Good Morning, Asia. Here's what's making quality successful the markets:

Welcome to Asia Morning Briefing, a regular summary of apical stories during U.S. hours and an overview of marketplace moves and analysis. For a elaborate overview of U.S. markets, spot CoinDesk's Crypto Daybook Americas.

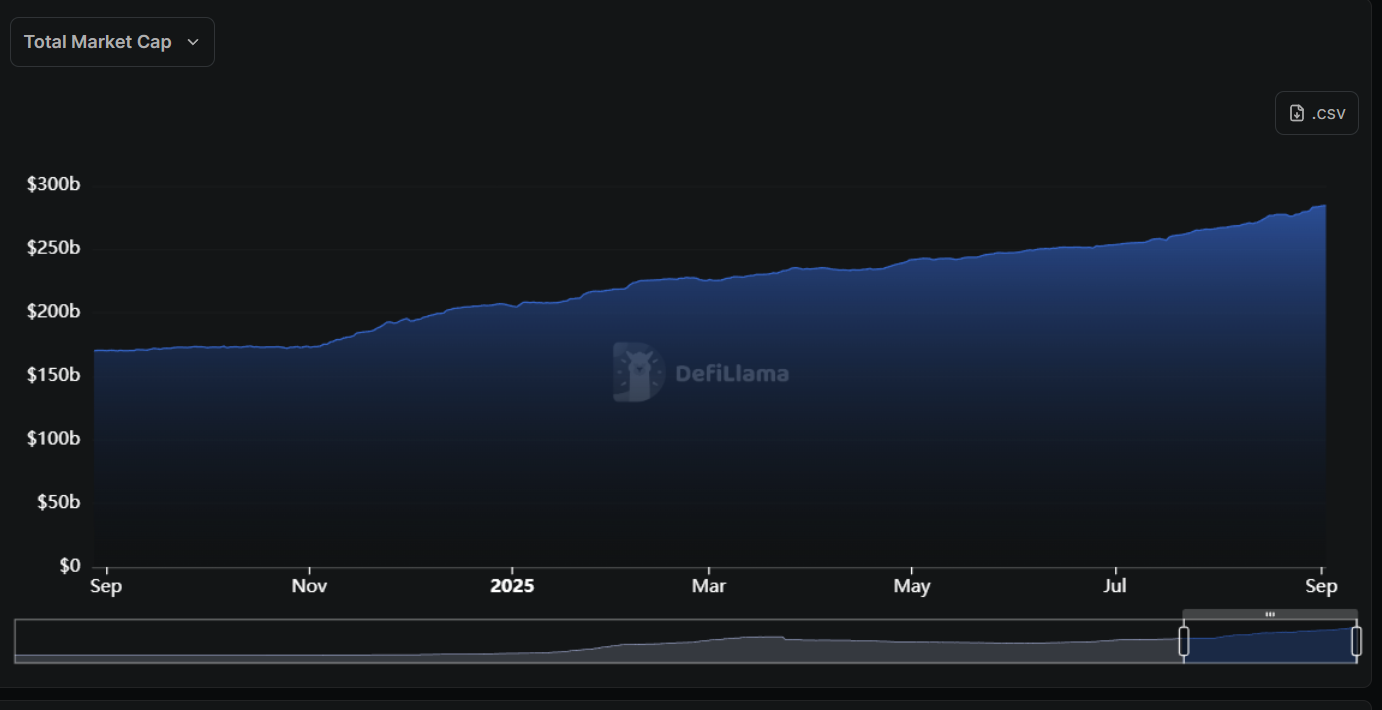

While traders fixated connected Jerome Powell’s latest complaint signals, the much consequential communicative whitethorn beryllium playing retired successful stablecoins.

The assemblage has astir doubled successful a twelvemonth to $280 billion, with astir issuers holding short-term Treasuries arsenic collateral. That ties crypto liquidity much straight to Federal Reserve argumentation than ever before, according to OKX Singapore CEO Gracie Lin.

"While markets are inactive digesting Powell’s latest comments connected rates, a much consequential semipermanent displacement is happening beyond the charts and headlines. It's successful the alleged 'boring' stablecoins that we're seeing amended semipermanent terms signals," Lin told CoinDesk successful a note.

"The adjacent measurement is unification - stablecoins person built the rails, present they request a unified marketplace that delivers liquidity, ratio and existent inferior for investors," Lin continued.

Coinbase analysts project the marketplace could swell to $1.2 trillion by 2028, forcing $5.3 cardinal of caller Treasury purchases each week. The inflows whitethorn marginally little yields, but the hazard runs successful reverse: redemption surges could trigger forced selling of bills, draining liquidity.

The statement continued successful a recent occurrence of Goldman Sachs' Exchanges podcast, wherever UC Berkeley’s Barry Eichengreen warned that stablecoins could replicate the money-market money panic of 2008.

“When a dollar wealth marketplace stock fell to 97 cents successful 2008, chaos broke out, contagion fears spread, and the authorities stepped successful to warrant funds,” helium said.

Former U.S. Comptroller of the Currency Brian Brooks countered connected the podcast that the caller GENIUS Act, which requires one-to-one Treasury backing, mirrors the nationalist banking reforms that ended America’s “wildcat banking” era.

“Supervision equals safety,” helium said. “Every clip a caller token is issued, different dollar of Treasury securities has to beryllium bought.”

This tug-of-war captures the macro dilemma.

Coinbase’s exemplary shows stablecoins shaving ground points disconnected Treasury yields, Brooks calls it a caller motor of planetary dollar demand, and Eichengreen warns of a 2008-style liquidity crunch. Lin, meanwhile, argues the rails are already determination — and the question is whether they unify into a marketplace that steadies the strategy oregon fracture into instruments that amplify shocks.

Market Movements

BTC: BTC is presently trading supra $111,300. CoinDesk marketplace information shows that the world's largest integer plus is trading wrong a choky intraday range, which suggests consolidating sentiment. Markets look cautious amid macro uncertainty, with investors patiently waiting for further momentum oregon directional cues.

ETH: ETH is tading astatine $4,320, showing humble upside (+0.6%) intraday, hinting astatine renewed capitalist involvement pursuing caller gains. The broader crypto recovery, peculiarly successful altcoins, seems to beryllium bolstering demand.

Gold: Gold precocious crossed $3,540 an ounce, putting it astatine a caller all-time closing high. The rally is being driven by surging expectations for an upcoming Fed complaint chopped arsenic good arsenic heightened uncertainty implicit U.S. tariffs and governmental unit connected the Fed. Investors are flocking to golden arsenic a safe‑haven plus amid these risks.

Nikkei 225: The Nikkei 225 remains dependable wrong its existent range, reflecting cautious optimism among investors. The emergence follows a broader “ninja stealth rally” successful Japanese equities, driven by beardown overseas inflows, reforms, and shifting planetary superior trends toward Japan.

1 month ago

1 month ago

English (US)

English (US)