Good Morning, Asia. Here's what's making quality successful the markets:

Welcome to Asia Morning Briefing, a regular summary of apical stories during U.S. hours and an overview of marketplace moves and analysis. For a elaborate overview of U.S. markets, spot CoinDesk's Crypto Daybook Americas.

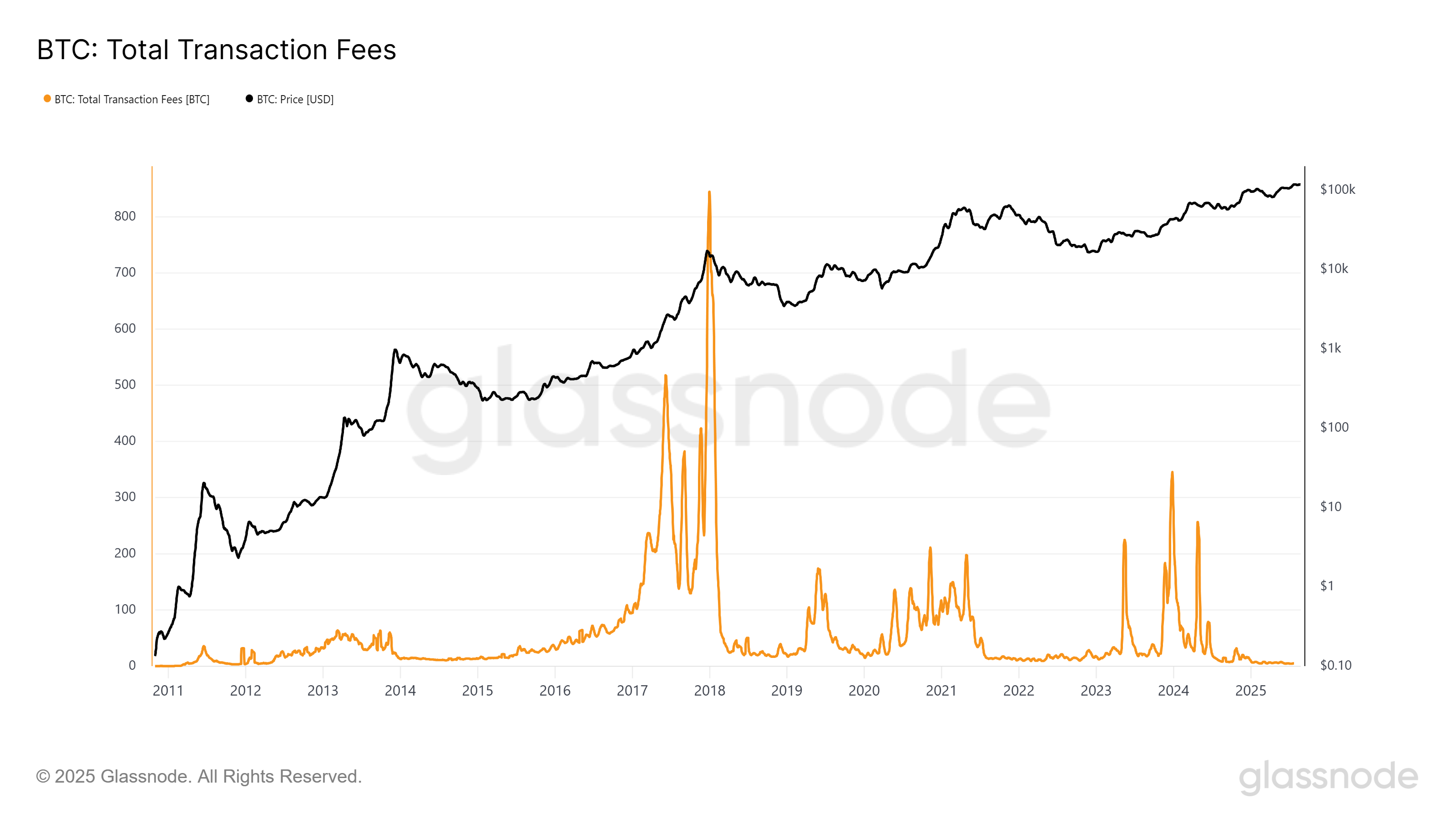

Bitcoin’s terms is holding adjacent records, but the concatenation itself is quiet. Glassnode information shows transaction fees person collapsed backmost toward decennary lows, adjacent arsenic BTC flirts with six figures.

In past cycles, interest spikes tracked bull markets arsenic traders bid for blockspace. This year, the interest curve is level portion terms rises, a wide motion that onchain request is nary longer driving the market.

A caller study from Galaxy Research shows median regular fees person fallen much than 80% since April 2024, with arsenic overmuch arsenic 15% of regular blocks present clearing astatine conscionable 1 satoshi per vbyte. Nearly fractional of caller blocks are not full, signaling anemic request for blockspace and a dormant mempool.

This is simply a crisp opposition to anterior bull cycles, wherever terms rallies translated into congestion and interest spikes.

The information confirms a structural shift: spot ETFs and custodians present clasp much than 1.3 cardinal BTC, and coins parked successful those wrappers seldom interaction the concatenation again.

At the aforesaid time, retail enactment that erstwhile clogged the Bitcoin blockchain has migrated to Solana, wherever memecoins and NFTs payment from cheaper and faster execution. The result, Galaxy notes, is that the bitcoin terms is being acceptable by custodial inflows portion the network's onchain request – erstwhile a proxy for terms question – has slowed down.

For miners, this dynamic is peculiarly punishing. With rewards halved to 3.125 BTC and fees contributing little than 1% of artifact gross successful July, profitability is nether strain. That accent is pushing listed miners to diversify into AI and HPC hosting.

Read more: Bitcoin Mining Faces 'Incredibly Difficult' Market arsenic Power Becomes the Real Currency

A report from earlier this year by Rittenhouse Research argues that Galaxy Digital’s determination retired of mining altogether could beryllium the exemplary for the sector.

This determination has been applauded by the equity markets. While BTC is down much than 3% on-year, the CoinShares Bitcoin Mining ETF has gained astir 22%. Investors are rewarding firms that person leaned into diversification alternatively than relying connected artifact rewards alone.

Listed miners archer a akin story. Hive, Core Scientific, and TeraWulf each reported Q2 results padded by HPC and AI hosting revenues.

Those with nary diversification, similar Bitdeer and BitFuFu, stay profoundly exposed to energy costs, instrumentality depreciation, and a interest marketplace that Galaxy warns successful its study is “anything but robust.”

The juxtaposition is telling: Galaxy’s ain probe warns that the Bitcoin blockchain's colony relation is stagnating, portion Galaxy's equilibrium expanse is being repositioned for maturation successful AI information centers.

Onchain information makes the point: without integrated request for blockspace, fees can’t money security. And if fees enactment low, equity markets are coating a wide representation that mining sector’s champion aboriginal returns whitethorn travel from AI, not Bitcoin.

Market Movements

BTC: Bitcoin traded astatine $113,286.95, down 1.79%, aft concisely plunging to a six-week debased adjacent $110,600, with the broader crypto marketplace facing dense liquidations and volatility.

ETH: Ether traded level astatine $4,779 arsenic Jerome Powell’s dovish Jackson Hole remarks boosted expectations of a September complaint cut, with asset managers predicting caller highs for bitcoin and an ETH breakout supra $5,000 contempt risks from treasury adoption and equity volatility.

Gold: Gold closed astatine $3,371 aft Powell’s dovish Jackson Hole remarks boosted September rate-cut odds.

Nikkei 225: Asia-Pacific stocks climbed Monday, with Japan’s Nikkei 225 up 1.08%, aft Powell signaled imaginable Fed complaint cuts successful September during his Jackson Hole speech.

Elsewhere successful Crypto

- The Funding: Why raising a crypto VC money is harder present — adjacent successful a bull marketplace (The Block)

- Why Luca Netz Will Be 'Disappointed' If Pudgy Penguins Doesn't IPO Within 2 Years (Decrypt)

- KPMG Says Investor Interest successful Digital Assets Will Drive Strong Second Half for Canadian Fintechs (CoinDesk)

1 month ago

1 month ago

English (US)

English (US)