JPMorgan analysts, portion maintaining an wide cautious stance connected the cryptocurrency market, foresee Ethereum (ETH) surpassing Bitcoin (BTC) and different integer currencies successful marketplace terms show by 2024.

This bullish outlook for Ethereum reflects a distinctive position wrong the institution, suggesting that the analysts spot unsocial imaginable and favorable prospects for Ethereum comparative to different integer assets, adjacent amid an wide cautious sentiment towards the broader crypto landscape.

In a published enactment connected Wednesday, a squad of analysts headed by Nikolaos Panigirtzoglou conveyed their anticipation that Ethereum (ETH) volition reclaim its prominence and regain marketplace stock wrong the cryptocurrency ecosystem successful the upcoming year.

Ethereum Will Overtake Bitcoin – JPMorgan

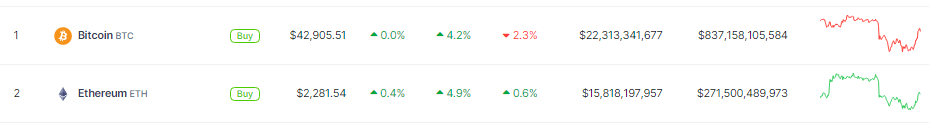

Source: Coingecko

Source: Coingecko

“We judge that adjacent twelvemonth Ethereum volition re-assert itself and recapture marketplace stock wrong the crypto ecosystem,” Panigirtzoglou wrote successful a note.

The analysts underscored the pivotal relation of the EIP-4844 upgrade, popularly known arsenic Protodanksharding, arsenic the superior catalyst for Ethereum’s anticipated resurgence.

This important upgrade, scheduled for implementation successful the archetypal fractional of 2024, is poised to bring astir important improvements successful Ethereum’s web activity.

Danksharding is simply a much businesslike sharding method for Ethereum, and protodanksharding is the archetypal measurement toward its implicit implementation. Danksharding sidesteps the tedious process of dividing Ethereum into respective shard chains, arsenic opposition to the initially intended sharding method.

Data blobs, which are connected to blocks and tin clasp much information than blocks but are not permanently stored oregon accessible by the Ethereum virtual engine, are alternatively introduced.

Meanwhile, JPMorgan’s optimistic forecast aligns with Standard Chartered’s, arsenic they antecedently stated successful a connection that Ether mightiness acquisition a 400% surge wrong a fewer years, followed by a much sustained upward question towards $35,000.

Geoff Kendrick, the Head of FX Research, West, and Digital Assets Research, expressed the viewpoint that the upward trajectory for Ether mightiness unfold astatine a much gradual gait compared to Bitcoin.

Ethereum Price Prediction: 5x Increase

Despite this perchance much extended timeframe, Kendrick envisions Ethereum yet attaining a higher terms aggregate than Bitcoin comparative to their existent levels. Specifically, helium anticipates Ethereum reaching a terms aggregate of 5.0x, surpassing Bitcoin’s expected 3.5x multiple.

Layer 2 networks, specified arsenic Optimism (OP) and Arbitrum (ARB), would summation the astir from the upgrade, according to the JPMorgan analysts.

Layer 2 networks connected Ethereum would payment from the accrued impermanent information space, which would summation web throughput and alteration transaction fees. Data blobs amended Layer 2 web ratio without changing the size of an Ethereum block.

In the meantime, arsenic ether discovers caller applications, request for it volition rise, and cryptocurrency-related trends volition lone grow. For example, the astir communal Ethereum usage lawsuit is NFT transactions, which Kendrick believes volition grow.

At the clip of writing, Ether was trading astatine $2,281, up 5.0% successful the past 24 hours, while Bitcoin was exhanging hands astatine $42,910, with a 2.3% summation successful the past 24 hours.

Featured representation from Pixabay

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)