Debt financing volition beryllium a affirmative catalyst for the shares of the publically traded crypto miners whose stocks person tumbled this twelvemonth arsenic crypto and broader equity markets saw important selloffs, according to Wall Street analysts.

Due to their precocious correlation to the prices of the assets they mine, crypto mining stocks saw accelerated appreciation past twelvemonth arsenic bitcoin prices soared to an all-time-high. However, the rally evaporated this twelvemonth with little bitcoin prices, rising web hashrate and brutal competition.

With markets disconnected their peak, entree to superior has besides go somewhat restricted for the miners who request ample amounts of superior to enactment competitory and grow. “Access to the 3 M’s (money, megawatts and mining rigs) matters much than ever and based connected investors concerns astir superior needs, accessing superior efficiently seems to substance the astir close now,” said concern slope BTIG’s expert Gregory Lewis successful a probe enactment this week.

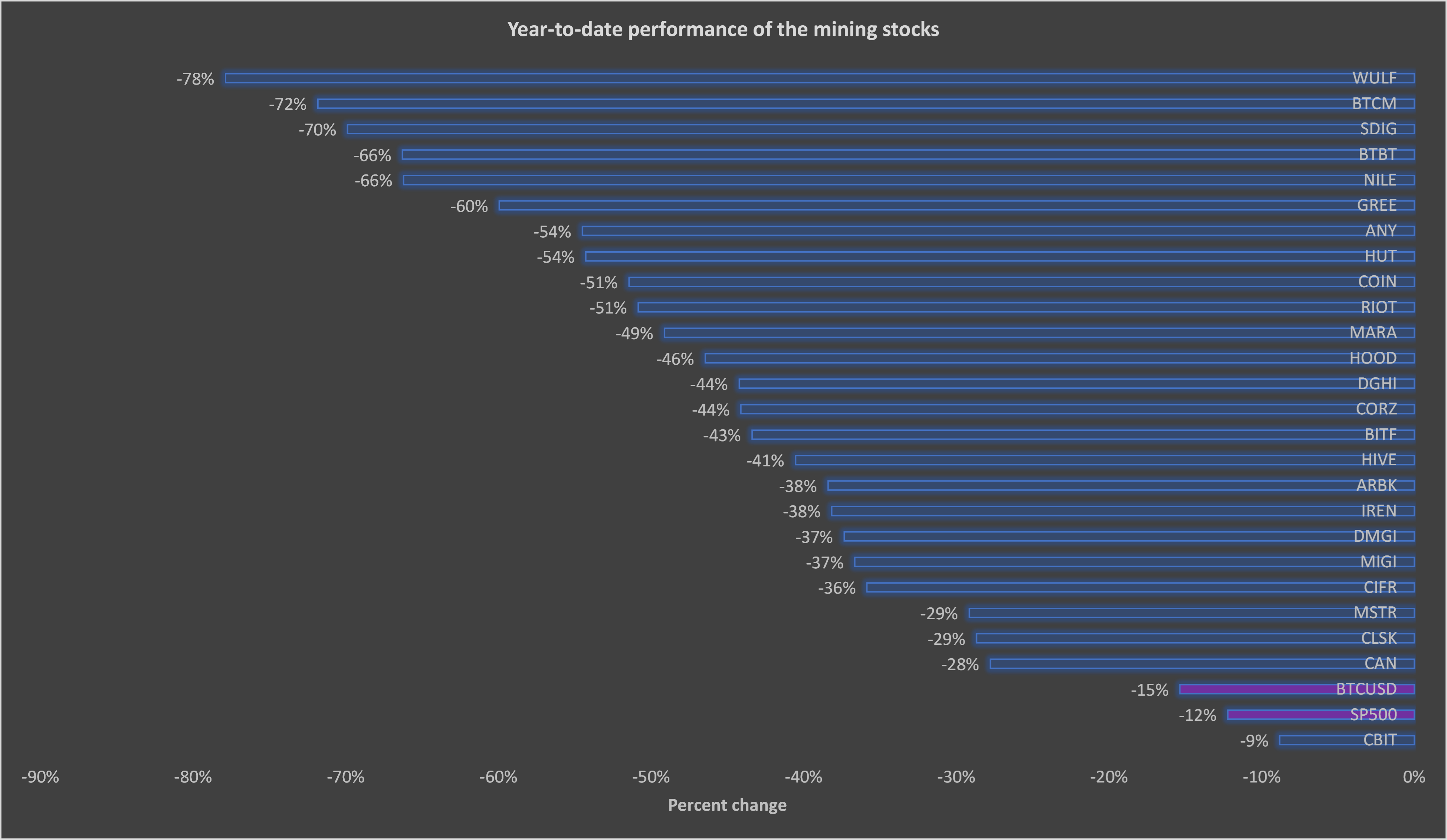

Year-to-date show of publically traded miners arsenic of April 27 adjacent (CoinDesk, FactSet)

One mode miners volition beryllium capable to navigate this situation is by delivering connected their promises to money maturation successful much businesslike ways by borrowing money, alternatively than conscionable raising equity. “We expect backing concerns for immoderate miners to beryllium addressed successful the near-term arsenic the BTC mining financing marketplace matures which should beryllium a affirmative catalyst for miners [who are] capable to entree indebtedness financing,” Lewis wrote.

This was echoed by concern slope DA Davidson’s expert Chris Brendler successful a caller probe report. “We expect improved execution [of mining operations] and broadening entree to indebtedness superior to beryllium affirmative catalysts [for the miners] near-term,” Brendler wrote.

As the manufacture matures, indebtedness superior is preferred by investors, fixed its non-dilutive nature. Indeed, offering equity successful the existent marketplace has often not been benignant to the stock terms of miners. Most recently, shares of TeraWulf (WULF), which uses 100% cleanable vigor to powerfulness its mining operations, tumbled astir 30% connected April 12 aft the institution said it would raise $20.6 million by selling communal stock. Another miner, Digihost (DGHI), said successful March that it would rise $250 million done an “at-the-market (ATM)” equity program, which allows the miners to merchantability shares from clip to time. At the clip Digihost’s marketplace headdress was little than $100 million, making a superior rise of $250 cardinal – adjacent implicit a play of clip – a sizable amount. The shares of the banal fell astir 18% connected March 4, according to FactSet data.

That hasn’t stopped immoderate of the miners from keeping their options unfastened to equity raises done ATM offerings, however. Most recently, Riot Blockchain (RIOT), Bit Digital (BTBT) and Mawson Infrastructure (MIGI) each filed to merchantability up to $500 cardinal successful shares. TeraWulf besides said aboriginal successful April that it plans to merchantability up to $200 million worthy of shares done an ATM program. And successful February, Hut 8 (HUT) launched a $65 million ATM offering and Marathon Digital (MARA) filed to rise $750 million. The stock prices didn’t respond arsenic negatively close away, fixed the filings were “shelf” registrations, meaning determination was no contiguous intention to instantly merchantability each the securities being registered. However, astir of these stocks person traded down with the marketplace since their announcements.

Creative ways to rise debt

In airy of specified marketplace conditions, raising debt, done originative ways, has go an emerging inclination among miners. Using specialized bitcoin mining computers, called ASICs, arsenic collateral for loans has go fashionable among miners to money their maturation plans, arsenic good arsenic utilizing mined integer assets arsenic collateral.

Most recently, bitcoin miner CleanSpark (CLSK) raised $35 cardinal successful instrumentality financing, backed by 3,336 caller S19j Pro bitcoin miners. Meanwhile, Australian bitcoin miner Iris Energy (IREN) secured $71 cardinal successful instrumentality financing backed by 19,800 Bitmain S19j Pro miners and miner Greenidge Generation (GREE) raised $81.4 million successful S19j Pro-backed loans.

“Although spreads and beforehand rates are nary longer improving successful this environment, we inactive spot an expanding accidental to leverage secured indebtedness solutions specified arsenic bitcoin-backed indebtedness facilities and rig collateralized instrumentality financing,” Brendler wrote successful his note. “The assemblage has besides matured with an expanding acceptable of lenders that are starting to see much accepted fiscal institutions for the archetypal time,” helium added.

However, BTIG’s Lewis warns that entree to “attractive capital” oregon indebtedness presumption that are much favorable for the miners whitethorn not beryllium imaginable for each of them. He believes larger bitcoin miners specified arsenic Riot, Marathon Digital, Core Scientific (CORZ) and CleanSpark volition person aggregate options to rise debt, including plus backed and perchance firm debt.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for The Node, our regular newsletter bringing you the biggest crypto quality and ideas.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)