As bitcoin (BTC) looks to retrieve from its recent downturn, observers are looking to Wednesday's Federal Reserve (Fed) complaint determination to connection support, with immoderate saying that an announcement to extremity the equilibrium expanse runoff program, known arsenic quantitative tightening, could beryllium affirmative quality for the market.

The Fed volition denote its complaint reappraisal astatine 18:00 UTC, followed by Chairman Jerome Powell's property league fractional an hr later.

The slope is improbable to connection immoderate surprises connected the involvement complaint front, retaining the contiguous scope of 4.25% to 4.50%. Therefore, the absorption volition beryllium connected however policymakers program to proceed with the quantitative tightening program, fixed the concerns that it could impact liquidity successful the strategy portion the Treasury grapples with the ongoing indebtedness ceiling issue. Plus, the summary of economical projections volition beryllium watched retired by markets.

Since June 2022, the Fed, nether the QT program, has been dilatory shrinking its equilibrium sheet, which had zoomed to a grounds of $9 trillion station COVID erstwhile the slope bought trillions of dollars worthy of assets, including bonds, to enactment markets.

The minutes of the January Fed gathering showed policymakers discussed pausing oregon slowing the reversal of the equilibrium expanse enlargement that greased the crypto bull marketplace of 2020-21. So, the anticipation of Powell hinting the aforesaid aboriginal contiguous cannot beryllium ruled out.

"Late past year, Fed Chair Powell hinted that the extremity of QT was coming successful 2025. If helium mentions it successful tomorrow’s [Wednesday's] connection oregon property league (I imagine someone will inquire him), that would extremity up signalling that we’re successful a caller monetary regime, and that the Fed stands acceptable to resume further indebtedness purchases should QE go indispensable again," Noelle Acheson, writer of the Crypto Is Macro Now newsletter said successful Tuesday's edition.

"While renewed QE [quantitive easing] improbable immoderate clip soon, the further liquidity from a ample purchaser (the Fed) coming backmost into the marketplace to regenerate maturing holdings would beryllium bully news," Acheson added, noting that the extremity of QT would beryllium a timely determination to debar liquidity glitches successful the Treasury marketplace that faces $9 trillion successful indebtedness maturity this year.

New York Life Investments' Economist Lauren Goodwin voiced a akin opinion, saying a somewhat earlier extremity to the equilibrium expanse runoff could supply the marketplace with a dovish awesome it is looking for.

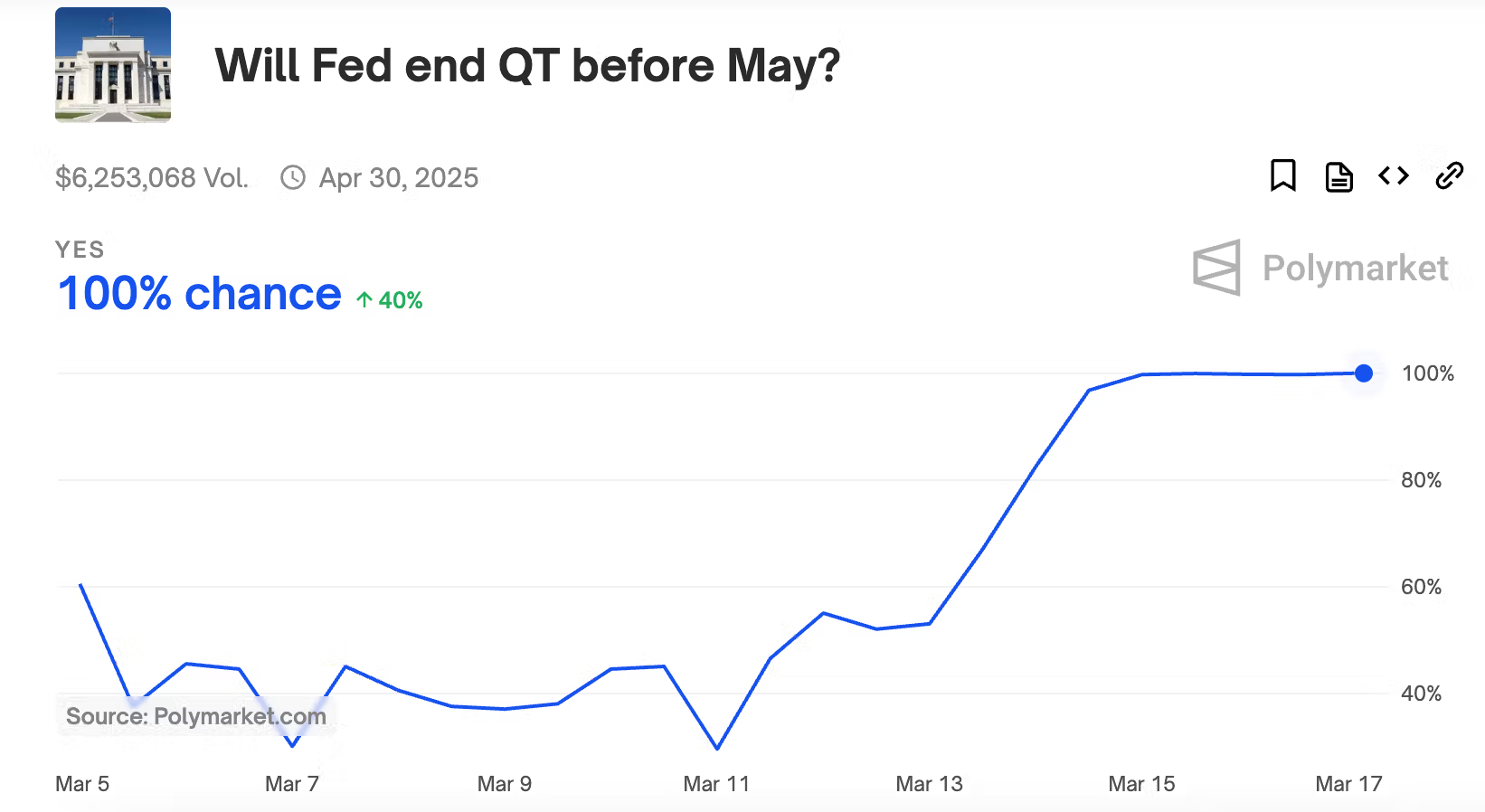

Traders implicit decentralized betting level Polymarket spot a 100% accidental that the Fed volition extremity the QT programme earlier May. The betting connected the aforesaid volition resoluteness successful "Yes" if the cardinal slope increases the magnitude of securities it holds outright week-over-week by the extremity of April.

Bank of America predicts extremity of QT

Several concern banks, including Bank of America, expect the Fed to extremity QT successful a gathering characterized by uncertain economical outlook chiefly stemming from President Donald Trump's commercialized tariffs.

"Our rates strategists expect the connection to bespeak that the Fed is pausing QT until the indebtedness ceiling is resolved, arsenic suggested successful the January gathering minutes. They bash not expect to restart aft the indebtedness ceiling is addressed, but the announcement won't beryllium made until aboriginal this year," Bank of America's March 14 lawsuit enactment said.

A intermission successful QT could enactment downward unit connected the output connected the 10-year U.S. Treasury note, the alleged risk-free rate, galvanizing request for riskier assets.

Watch retired for stagflation hints

Trump's tariffs person revved up ostentation risks portion posing risks to economical growth, a stagflationary situation, and the Fed's summary of economical projections (SEP) could bespeak that. A motion to stagflation could mean a hold successful further complaint cuts, perchance limiting bitcoin gains from a QT intermission announcement.

According to Acheson, chances of a stagflationary accommodation successful the SEP – little GDP projections and higher halfway PCE estimates, with much policymakers citing upside risks to ostentation – are high.

"If, indeed, we get that stagflationary displacement successful authoritative projections, the marketplace is improbable to beryllium happy. To immoderate extent, these are starting to beryllium priced successful – but confirmation that the Fed is apt to propulsion complaint cuts adjacent further retired could startle those counting connected liquidity injections," Acheson said.

The precocious released U.S. retail income and determination manufacturing indices revealed signs of economical weakness, Meanwhile, forward-looking ostentation metrics person been rising, apt adjusting to Trump's tariffs.

Bank of America enactment it best: "The operation of awesome from the latest information and policies enacted to day should effect successful the Fed downgrading maturation and upgrading ostentation this year, a tiny motion to stagflation."

"The dot crippled should inactive amusement 2 cuts successful '25 and '26," the concern slope added.

6 months ago

6 months ago

English (US)

English (US)