A first-of-its-kind survey published by the Basel Committee connected Banking Supervision details that the world’s largest fiscal institutions are exposed to astir €9.4 cardinal (US$9 billion) successful crypto assets. The probe insubstantial authored by the Basel Committee’s secretariat Renzo Corrias further explains that retired of each the banks’ full hazard exposure, cryptocurrency vulnerability is estimated to beryllium astir 0.01% of full exposures.

Banks Have $9 Billion successful Cryptocurrency Exposure Equating to Roughly 0.01% of Total Risk Exposure

A caller study published by the Basel Committee connected Banking Supervision (BCBS) explains that the world’s apical banks are exposed to astir $9 cardinal worthy of cryptocurrencies. The BCBS is simply a planetary enactment made up of members tied to the world’s cardinal banks and fiscal institutions from a myriad of jurisdictions.

The study, called “Banks’ exposures to cryptoassets – a caller dataset,” was written by secretariat Renzo Corrias. The probe aims to make a superior planetary modular connected the “prudential attraction of banks’ [crypto asset] exposures.”

“Total [crypto asset] exposures reported by banks magnitude to astir €9.4 billion. In comparative terms, these exposures marque up lone 0.14% of full exposures connected a weighted mean ground crossed the illustration of banks reporting [crypto asset] exposures,” the study written by Corrias details. “When considering the full illustration of banks included successful the Basel III monitoring workout (ie besides those that bash not study [crypto asset] exposures), the magnitude shrinks to 0.01% of full exposures.”

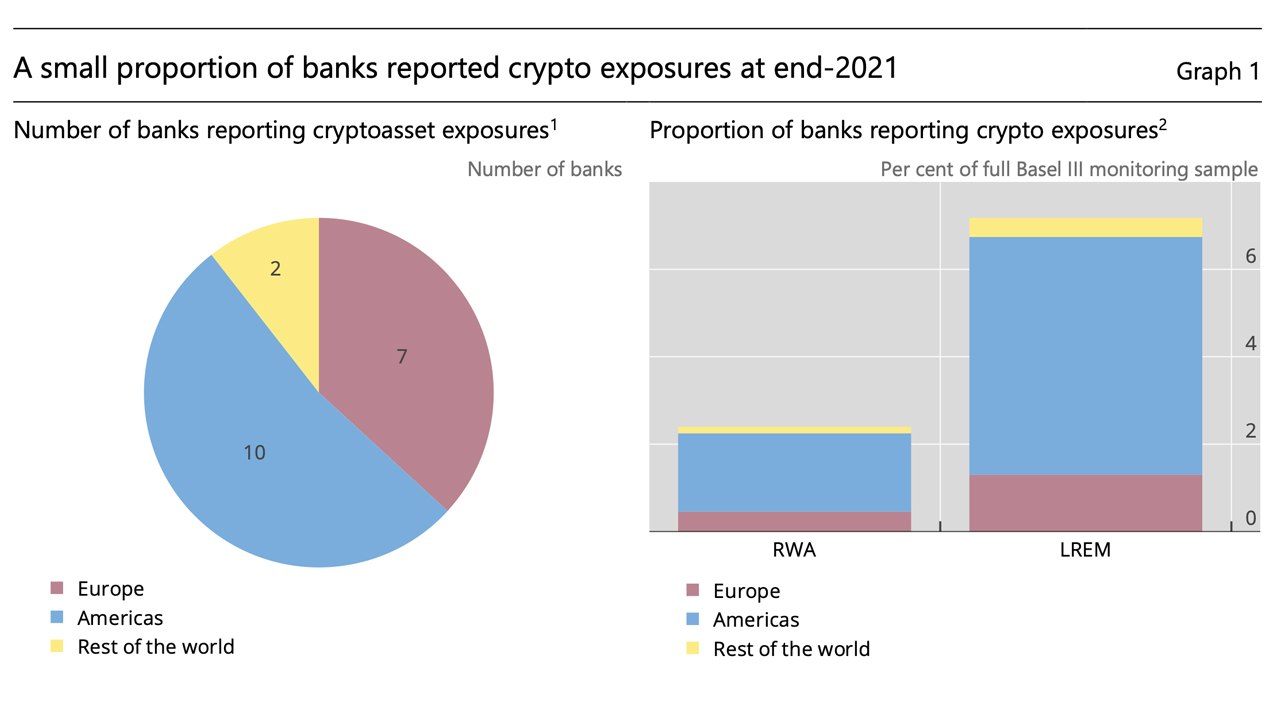

The BCBS shows that 19 banks worldwide submitted information for the research, and astir 10 fiscal institutions derived from the Americas. Seven banks stemmed from Europe, and 2 banks came from the remainder of the world. Corrias notes that the banks correspond a tiny radical of fiscal institutions retired of the corporate 182 banks the BCBS considered for its Basel III monitoring exercise.

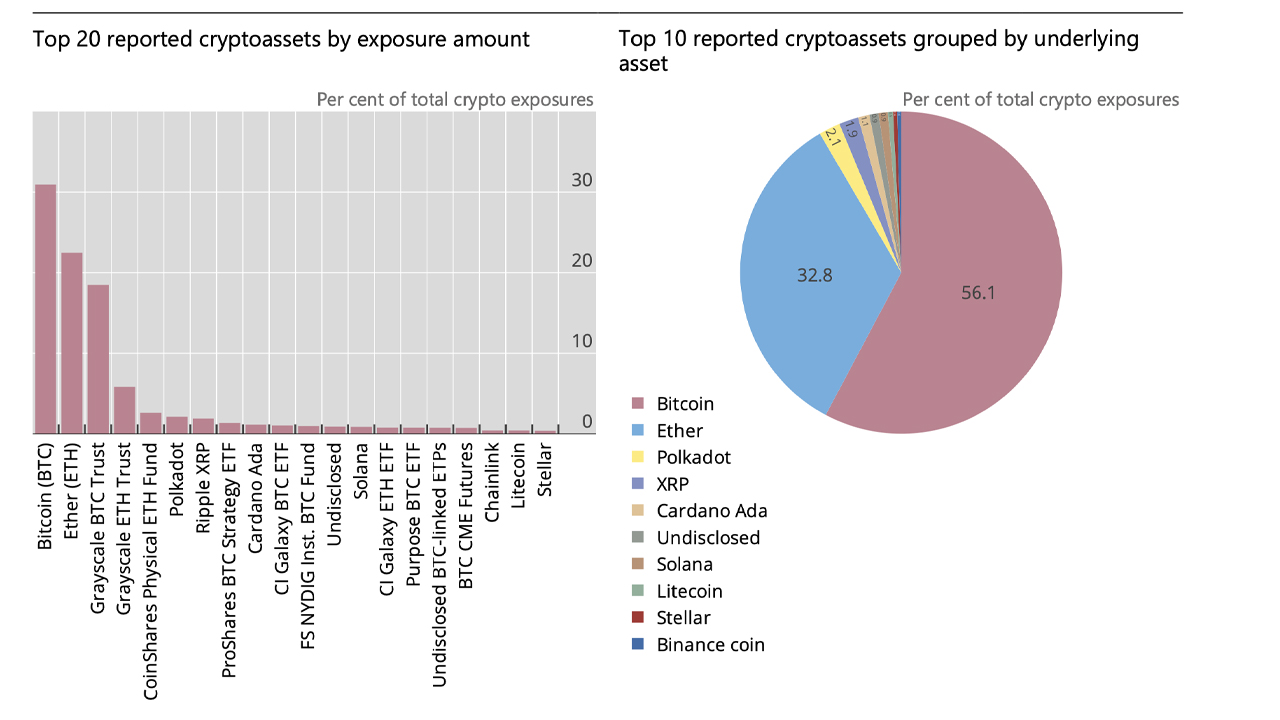

The crypto plus vulnerability the banks reported mostly consisted of bitcoin (BTC) which was astir 31% of exposures, and ethereum (ETH) which accounted for 22% of exposures. In summation to vulnerability to USD-backed stablecoins, banks are besides associated with crypto assets similar xrp (XRP), cardano (ADA), solana (SOL), litecoin (LTC), and stellar (XLM).

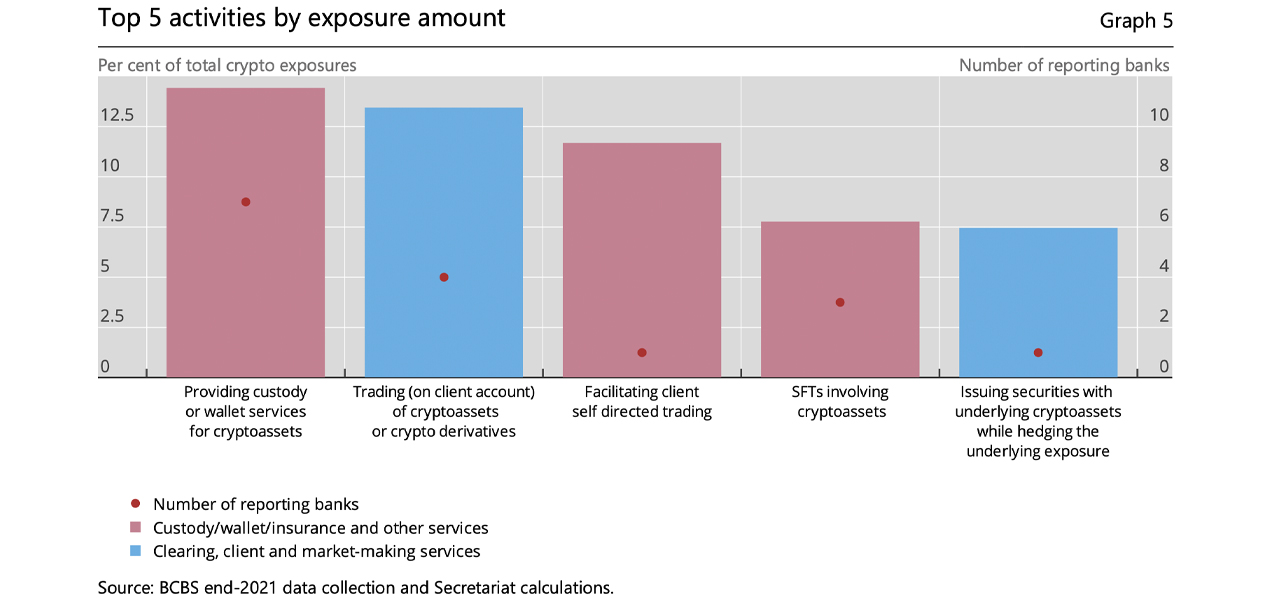

Corrias explains that the banks’ vulnerability to crypto is comprised of 3 antithetic categories which see crypto holdings and lending, clearing and market-making services, and custody/wallet/insurance services. Out of the apical 5 activities that adhd to the banks’ crypto exposure, the apical work is “providing custody oregon wallet services for [crypto assets].”

What bash you deliberation astir the caller BCBS study concerning banks’ exposures to crypto assets? Let america cognize what you deliberation astir this taxable successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)