Good Morning, Asia. Here's what's making quality successful the markets:

Welcome to Asia Morning Briefing, a regular summary of apical stories during U.S. hours and an overview of marketplace moves and analysis. For a elaborate overview of U.S. markets, spot CoinDesk's Crypto Daybook Americas.

Bitcoin treasury companies were the speech of the municipality during the caller BTC Asia league successful Hong Kong, and onchain information shows they clasp much than ever successful their virtual coffers, but a caller study from CryptoQuant highlights that they are being a spot much cautious successful their crypto buys.

CryptoQuant information shows aggregate BTC treasury holdings deed 840,000 BTC this year, led by Strategy with 637,000 BTC.

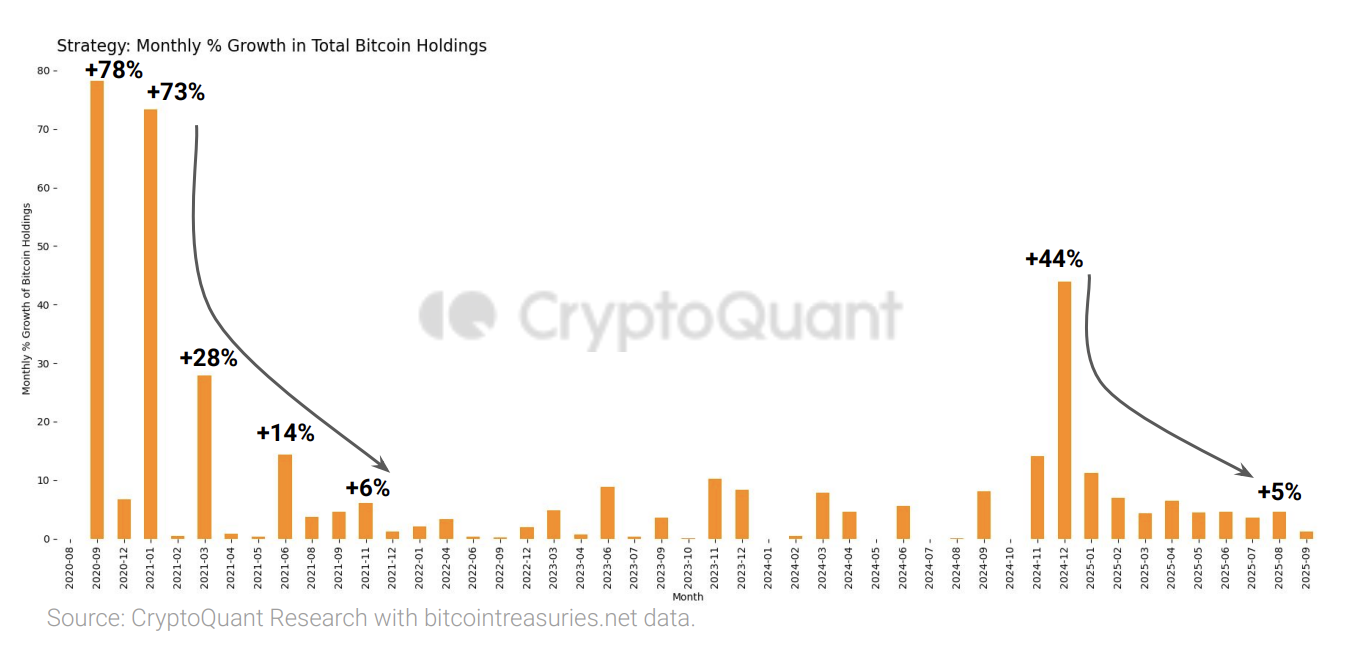

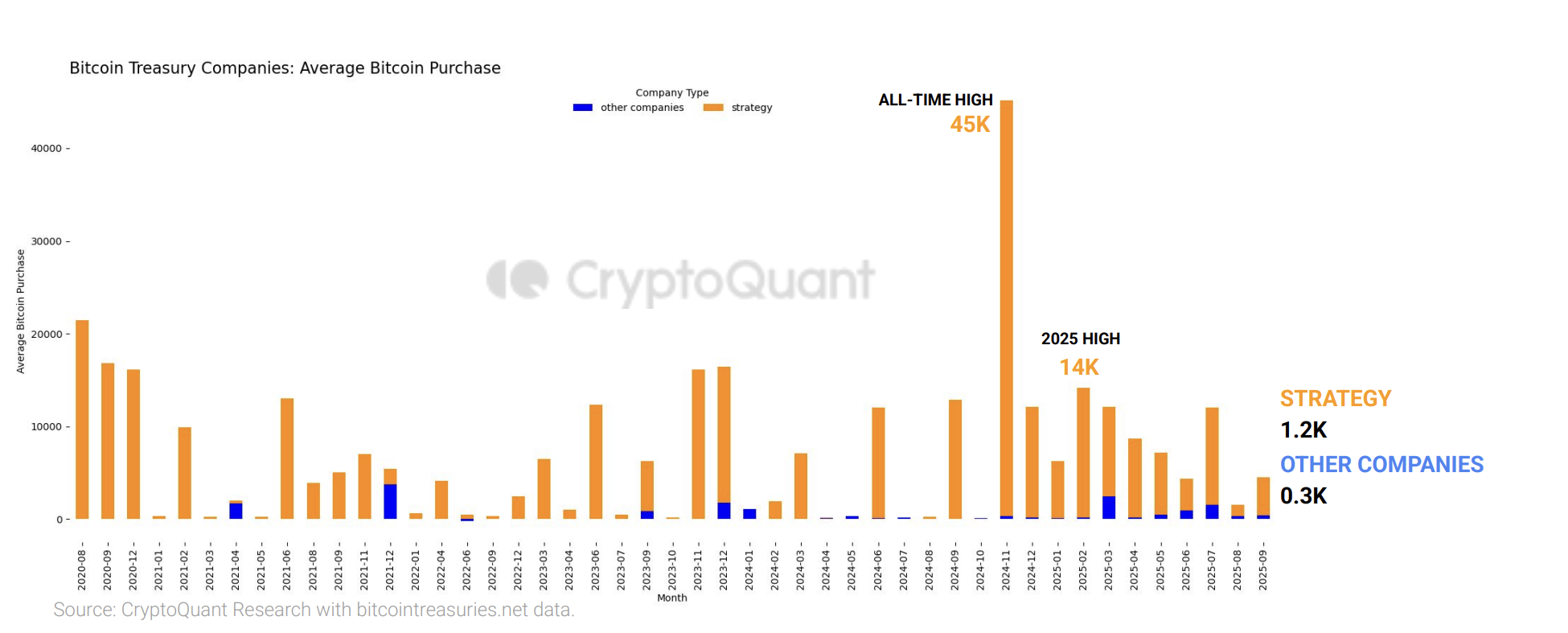

Yet the mean acquisition size has collapsed: Strategy bought conscionable 1,200 BTC per transaction successful August, portion different firms averaged 343 BTC. Both figures are down 86% from aboriginal 2025 highs, signaling smaller, much hesitant buys that suggest liquidity constraints oregon waning conviction.

The numbers amusement a striking divergence. Transaction enactment is adjacent grounds levels, 53 deals successful June and 46 successful August, but each woody involves acold little bitcoin.

Strategy acquired lone 3,700 BTC successful August compared to 134,000 BTC astatine its highest past year, portion different treasury firms slipped to 14,800 BTC from highs of 66,000 BTC.

The diminution successful mean woody size suggests treasuries are inactive progressive but unwilling to perpetrate ample blocks of capital, reflecting some liquidity constraints and a much cautious marketplace psychology.

All of this should beryllium considered a interest for investors, arsenic BTC's terms maturation successful the 2nd 4th of the twelvemonth was mostly driven by accumulation by treasury companies, CoinDesk Indices information shows.

By precocious August 2025, institutions were absorbing much than 3,100 BTC a time against conscionable 450 mined, creating a 6:1 demand-supply imbalance that underscored however relentless organization buying was driving bitcoin's terms higher, CoinDesk reported astatine the time.

This slouching request raises the hazard that the existent terms spot whitethorn beryllium little sustainable if treasuries proceed buying cautiously alternatively than astatine scale.

That's not to accidental that determination isn't maturation successful the BTC Treasury sector. It's conscionable smaller.

Bitwise reports that 28 caller treasury companies were formed successful July and August alone, collectively adding much than 140,000 BTC.

Meanwhile, Asia is emerging arsenic the adjacent beforehand for integer plus treasury companies arsenic Taiwan-based Sora Ventures has launched a $1 cardinal money to effect determination treasury firms, with an archetypal committedness of $200 million.

Unlike Metaplanet, Asia’s largest nationalist treasury steadfast with 20,000 BTC connected its equilibrium sheet, Sora’s conveyance volition excavation organization superior to enactment aggregate entrants.

Whether Asia’s caller question offsets the shrinking wound sizes of incumbents successful accumulation is present the cardinal question for the adjacent signifier of bitcoin adoption – and wherever the terms is going.

Market Movement

BTC: Bitcoin remains resilient astir the $110K–$113K range, supported by expectations of Federal Reserve complaint cuts, expanding organization inflows via ETFs, and improved marketplace sentiment amid macroeconomic uncertainty

ETH: Ethereum is trading adjacent the $4,300 level. Its short-term weakness, with a 3.8% play decline, is ascribed to ETF outflows and seasonal subdued trading successful September. However, longer-term outlook remains positive, buoyed by organization interest, increasing staking activity, and speculative forecasts targeting $4,600–$5,000 if absorption breaks

Gold: Gold is rallying to grounds levels amid a operation of anemic U.S. jobs data, heightened Fed easing expectations, a brushed U.S. dollar, governmental and economical uncertainty, and continued cardinal slope accumulation of bullion.

Nikkei 225: Asia-Pacific stocks mostly roseate Monday, with Japan’s Nikkei 225 up 1.5% aft Prime Minister Shigeru Ishiba resigned pursuing unit from his predetermination defeat.

1 month ago

1 month ago

English (US)

English (US)