talking astir the upcoming CPI information merchandise and different things pertinent to bitcoin.

This is simply a impermanent station by Ansel Lindner. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)