By Omkar Godbole (All times ET unless indicated otherwise)

Bitcoin (BTC) remains nether unit aft losing the bullish trendline from April lows, with downside mostly contained astir $114,600 for now.

Even so, it looks arsenic though caller request is entering the market. Glassnode’s Supply by Investor Behavior metric shows that successful the past 5 days, proviso held by archetypal clip buyers accrued by 1.0% to 4.93 cardinal BTC.

Meanwhile, proviso controlled by alleged condemnation buyers, i.e. investors with beardown holding intent, has grown 10% to 1.03 cardinal BTC. Nevertheless, the latest surge appears subdued compared with July, a motion that the latest terms dip whitethorn beryllium excessively shallow for bargain hunters.

Loss Sellers, those getting escaped of the cryptocurrency astatine little than they paid, spiked 37.8% to 87,000 BTC, signaling accrued short-term selling pressure. These are mostly short-term holders, according to analytics steadfast CryptoQuant.

If the marketplace rapidly absorbs these sales, it could people a reset akin to past events that preceded beardown rebounds. If absorption falters, it could awesome a deeper momentum breakdown, CryptoQuant said connected X.

On the ether front, prices look to beryllium retracing to trial a important breakout constituent adjacent $4,100.

"Ethereum rolled backmost to $4,200, losing much than 12% from its peak. The second-largest coin by capitalization is earnestly aiming to trial the spot of the erstwhile absorption country adjacent $4,100, which has been holding backmost terms maturation since March 2024," said Alex Kuptsikevich, the chief marketplace expert astatine FxPro. "The quality to enactment supra this level volition bespeak a alteration successful the marketplace authorities for this cryptocurrency, arsenic the abundant superior inflows besides suggest."

Looking much broadly, the crypto marketplace alongside Nasdaq market breadth points to interim weakness wrong an ongoing bull run. According to immoderate observers, bitcoin, ether and solana person each precocious entered oversold territory connected the Relative Strength Index (RSI), suggesting that portion caution is warranted, these dips whitethorn contiguous opportunities. Stay alert!

What to Watch

- Crypto

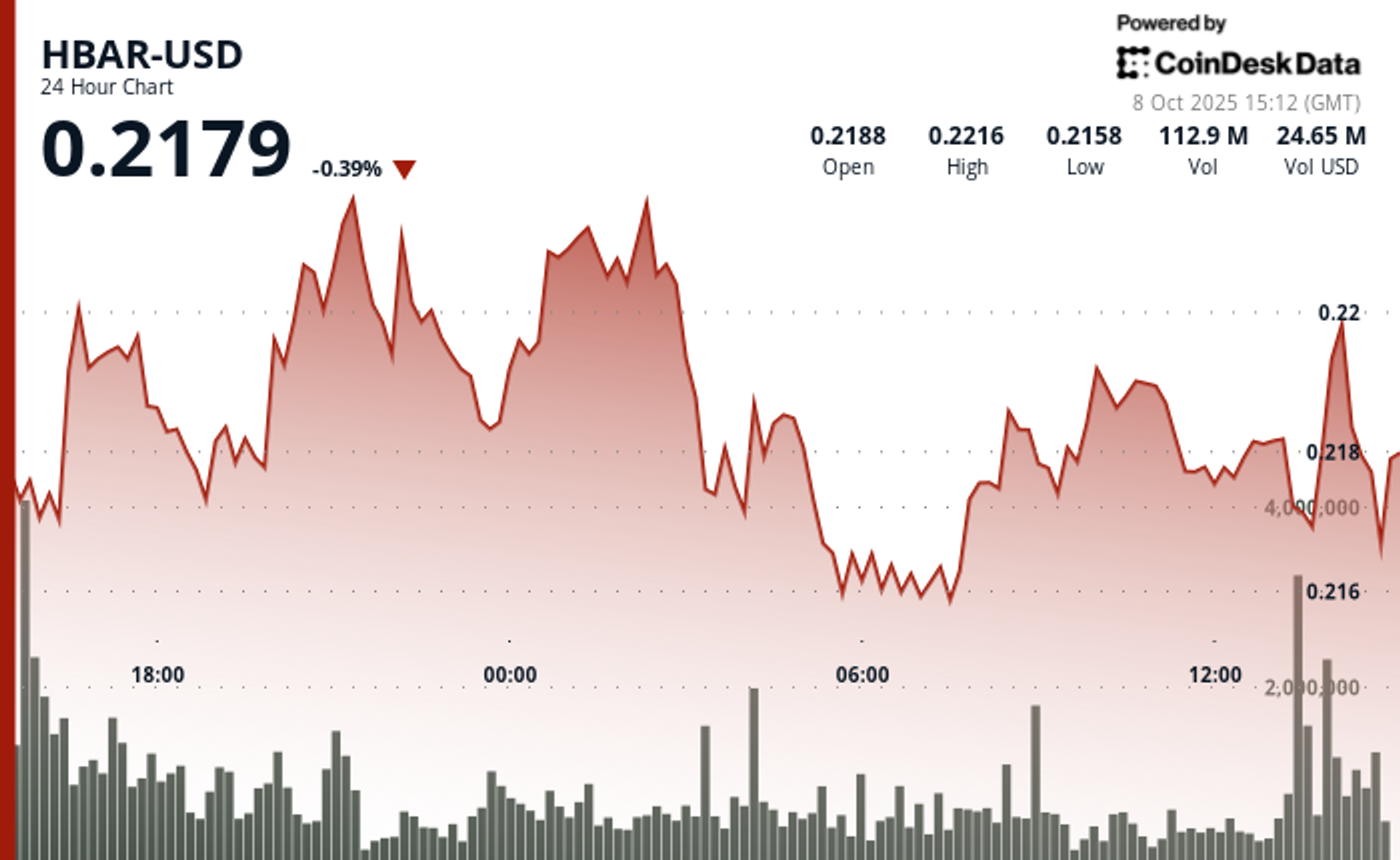

- Aug. 20, 1 p.m.: Hedera (HBAR) plans to upgrade its mainnet to mentation 0.64. The process is expected to past astir 40 minutes, during which web services whitethorn acquisition impermanent interruptions.

- Aug. 20: Qubic (QUBIC), the fastest blockchain ever recorded, volition acquisition its archetypal yearly halving event arsenic portion of a controlled emanation model. Although gross emissions stay fixed astatine 1 trillion QUBIC tokens per week, the adaptive pain complaint volition summation substantially — burning immoderate 28.75 trillion tokens and reducing nett effectual emissions to astir 21.25 trillion tokens.

- Aug. 21: Layer-1 blockchain Viction (VIC), formerly known arsenic TomoChain, finalizes the Atlas hard fork upgrade connected mainnet. The update launched connected July 23. All node operators indispensable implicit the upgrade by Aug. 21 to guarantee afloat web functionality.

- Macro

- Aug. 19, 8:30 a.m.: Statistics Canada releases July user terms ostentation data.

- Core Inflation Rate MoM Est. 0.4% vs. Prev. 0.1%

- Core Inflation Rate YoY Prev. 2.7%

- Inflation Rate MoM Est. 0.3% vs. Prev. 0.1%

- Inflation Rate YoY Est. 1.7% vs. Prev. 1.9%

- Aug. 19, 2:10 p.m.: Fed Vice Chair for Supervision Michelle W. Bowman volition talk connected “Fostering New Technology successful the Banking System” astatine the Wyoming Blockchain Symposium 2025. Watch live.

- Aug. 19, 4 p.m.: The Central Bank of Uruguay announces its monetary argumentation decision.

- Monetary Policy Rate Prev. 9%

- Aug. 20, 11 a.m.: Fed Governor Christopher J. Waller volition talk connected “Payments” astatine the Wyoming Blockchain Symposium 2025. Watch live.

- Aug. 20, 2 p.m.: The Fed volition merchandise the minutes from the July 29-30 FOMC meeting.

- Aug. 21, 8:30 a.m.: Statistics Canada releases July shaper terms ostentation data.

- PPI MoM Prev. 0.4%

- PPI YoY Prev. 1.7%

- Aug. 21, 9:45 a.m.: S&P Global releases (flash) August U.S. information connected manufacturing and services activity.

- Composite PMI Prev. 55.1

- Manufacturing PMI Est. 49.5 vs. Prev. 49.8

- Services PMI Est. 53.7 vs. Prev. 55.7

- Aug. 19, 8:30 a.m.: Statistics Canada releases July user terms ostentation data.

- Earnings (Estimates based connected FactSet data)

- Aug. 25: Windtree Therapeutics (WINT), pre-market, N/A

Token Events

- Governance votes & calls

- Aavegotchi DAO is voting connected a Bitcoin Ben’s Crypto Club Las Vegas sponsorship: a $1,000/month firm rank (logo connected sponsor wall, squad access, newsletter feature, 1 branded meetup/month) oregon a $5,000, 90-day Graffiti Wall mural with promo. Voting ends Aug. 23.

- Aug. 19: Sui (SUI) to clasp ecosystem call astatine 15:00 UTC.

- Aug 19: Metis (METIS) to host inquire maine anything connected Telegram with CCO Daniel Kwak astatine 16:00 UTC.

- Unlocks

- Aug. 20: LayerZero (ZRO) to unlock 8.53% of its circulating proviso worthy $57.59 million.

- Aug. 20: Kaito (KAITO) to unlock 8.82% of its circulating proviso worthy $27.55 million.

- Token Launches

- Aug. 19: SOON (SOON) to database connected CoinTR.

- Aug. 19: Useless Coin (USELESS) to database connected BTSE.

- Aug. 19: Destra Network (DSYNC) to database connected LBank.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done Aug. 31.

- Aug. 17-21: Crypto 2025 (Santa Barbara, California)

- Aug. 18-21: Wyoming Blockchain Symposium 2025 (Jackson Hole)

- Aug. 21-22: Coinfest Asia 2025 (Bali, Indonesia)

- Aug. 25-26: WebX 2025 (Tokyo)

Token Talk

By Shaurya Malwa

- Starknet's v0.14.0 upgrade introduces a multi-sequencer setup with Tendermint consensus, the archetypal measurement toward decentralizing sequencing and proving. Multiple sequencers volition present enactment successful artifact generation, aiming to boost resilience and throughput.

- The merchandise includes a pre-confirmation strategy for near-instant transaction updates and an EIP-1559-inspired interest exemplary with a minimum complaint of 3 gFRI. A little 15-minute mainnet outage is expected during rollout.

- Starknet plans to grow sequencer and prover decentralization successful aboriginal versions, with the semipermanent extremity of a afloat distributed scaling system.

- The displacement whitethorn besides person implications for Starknet’s STRK token, which is utilized for transaction fees and staking. With the instauration of a basal interest pain and a much competitory interest market, traders tin expect semipermanent proviso compression akin to Ethereum’s post-EIP-1559 dynamics, which has burned implicit 5 cardinal ETH to date.

- Solana's DeFi TVL roseate 30.4% successful the 2nd 4th to $8.6 billion, driven chiefly by Kamino’s $2 cardinal contribution, cementing its spot arsenic the second-largest web by DeFi activity, Messari information shows.

- Spot DEX volumes fell 45% to $2.5 cardinal arsenic memecoin hype faded, portion stablecoin proviso dropped 17% to $10.3 billion. USDC’s Solana marketplace stock slid to 69% with a $7.2 cardinal cap, portion USDT held dependable adjacent $2.3 billion.

- Liquid staking information grew to 12.2% of SOL’s supply, lifting staked worth to $60 cardinal and enhancing DeFi yields. Solana’s circulating marketplace headdress climbed 30% to $82.8 billion, ranking sixth among each tokens.

Derivatives Positioning

- BTC's retest of $115,000 overnight saw cumulative unfastened involvement successful USDT perpetual futures listed connected Deribit, Binance, OKX, Bybit and Hyperliquid driblet 222,000 BTC to 214,000 BTC, the lowest successful implicit a week.

- The superior outflow suggests the terms driblet was driven by the unwinding of agelong positions alternatively than the initiation of caller abbreviated positions.

- The other was the lawsuit with ETH. Open involvement roseate to supra 5 cardinal ETH, suggesting an influx of caller shorts.

- Open involvement successful the apical 10 tokens, excluding ETH and BNB, fell implicit the past 24 hours.

- Mantle Network's MNT token has gained astir 14% successful 24 hours. However, backing rates person flipped bearish successful the past fewer hours alongside an uptick successful unfastened interest. Those holding agelong positions are present shorting futures to hedge their bullish exposure.

- On the CME, positioning successful BTC modular futures sized astatine 5 BTC remains airy with annualized three-month ground locked beneath 10%. ETH's unfastened involvement has risen to 1.83 million, reversing the bulk of a diminution that took it to 1.51 cardinal ETH, indicating renewed superior inflows. The basis, however, dropped to 8.90% from 11%.

- Open involvement successful ETH CME options surpassed 200,000 ETH for the archetypal clip since September, indicating accrued capitalist involvement successful hedging instruments.

- On Deribit, BTC puts retired to November expiry commercialized astatine a premium to calls, reflecting concerns the terms volition drop. Subsequent expiries amusement neutral-to-bullish sentiment. In ETH's case, the bearish sentiment is seen retired to September expiries.

- Block flows via OTC web Paradigm featured agelong positions successful the BTC $120K enactment expiring Aug. 22 and the ETH $4K enactment expiring Aug. 29.

Market Movements

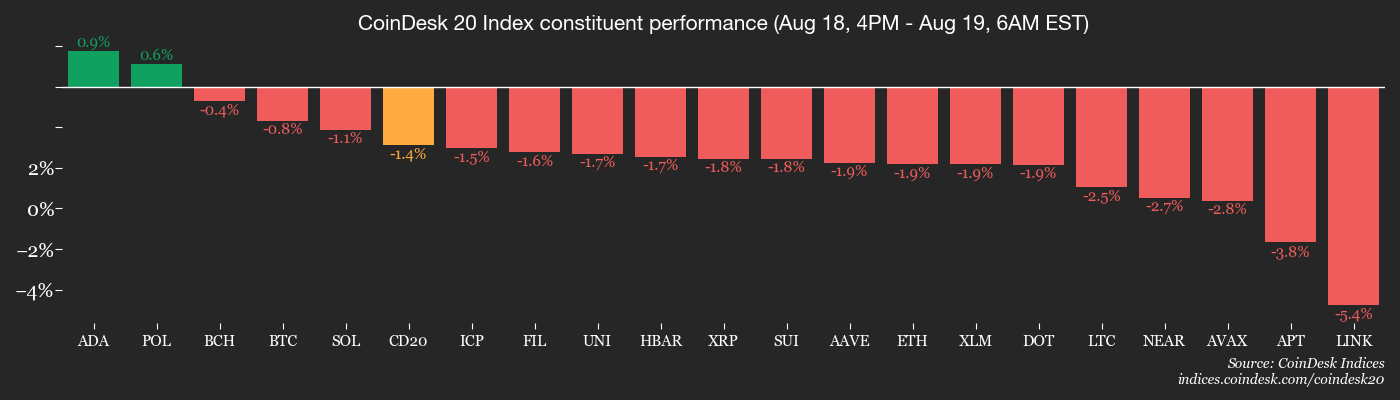

- BTC is down 1.84% from 4 p.m. ET Monday astatine $115,205.89 (24hrs: -2.73%)

- ETH is down 2.75% astatine $4,305.90 (24hrs: -5.77%)

- CoinDesk 20 is down 1.93% astatine 4,057.54 (24hrs: -4.56%)

- Ether CESR Composite Staking Rate is down 8 bps astatine 2.85%

- BTC backing complaint is astatine 0.0018% (1.9392% annualized) connected Binance

- DXY is up 0.14% astatine 97.99

- Gold futures are up 0.43% astatine $3,397.00

- Silver futures are up 0.65% astatine $38.22

- Nikkei 225 closed up 0.77% astatine 43,714.31

- Hang Seng closed down 0.37% astatine 25,176.85

- FTSE is unchanged astatine 9,132.66

- Euro Stoxx 50 is down 0.46% astatine 5,423.34

- DJIA closed connected Monday unchanged astatine 44,946.12

- S&P 500 closed down 0.29% astatine 6,449.80

- Nasdaq Composite closed down 0.4% astatine 21,622.98

- S&P/TSX Composite closed unchanged astatine 27,905.49

- S&P 40 Latin America closed up 1.23% astatine 2,686.10

- U.S. 10-Year Treasury complaint is down 3.3 bps astatine 4.295%

- E-mini S&P 500 futures are down 0.19% astatine 6,459.50

- E-mini Nasdaq-100 futures are down 0.2% astatine 23,756.25

- E-mini Dow Jones Industrial Average Index are down 0.11% astatine 44,992.00

Bitcoin Stats

- BTC Dominance: 59.7% (+0.48%)

- Ether-bitcoin ratio: 0.03698 (-2.92%)

- Hashrate (seven-day moving average): 957 EH/s

- Hashprice (spot): $56.04

- Total fees: 2.54 BTC / $299,765

- CME Futures Open Interest: 141,755 BTC

- BTC priced successful gold: 34.3 oz.

- BTC vs golden marketplace cap: 9.74%

Technical Analysis

- The output connected the 10-year Japanese authorities enslaved is connected the verge of hitting 17-year highs supra 1.6%.

- Such a determination could trigger volatility successful enslaved markets crossed the developed world, perchance influencing hazard sentiment successful some stocks and cryptocurrencies.

Crypto Equities

- Strategy (MSTR): closed connected Monday astatine $363.6 (-0.74%), -0.72% astatine $361 successful pre-market

- Coinbase Global (COIN): closed astatine $320.73 (+1%), -0.53% astatine $319.03

- Circle (CRCL): closed astatine $141.58 (-5.15%), +1.12% astatine $143.17

- Galaxy Digital (GLXY): closed astatine $26.79 (+2.68%), -1.08% astatine $26.50

- Bullish (BLSH): closed astatine $63.37 (-8.87%), -2.15% astatine $62.01

- MARA Holdings (MARA): closed astatine $16.09 (+2.68%), -0.75% astatine $15.97

- Riot Platforms (RIOT): closed astatine $12.32 (+8.74%), -0.16% astatine $12.30

- Core Scientific (CORZ): closed astatine $14.53 (+2.83%), +0.69% astatine $14.63

- CleanSpark (CLSK): closed astatine $9.84 (+0.92%), -0.51% astatine $9.79

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $28.29 (+5.96%), -2.83% astatine $27.49

- Semler Scientific (SMLR): closed astatine $33.76 (-0.24%)

- Exodus Movement (EXOD): closed astatine $26.58 (-7.77%), unchanged successful pre-market

- SharpLink Gaming (SBET): closed astatine $20.12 (+1.36%), -1.49% astatine $19.82

ETF Flows

Spot BTC ETFs

- Daily nett flows: -$121.7 million

- Cumulative nett flows: $54.83 billion

- Total BTC holdings ~1.3 million

Spot ETH ETFs

- Daily nett flows: -$196.6 million

- Cumulative nett flows: $12.49 billion

- Total ETH holdings ~6.4 million

Source: Farside Investors

Chart of the Day

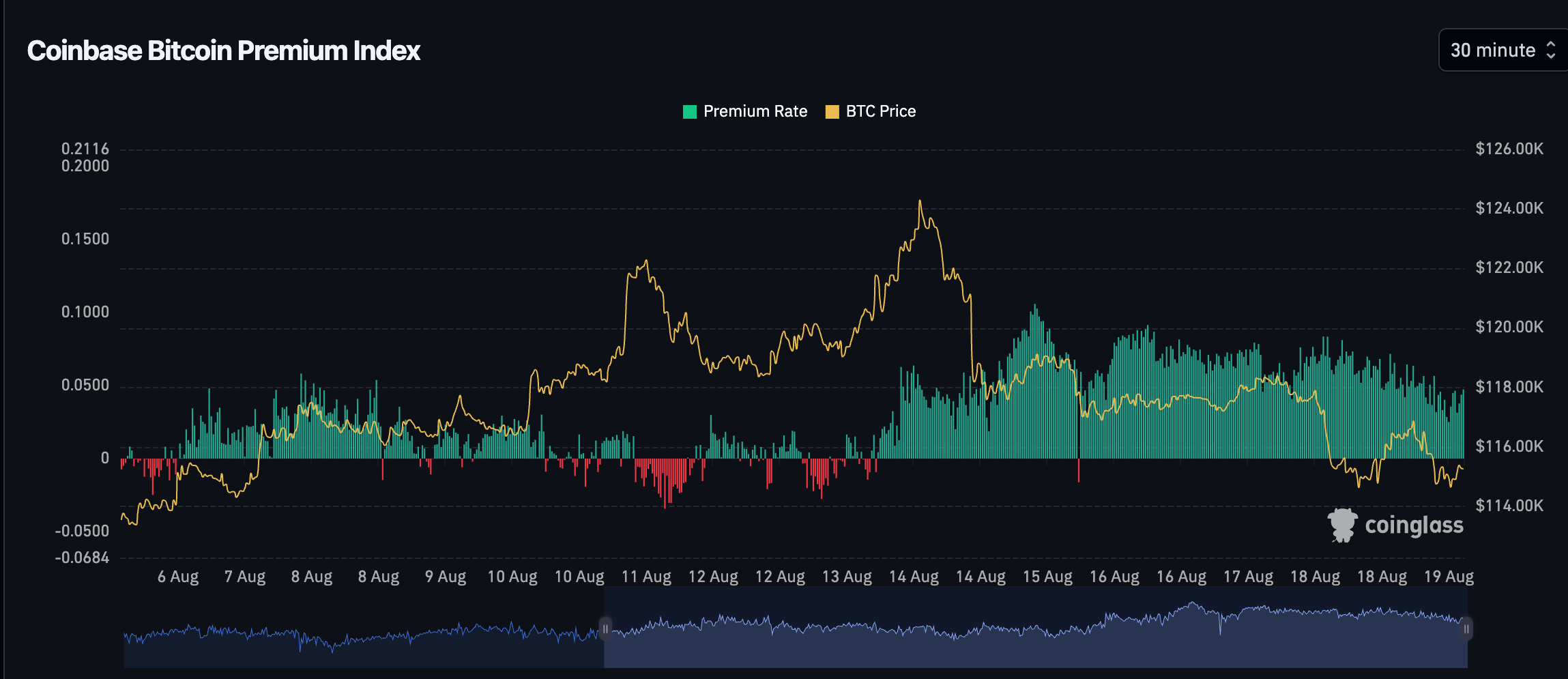

- The Coinbase premium measures the percent quality betwixt the terms of bitcoin connected the U.S. speech and the BTC/USD brace connected offshore elephantine Binance.

- The indicator has remained consistently affirmative since Friday, a motion U.S. investors are injecting much buying unit into the marketplace than their planetary counterparts.

While You Were Sleeping

- Blockchain Lender Figure Joins Crypto IPO Rush With Nasdaq Listing Bid Under 'FIGR' (CoinDesk): Goldman Sachs, Jefferies and BofA Securities are the pb underwriters. Figure's S-1 filing shows it had $191 cardinal gross and $29 cardinal nett income successful first-half 2025.

- Ripple Extends $75M Credit Facility to Gemini arsenic Exchange Pursues IPO (CoinDesk): Gemini's S-1 IPO filing revealed a lending woody with Ripple and a widening first-half nonaccomplishment arsenic the institution endeavors to go the 3rd crypto speech to spell nationalist successful the U.S.

- Is Bitcoin's Bull Run Losing Steam? Here’s What Crypto and Nasdaq Market Breadth Indicates (CoinDesk): Most apical 100 cryptocurrencies and Nasdaq-100 stocks are trading supra 200-day averages, showing semipermanent strength, though fractional present beryllium beneath 50-day levels, pointing to short-term weakness.

- S&P Affirms U.S. Credit Rating arsenic Tariff Revenue Expected to Plug Fiscal Leaks (The Wall Street Journal): S&P held the U.S. astatine AA+/A-1+ with a unchangeable outlook, citing tariffs offsetting fiscal gaps and informing of a downgrade if deficits aren’t contained oregon the Fed's independency is threatened.

- Japan Must Raise Rates, Get Fiscal House successful Order, Says Veteran Lawmaker Kono (Reuters): Japan's erstwhile overseas curate said the country's cardinal slope was excessively precocious successful raising rates and should present tighten steadily to fortify the yen and easiness inflation’s strain connected households and companies.

- China Refiners Grab Russian Oil arsenic Trump Menaces Flows to India (Bloomberg): Chinese refiners person doubled purchases of Russian Urals crude this period arsenic Indian imports slumped up of a 50% U.S. tariff, effectual Aug. 27, punishing New Delhi for buying Russian oil.

In the Ether

1 month ago

1 month ago

English (US)

English (US)