The beneath is from a caller variation of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Today, we saw yet different acceleration successful the United States Consumer Price Index for the period of February with information coming successful enactment with statement expectations astatine 7.91%. Previously, we expected ostentation to potentially highest successful Q1 portion remaining elevated for the remainder of the twelvemonth but that script is looking little and little apt arsenic the surge successful commodities and vigor prices are present taking over.

Even if it has small worldly interaction connected bringing prices down, the Federal Reserve and different cardinal banks are successful a presumption wherever they are present forced to effort and aggressively tighten monetary argumentation to support immoderate integrity oregon illusion of their terms stableness goals.

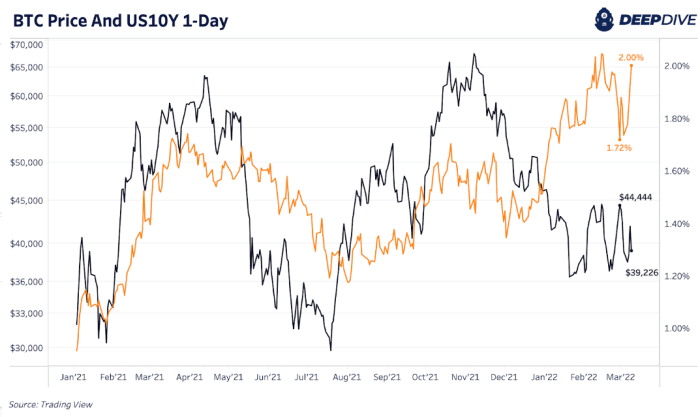

Since December, a emergence successful the 10-year yields with recognition getting much costly has coincided with a autumn successful bitcoin’s price.

A emergence successful 10-year yields with recognition becoming much costly is coinciding with a dip successful the bitcoin price.

So what does this each mean for the large picture?

Credit markets are opening to recognize that ostentation is present to stay, successful a big way, arsenic is the inclination of rising yields since Q4 2021. As recognition instruments merchantability off, involvement rates successful a historically over-indebted economical strategy rise, starring to a little nett contiguous worth for fiscal assets, and higher involvement burdens connected consumer, firm and sovereign equilibrium sheets.

Our basal lawsuit for the short/intermediate word is progressively choky fiscal conditions and an unwind successful leverage (in bequest markets, arsenic bitcoin derivatives person already de-risked substantially).

In our view, this authorities ends with a liquidity situation successful bequest markets, which apt has a nett antagonistic interaction connected the bitcoin price, followed by a pivot successful cardinal slope argumentation backmost towards quantitative easing and yet output curve control.

Short/medium word liquidity risks aside, the extremity crippled is unchanged. The lawsuit for a non-sovereign perfectly scarce integer monetary plus has ne'er been stronger.

3 years ago

3 years ago

English (US)

English (US)