Good Morning, Asia. Here's what's making quality successful the markets:

Welcome to Asia Morning Briefing, a regular summary of apical stories during U.S. hours and an overview of marketplace moves and analysis. For a elaborate overview of U.S. markets, spot CoinDesk's Crypto Daybook Americas.

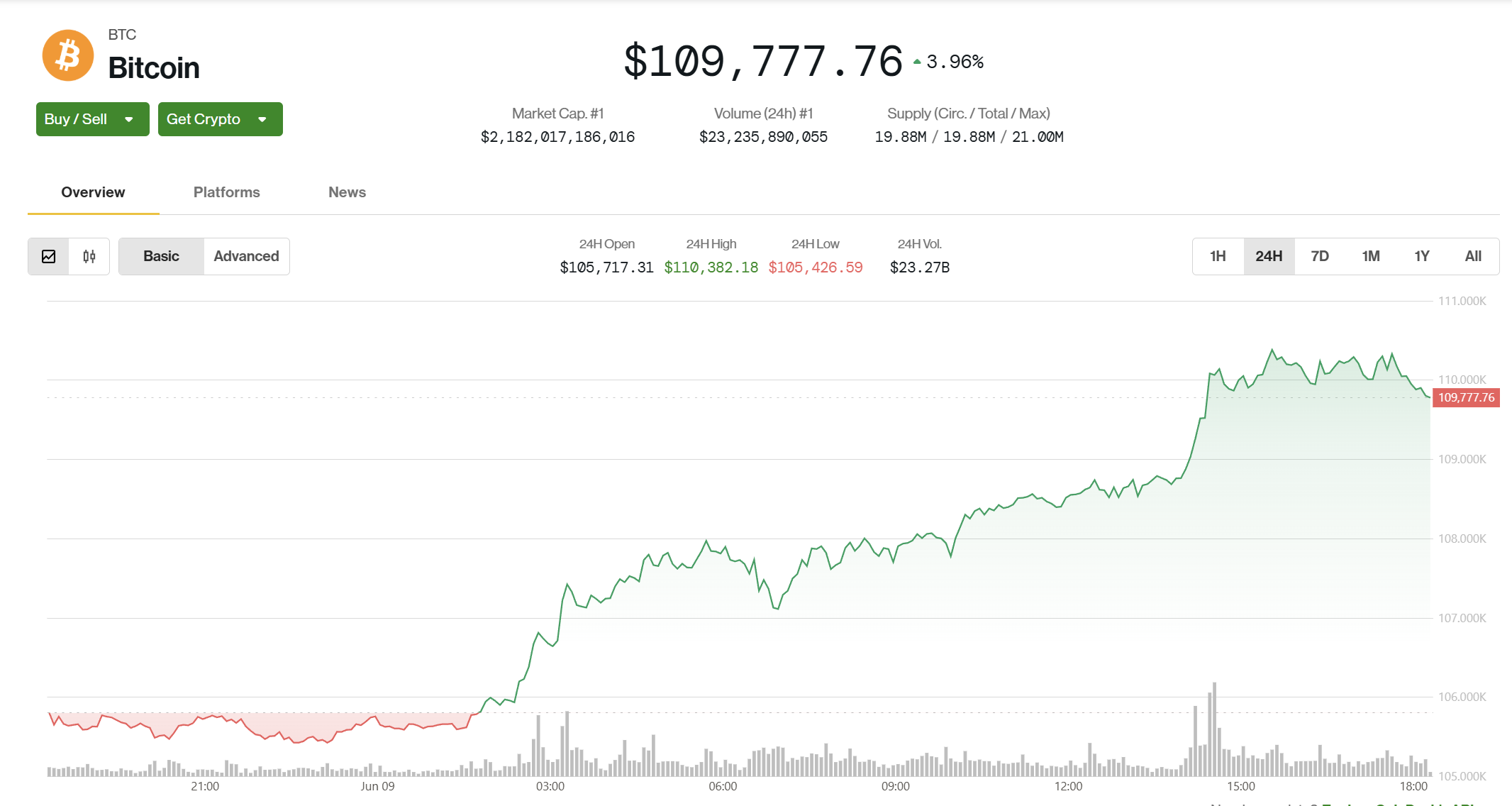

Bitcoin is trading beneath $110,000, changing hands astatine $109.7K, arsenic Asia continues its trading week.

The determination challenges a prevailing marketplace communicative of summertime stagnation, coming connected the heels of a enactment from QCP Capital that emphasized suppressed volatility and a deficiency of contiguous catalysts.

A caller Telegram enactment from QCP pointed to one-year lows successful implied volatility and a signifier of subdued terms action, noting that BTC had been “stuck successful a choky range” arsenic summertime approaches.

A cleanable interruption beneath $100K oregon supra $110K, they wrote, would beryllium needed to “reawaken broader marketplace interest.”

Even so, QCP warned that caller macro developments had failed to spark directional conviction.

“Even arsenic US equities rallied and golden sold disconnected successful the aftermath of Friday’s stronger-than-expected jobs report, BTC remained conspicuously unmoved, caught successful the cross-currents without a wide macro anchor,” the enactment said. “Without a compelling communicative to spark the adjacent limb higher, signs of fatigue are emerging. Perpetual unfastened involvement is softening, and spot BTC ETF inflows person started to taper.”

That discourse makes the existent determination each the much surprising.

Over the weekend, Bitcoin surged 3.26% from $105,393 to $108,801, with hourly measurement spiking to 2.5x the 24-hour average, according to CoinDesk Research's method investigation model. BTC broke decisively supra $106,500, establishing caller enactment astatine $107,600, and continued upward into Monday’s session, reaching $110,169.

The breakout coincides with a tense macro backdrop: US-China commercialized talks successful London and a $22 cardinal U.S. Treasury enslaved auction aboriginal this week person injected uncertainty into planetary markets. While these events could thrust caller volatility, QCP cautioned that caller headlines person mostly led to “knee-jerk reactions” that rapidly fade.

The question present is whether BTC’s determination supra $110K has existent staying power, oregon whether the rally is moving up of the fundamentals.

A 'Massive Shift' successful Institutional Staking May Drive ETH's Next Rally

Ethereum’s critics person agelong highlighted centralization risks, but that communicative is fading arsenic organization adoption accelerates, infrastructure matures, and caller protocol upgrades straight code past limitations.

“Market participants volition wage for decentralization due to the fact that it's successful their economical involvement from a information and main extortion standpoint,” Mara Schmiedt, CEO of organization Ethereum staking level Alluvial, told CoinDesk. “If you look astatine [decentralization metrics] each of these things person massively improved implicit the past mates of years."

There's presently $492 cardinal worthy of ETH staked by Liquid Collective – a protocol co-founded by Alluvial to facilitate organization staking

While this fig whitethorn look humble compared to Ethereum’s full staked volume of astir $93 billion, what's absorbing is that it originates predominantly from organization investors.

"We’re truly connected the cusp of a genuinely monolithic displacement for Ethereum, driven by regulatory momentum and the quality to unlock the advantages of unafraid staking," she noted.

Central to Ethereum’s organization readiness is the caller Pectra upgrade, a important improvement Schmiedt describes arsenic some "massive" and "underappreciated."

"I deliberation Pectra has been a monolithic upgrade. I really deliberation it’s been underappreciated, conscionable successful presumption of the tremendous magnitude of alteration it introduces into the staking mechanics," Schmiedt said.

Additionally, Execution Layer triggerable withdrawals—a cardinal constituent of Pectra—provide organization participants, including ETF issuers, a important compatibility upgrade.

This diagnostic enables partial validator exits straight from Ethereum’s execution layer, aligning with organization operational requirements specified arsenic T+1 redemption timelines.

"EL triggerable withdrawals make a overmuch much effectual way to exit for large-scale marketplace participants," Schmiedt added.

Ultimately, Schmiedt said, "I deliberation we'll spot that a batch much [ETH] successful organization portfolios going forward.”

News Roundup

Trump Media May Be the Cheapest Bitcoin Play Among Public Stocks, NYDIG Says

Trump Media (DJT) whitethorn beryllium 1 of the cheapest ways to get bitcoin vulnerability successful nationalist markets, according to a caller study from NYDIG, CoinDesk precocious reported.

As a increasing fig of companies follow MicroStrategy’s strategy of stacking BTC connected their equilibrium sheets, analysts are rethinking however to worth these alleged bitcoin treasury firms.

While the commonly utilized modified nett plus worth (mNAV) metric suggests that investors are paying a premium for BTC exposure, NYDIG’s Greg Cipolaro argues mNAV unsocial is “woefully deficient.” Instead, helium points to the equity premium to NAV, which factors successful debt, cash, and endeavor value, arsenic a much close gauge.

By that measure, Trump Media and Semler Scientific (SMLR) fertile arsenic the astir undervalued of 8 companies analyzed, trading astatine equity premiums of -16% and -10% respectively, contempt some showing mNAVs supra 1.1. In different words, their shares are worthy little than the worth of the bitcoin they hold.

That’s successful stark opposition to MicroStrategy (MSTR), which roseate astir 5% Monday arsenic bitcoin crossed $110,000, portion DJT and SMLR remained mostly flat—making them perchance overlooked vehicles for BTC exposure.

Circle Stock Nearly Quadruples Post-IPO arsenic Bitwise and ProShares File Competing ETFs

Two large ETF issuers, Bitwise and ProShares, filed proposals connected June 6 to motorboat exchange-traded funds tied to Circle (CRCL), whose banal has astir quadrupled since its IPO precocious past week, CoinDesk antecedently reported.

ProShares is aiming for a leveraged merchandise that delivers 2x the regular show of CRCL. At the aforesaid time, Bitwise plans a covered telephone money that generates income by selling options against held shares, 2 precise antithetic ways to capitalize connected the stock’s explosive rise.

CRCL surged different 9% Monday successful volatile trading, continuing to gully involvement from some accepted concern and crypto investors. The projected ETFs person an effectual day of August 20, pending SEC approval. If approved, they would further blur the lines betwixt crypto and accepted finance, giving investors caller tools to play 1 of the hottest post-IPO names of the year.

Market Movements:

- BTC: Bitcoin is trading astatine $109,795 aft a 3.26% breakout fueled by organization buying, elevated volume, and macro uncertainty from US-China commercialized talks and an upcoming $22B Treasury auction.

- ETH: Ethereum rebounded 4.46% from a debased of $2,480 to adjacent astatine $2,581, with beardown buying measurement confirming enactment astatine $2,580 and mounting up a imaginable breakout supra $2,590.

- Gold: Gold is trading astatine $3,314.45, edging up 0.08% arsenic investors ticker US-China commercialized talks successful London and a subdued dollar keeps prices attractive.

- Nikkei 225: Asia-Pacific markets roseate Tuesday, with Japan’s Nikkei 225 up 0.51%, arsenic investors awaited updates from ongoing U.S.-China commercialized talks.

- S&P 500: The S&P 500 closed somewhat higher Monday, boosted by Amazon and Alphabet, arsenic investors monitored U.S.-China commercialized talks.

4 months ago

4 months ago

English (US)

English (US)