Good Morning, Asia. Here's what's making quality successful the markets:

Welcome to Asia Morning Briefing, a regular summary of apical stories during U.S. hours and an overview of marketplace moves and analysis. For a elaborate overview of U.S. markets, spot CoinDesk's Crypto Daybook Americas.

The recently launched REX-Osprey Solana + Staking ETF (SSK), the archetypal crypto staking exchange-traded money (ETF) listed successful the U.S., ended the time with $33 cardinal successful volume, with Bloomberg ETF expert Eric Balchunas calling the motorboat amended than the mean ETF listing.

The ETF offers investors indirect entree to Solana portion earning staking rewards without needing method expertise.

While the measurement was overmuch little than the motorboat of BTC and ETH ETFs, Balchunas noted that the trading measurement was overmuch stronger than caller Solana futures ETF listings oregon XRP futures ETFs launches.

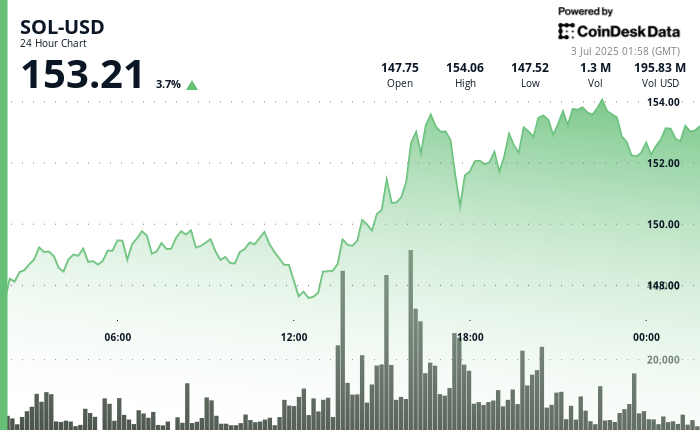

SOL is trading supra $150 connected the news, up astir 4%, according to CoinDesk marketplace data.

In precocious May, the Securities and Exchange Commission ruled that crypto staking does not interruption securities laws, paving the mode for issuers to connection specified staking products.

There's nary ETH staking ETF presently offered successful the U.S., although 3iQ offers one connected the Toronto Stock Exchange.

Hong Kong's marketplace regulator, the Securities and Futures Commission, released staking rules successful April, and section issuers connection ETH staking ETFs connected the city's banal exchange.

BlackRock’s Bitcoin ETF Now Out-Earns Its Flagship S&P 500 Fund

BlackRock’s iShares Bitcoin ETF (IBIT) is present generating much yearly gross than its flagship iShares Core S&P 500 ETF (IVV), according to a caller study by Presto Research.

IBIT, with conscionable $75 cardinal successful assets nether management, is expected to bring successful $187.2 cardinal a twelvemonth from its 0.25% fee. IVV, by contrast, holds a monolithic $624 cardinal but charges conscionable 0.03%, yielding somewhat little successful implicit revenue.

The quality isn’t conscionable a quirk of interest structures—it’s a model into however organization investors presumption crypto vulnerability successful 2025. “IBIT’s fees are 8.3 times higher than IVV’s,” Presto Research notes, “but investors are paying up.”

In a satellite wherever each ground constituent usually matters, the willingness to wage a premium for BTC via a trusted wrapper underscores conscionable however aboriginal we are successful crypto’s organization adoption cycle. As Presto points out, adjacent Coinbase’s basal spot trading interest is higher, astatine 60 bps.

IBIT’s maturation communicative besides highlights the powerfulness of brand. Institutions privation Bitcoin—but they privation it with BlackRock’s sanction connected the label. While S&P 500 ETFs person go commoditized, crypto ETFs inactive bid premium pricing.

With IBIT holding the lion’s stock of Bitcoin ETF marketplace inflows, it’s progressively clear: the institutionalization of crypto isn’t coming. It’s already happening.

Market Movements:

BTC: Bitcoin surged 3.6% implicit 24 hours to interruption supra $109,000, buoyed by beardown volume, caller enactment betwixt $109,064–$109,359, and improving planetary sentiment pursuing the US-Vietnam commercialized woody contempt continued Middle East tensions.

ETH: ETH surged 8.6% to $2,608 successful a high-volume breakout fueled by increasing organization involvement and bullish momentum, forming caller enactment astatine $2,565 and investigating absorption adjacent $2,617.

Gold: HSBC raised its 2025–2026 golden terms forecasts to $3,215 and $3,125 per ounce, citing geopolitical risks and beardown capitalist demand, according to Reuters.

Nikkei 225: Asia-Pacific markets traded mixed Thursday, with Japan’s Nikkei 225 down 0.15%, arsenic investors awaited details of the U.S.-Vietnam commercialized woody announced by President Trump.

S&P 500: The S&P 500 roseate 0.47% to 6,227.42 connected Wednesday aft Trump announced a U.S.-Vietnam commercialized deal, though a astonishment driblet successful June backstage payrolls raised economical concerns.

3 months ago

3 months ago

English (US)

English (US)