Good Morning, Asia. Here's what's making quality successful the markets:

Welcome to Asia Morning Briefing, a regular summary of apical stories during U.S. hours and an overview of marketplace moves and analysis. For a elaborate overview of U.S. markets, spot CoinDesk's Crypto Daybook Americas.

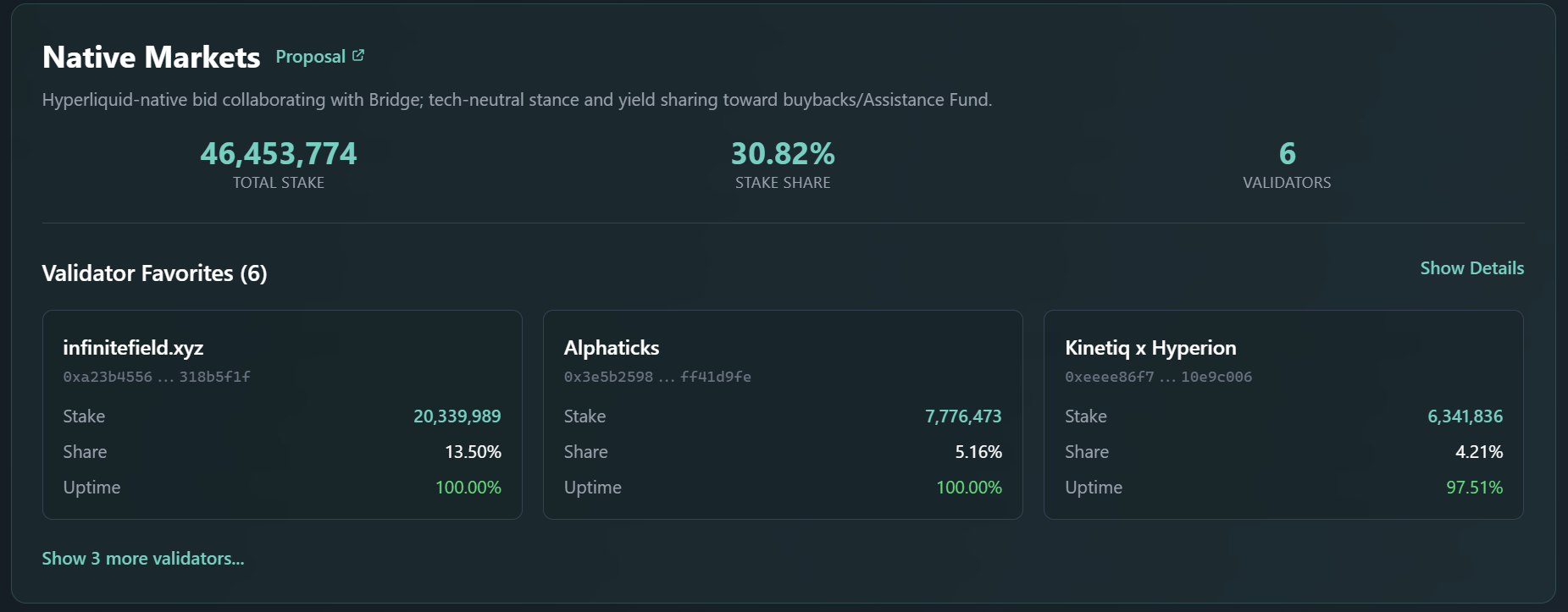

The first signs of however validators are leaning successful Hyperliquid’s hotly contested stablecoin ballot are in, and the Stripe-aligned Native Markets squad has an aboriginal lead.

As of Thursday greeting Hong Kong time, Native Markets has secured 30.8% of the delegated stake, led by heavyweight validators infinitefield.xyz (13.5%) and Alphaticks (5.2%).

Paxos Labs, the New York–regulated issuer down PayPal’s PYUSD, sits astatine 7.6% with backing from B-Harvest and HyBridge. Ethena has picked up 4.5%, portion Agora, Frax, and Sky, despite splashy proposals, person yet to pull meaningful support, though galore of the astir salient validators person yet to formed their virtual vote.

The bigger picture: much than fractional of stake, 57%, remains unassigned.

That artifact includes immoderate of the astir influential validators connected Hyperliquid, specified arsenic Nansen x HypurrCollective (the azygous largest validator with implicit 18%) and Galaxy Digital. Where they yet onshore volition determine whether Native Markets’ aboriginal momentum carries done to the September 14 deadline.

Native Markets is pitching a Hyperliquid-native stablecoin issued via Stripe’s Bridge infrastructure, promising yield-sharing to the Assistance Fund and HYPE buybacks.

But salient voices, including Agora CEO Nick van Eck, pass that Stripe’s simultaneous propulsion to motorboat its Tempo blockchain and its power of wallet supplier Privy could make conflicts.

Despite those criticisms, immoderate validators look to presumption Stripe’s planetary outgo rails arsenic a compelling advantage.

What’s astatine involvement is acold much than conscionable different token launch. Hyperliquid presently holds $5.5 cardinal successful USDC deposits, astir 7.5% of the stablecoin’s supply.

Replacing that with USDH would redirect hundreds of millions successful yearly Treasury yield. Paxos has pledged 95% of reserve net to HYPE buybacks, Frax promised 100% of output straight to users, Agora offered 100% of nett output alongside organization custodianship, and Sky (ex-MakerDAO) projected 4.85% returns positive a $25 cardinal “Hyperliquid Star” task to bootstrap DeFi connected the chain.

Hyperliquid already commands astir 80% of decentralized perpetuals trading. Whichever issuer wins the USDH declaration won’t conscionable beryllium minting a stablecoin, they’ll beryllium wiring themselves into the fiscal backbone of 1 of crypto’s fastest-growing exchanges.

Market Movement:

BTC: Currently trading astatine $114,053, up 2.6% successful the past 24 hours and 2.1% implicit the past week, though inactive down 3.9% for the month. The determination reflects a short-term rebound fueled by affirmative hazard sentiment and dependable demand, adjacent arsenic longer-term consolidation continues.

ETH: ETH is trading astatine $4,373.99, up 2%, arsenic investors motion disconnected a mass-slashing lawsuit that penalized implicit 30 validators.

Gold: Gold held adjacent $3,635 an ounce aft Tuesday’s $3,674 highest arsenic investors await U.S. ostentation information that could signifier Fed cuts, portion ANZ raised its year-end golden people to $3,800 and sees a highest adjacent $4,000 by June connected beardown concern request and central-bank buying.

Nikkei 225: Asia-Pacific markets opened mixed Thursday, with Japan’s Nikkei 225 up 0.23% and the Topix down 0.18%, aft Wall Street deed grounds highs connected Fed rate-cut hopes and upbeat ostentation data.

S&P 500: The S&P 500 roseate 0.3% to a grounds 6,532.04 Wednesday aft an unexpected driblet successful wholesale prices bolstered hopes for a Fed complaint chopped adjacent week.

Elsewhere successful Crypto:

- Trump's CFTC Hopeful Quintenz Takes His Dispute With Tyler Winklevoss (Very) Public (CoinDesk)

- Polygon rolls retired hard fork to code finality bug causing transaction delays (The Block)

- Activist capitalist Elliott Management says crypto is facing an ’inevitable collapse’ aft its ‘perceived proximity to the White House’ inflated a bubble (Fortune)

2 months ago

2 months ago

English (US)

English (US)