The Bank of England is the archetypal to pivot backmost to quantitative easing, claiming to reconstruct marketplace functioning and trim risks of contagion.

“Fed Watch” is simply a macro podcast, existent to bitcoin’s rebel nature. In each episode, we question mainstream and Bitcoin narratives by examining existent events successful macro from crossed the globe, with an accent connected cardinal banks and currencies.

Watch This Episode On YouTube Or Rumble

Listen To The Episode Here:

In this episode, CK and I got the privilege to beryllium down with David Lawant of Bitwise to sermon macro and its narration to bitcoin. We screen Bitwise and Lawant’s instrumentality connected the existent bitcoin market, terms and ETF likelihood. On the macro side, we screen the U.K. exigency monetary argumentation alteration and China’s pivot connected the Belt and Road lending practices.

Bitcoin Market, Price And ETF Status

We statesman the podcast with talking astir Bitwise and the wide authorities of the bitcoin market. Lawant describes wherefore helium is the astir bullish helium has ever been connected bitcoin.

As a jumping disconnected point, we look astatine immoderate charts. The archetypal 1 is the regular illustration and shows a enactment portion astir $18,000 and the diagonal inclination enactment supra the existent price. This signifier has been forming implicit a four-month timeframe, truthful erstwhile terms breaks retired of the downward sloping trend, the determination should beryllium comparatively quick.

The bitcoin illustration regular timeframe shows enactment astir $18,000

The bitcoin illustration regular timeframe shows enactment astir $18,000

I temper the somewhat bearish regular illustration with the play illustration below. As you tin see, the greenish barroom denotes a bullish play divergence. This is the archetypal specified divergence successful the past of bitcoin! If terms tin adjacent the week supra $18,810 the divergence volition beryllium confirmed.

This bullish play divergence is the archetypal bitcoin's history.

This bullish play divergence is the archetypal bitcoin's history.

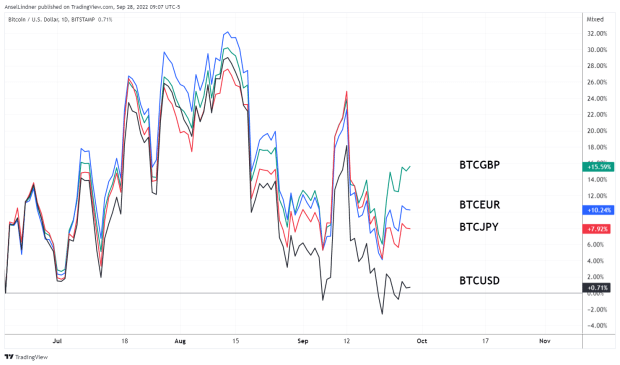

The adjacent illustration we look astatine during our unrecorded watercourse is below. It shows the terms enactment of bitcoin since the June 2022 debased successful British pounds, euros, yen and dollars. It is simply a fascinating illustration due to the fact that bitcoin is acting some similar a risk-on asset, selling disconnected successful times of fiscal crisis, and a risk-off asset, performing champion against the worst currencies.

The bitcoin terms enactment successful assorted currencies since June 2021

The bitcoin terms enactment successful assorted currencies since June 2021

U.K. Emergency Monetary Policy Change

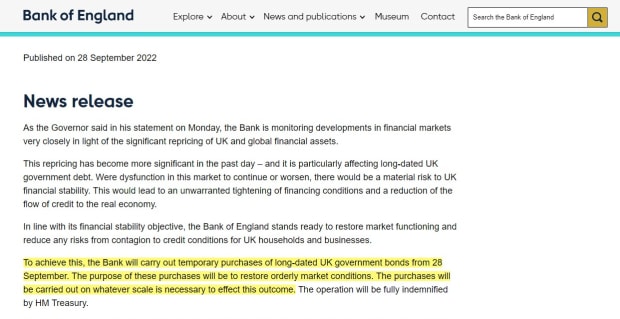

The large quality of the time that we screen is the processing concern successful the U.K. Due to a fiscal emergency, the Bank of England restarted quantitative easing (QE) connected Wednesday this week.

“In enactment with its fiscal stableness objective, the Bank of England stands acceptable to reconstruct marketplace functioning and trim immoderate risks from contagion to recognition conditions for U.K. households and businesses.

“To execute this, the Bank volition transportation retired impermanent purchases of long-dated U.K. authorities bonds from 28 September. The intent of these purchases volition beryllium to reconstruct orderly marketplace conditions. The purchases volition beryllium carried retired connected immoderate standard is indispensable to effect this outcome.” — Bank of England

Source: Bank of England

Source: Bank of England

The effect of this exigency argumentation announcement was immediate. Below is the 30-year U.K. authorities bond, showing a azygous time determination from 5.0% each the mode down to 4% — a monolithic determination arsenic the Bank of England addresses the acute fiscal crisis. At the clip of writing, this complaint has stabilized astatine 4%.

The 30-year gilt started the twelvemonth astatine hardly implicit 1% yield, dilatory making its mode higher until August 2022 erstwhile the concern became much dire.

The 30-year U.K. authorities enslaved with a 5% downward determination successful a azygous day

The 30-year U.K. authorities enslaved with a 5% downward determination successful a azygous day

Our treatment covers galore antithetic aspects of the U.K. crisis, including whether this is the commencement of a planetary pivot from cardinal banks. You’ll person to perceive to perceive Lawant’s and my predictions!

China’s Belt And Road 2.0 Lending

The past taxable we screen this week is what the Chinese insiders are starting to telephone Belt and Road 2.0. Leaders successful the Chinese Communist Party person started to recognize that the fiscal doctrine guiding the Belt and Road was horrible. They lent retired $1 trillion successful financing to projects that person questionable profitability. As it stands, 60% of recipient countries of Belt and Road inaugural loans are successful fiscal trouble. In galore cases, Chinese financiers are betting connected the International Monetary Fund and Paris Club loans to their debtors conscionable to get paid back. The full happening is backfiring.

I urge speechmaking this article from the Wall Street Journal connected the situation, and however China is attempting to lick the problem.

The past happening I’ll notation connected this taxable is that the Chinese are choosing a clip to alteration their lending strategy, close erstwhile the satellite is going into a recession and those emerging markets request the loans the most. This could spell large occupation for countries that person antecedently gotten person to China and present beryllium connected them much than the West for financing.

This is simply a impermanent station by Ansel Lindner. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)