CoinShares play study for the week of July 4 showed that carnivore marketplace sentiments are receding arsenic Ethereum (ETH) records its 3rd consecutive week of inflows.

According to the report, integer assets concern products saw $15 cardinal successful inflows, and its full assets nether absorption (AuM) recovered from its year-low to $36.2 billion.

Positive sentiment returning to Ethereum

Ethereum concern products recorded inflows totaling $7.6 cardinal during the week, marking the 3rd consecutive week that the plus had seen inflows.

Per CoinShares, this is simply a “modest turn-around successful sentiment” for the coin due to the fact that it had recorded 11 consecutive weeks of outflows.

The study continued that the caller affirmative sentiment surrounding Ethereum tin beryllium linked to the expanding probability of the blockchain migration to a Proof-of-Stake network.

Ethereum precocious completed its Sepolia testnet merge, which draws it nearer to the mainnet Merge that is speculated to hap aboriginal this year.

Multi-asset concern products besides saw insignificant albeit accordant inflows of $2.2 million. All different altcoins had a mostly inactive week.

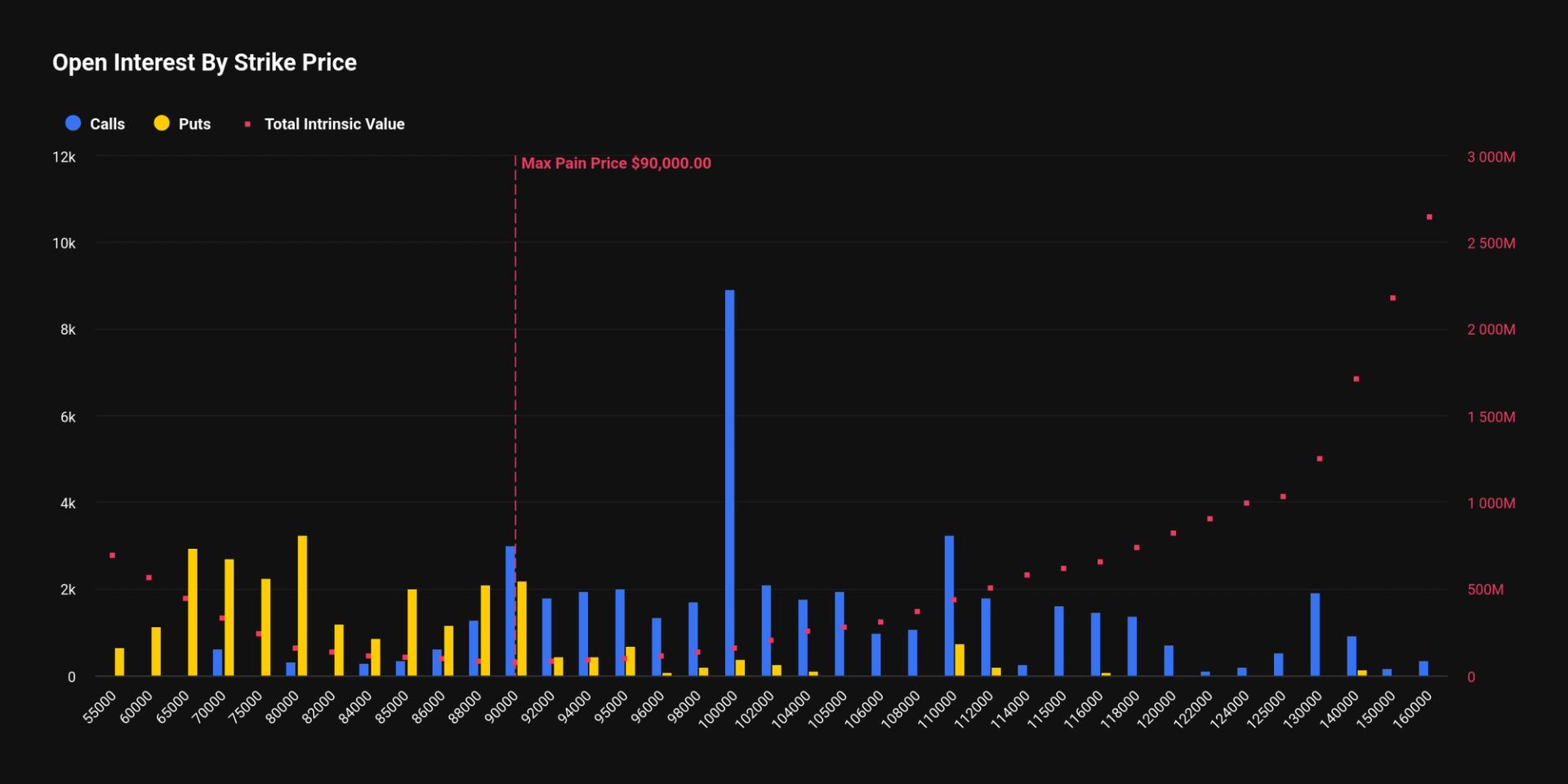

Investors are inactive shorting Bitcoin.

CoinShares’ caller study showed that investors are inactive taking abbreviated positions against Bitcoin (BTC) arsenic it recorded $6.3 cardinal successful inflows for this week.

This is coming connected the backmost of the week abbreviated Bitcoin positions had recorded implicit $50 cardinal successful inflows.

Meanwhile, CoinShares said that abbreviated Bitcoin positions are opening to “cool off.” The flagship integer plus had staged a mini betterment successful the past week arsenic it traded for arsenic precocious arsenic $22,109.67.

Bitcoin concern products recorded insignificant outflows of $1.7 million.

US, Canada, and Swiss investors are bullish

According to the demographics of the investors, astir of the inflows came from the US, Canada, and Switzerland exchanges.

Per the report, the 3 countries contributed $17.2 cardinal to the play inflows, portion France recorded $100,000 successful inflows.

However, the outflows from Brazil, Germany, and Sweden meant that full inflows did not transcend $14.6 million.

ProShares and 21Shares contributed implicit 80% of the full inflows among work providers. ProShares present has the highest year-to-date travel astatine $273 million.

On the different hand, CoinShares XBT, 3iQ, and ETC were liable for each the outflows.

The station Bear marketplace sentiments statesman to ‘cool off’ arsenic Ethereum records different week of inflows appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)