109 years ago, the U.S. Federal Reserve was created and ever since that day, the purchasing powerfulness of the U.S. dollar has dropped a large deal. Since the Fed started, much than 96% of the greenback’s purchasing powerfulness has been erased via inflation.

The Purchasing Power of the U.S. Dollar After the Creation of the Federal Reserve connected Dec. 24, 1913 Dwindles Lower

During the past 100 years, economists person blamed the U.S. Federal Reserve for a large woody of America’s rising inflation. American economist and societal theorist Thomas Sowell referred to the Fed arsenic a “cancer,” and erstwhile politcians similar Ron Paul person called connected the masses to abolish the Fed. Prior to the instauration of the Fed connected Dec. 23, 1913, America had 2 cardinal banks the preceded the existent U.S. cardinal bank.

The archetypal U.S. cardinal slope started successful 1791 which was the First Bank of the United States, a fiscal instauration charted by Congress astatine the time. The 2nd effort to make a cardinal slope successful America was successful 1816 with the enactment of the Second Bank of the United States. The 3rd cardinal slope is the existent fiscal instauration we cognize of contiguous called the Federal Reserve and it was officially created 109 years agone conscionable earlier Christmas Eve.

Because of the Panic of 1907, Americans astatine the clip were convinced that a cardinal slope was needed. A concealed acceptable of meetings connected Jekyll Island that included America’s apical fiscal elites and the alleged ‘Money Trust’ crafted the foundations of the Federal Reserve system. The American radical were kept successful the acheronian astir the meetings betwixt legislator Nelson Aldrich and the ‘House of Morgan.”

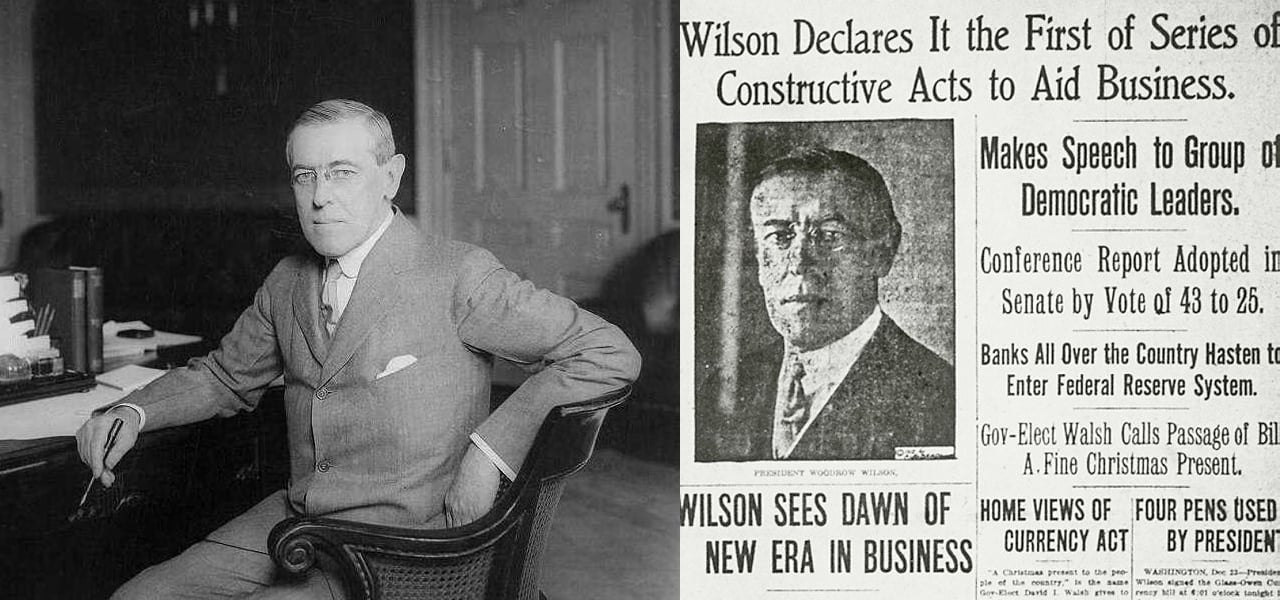

The concealed Jekyll Island meetings took spot connected Nov. 20, 1910 and Nov. 30, 1910. The House of Representatives voted connected the Federal Reserve Act connected December 22, 1913, the U.S. Senate voted connected the enactment the adjacent day, and President Woodrow Wilson signed the enactment into instrumentality connected Christmas Eve. Ever since this point, the greenbacks Americans usage that assertion to beryllium a ‘promissory note’ backed by the U.S. Federal Reserve, person mislaid sizeable value.

Furthermore, some would say that “only if the gait of wealth enlargement surpasses the gait of summation successful the accumulation of goods volition we person a wide summation successful prices.” However, immoderate individuals would besides importune that different types of authorities interference similar irrational spending, sanctions, and regulations tin marque the terms of goods and services emergence unnaturally.

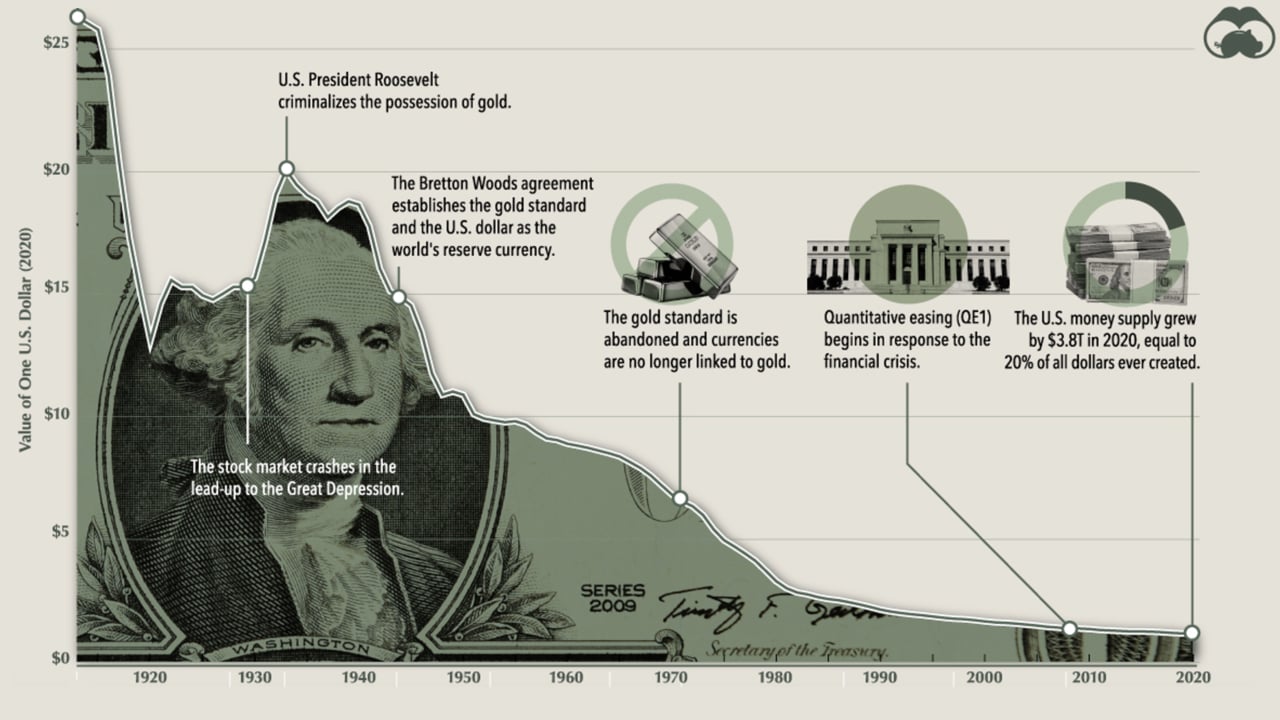

Statistics amusement that betwixt 1913 to 2017, the U.S. dollar has mislaid much than 96% of its purchasing power, according to the American Enterprise Institute. 2022 metrics amusement that $1 successful 1913 equates to astir $30.07 successful purchasing power today. One study says: “The dollar had an mean ostentation complaint of 3.17% per twelvemonth betwixt 1913 and today, producing a cumulative terms summation of 2,907.18%.”

A report published by visualcapitalist.com past twelvemonth explains however you could acquisition 10 bottles of brew backmost successful 1933 with a azygous greenback and today, you’d beryllium fortunate to get a tiny java for that $1. Since 2020, ostentation has soared arsenic the U.S. Federal Reserve accrued the monetary proviso by a sizeable magnitude during the past 3 years.

Visualcapitalist.com’s writer Govind Bhutada explained the “money proviso (M2) successful the U.S. has skyrocketed implicit the past 2 decades, up from $4.6 trillion successful 2000 to $19.5 trillion successful 2021.” He added that the “effects of the emergence successful wealth proviso were amplified by the fiscal situation of 2008 and much precocious by the COVID-19 pandemic — In fact, astir 20% of each U.S. dollars successful the wealth supply, $3.4 trillion, were created successful 2020 alone.”

The Ukraine-Russia warfare has caused vigor prices to leap a batch higher arsenic a large fig of Western countries similar the United States person imposed sanctions connected Russia. The sanctions, successful turn, made lipid and earthy state prices emergence a large deal, due to the fact that Russia is 1 of the largest suppliers of fossil fuels successful the world. Additionally, U.S. authorities officials person imposed a large woody of reddish portion connected firms that don’t travel on with the alleged clime alteration reform.

Between the U.S. government’s subject spending, the Fed’s monolithic monetary M2 summation since 2020, and the sweeping clime alteration regulations person each contributed to the rising prices crossed the country. This is the crushed wherefore escaped marketplace advocates similar alternatives similar precious metals and cryptocurrencies. Precious metals, for instance, are scarce and they cannot beryllium printed connected a whim similar fiat currencies.

Metals similar golden and metallic person intrinsic worth arsenic well, arsenic they are utilized wide for things similar jewelry, machine parts, and coins. Although, some precious metals and fiat currencies tin beryllium cumbersome successful carnal form, arsenic holding a large woody of golden oregon stacks of U.S. dollars requires information and secrecy of immoderate sort. Cryptocurrencies similar bitcoin (BTC) are besides scarce and cannot beryllium printed connected a whim similar promissory notes either.

Crypto assets similar bitcoin are much portable and portion they request information and secrecy, the outgo to bash truthful is negligible. Both of these types of alternate monies person not eroded successful worth similar fiat currencies each crossed the satellite person during the past 100 years. Data intelligibly shows the U.S. dollar cannot be a store of value for a agelong play of time. Like the economist Friedrich A. Hayek erstwhile said, bully wealth cannot beryllium until it is removed from the state.

“I don’t judge we shall ever person a bully wealth again earlier we instrumentality the happening retired of the hands of government, that is, we can’t instrumentality them violently retired of the hands of government, each we tin bash is by immoderate sly roundabout mode present thing that they can’t stop,” Hayek said.

Tags successful this story

climate change, Fed, Federal Reserve, Govind Bhutada, Greenback, House of Morgan, inflation, Jekyll Island, monetary M2 increase, money supply, Money Trust, Panic of 1907, Purchasing Power, Regulations, Sanctions, Ukraine-Russia war, US Central Bank, US Dollar, US Federal Reserve, USD, visualcapitalist.com, Woodrow Wilson

What bash you deliberation astir the U.S. dollar losing much than 96% of its purchasing powerfulness since the time the Fed was created? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)