In caller weeks, Ethereum has witnessed a noticeable uptick successful its marketplace price, reaching a one-month precocious and showcasing a increasing request for the asset. Amid this development, the on-chain analytics level Lookonchain revealed an Ethereum whale’s noteworthy strategy, marking a bold stance connected Ethereum’s aboriginal trajectory.

Strategic Accumulation Amid Rising Prices

According to Loookonchain, an chartless whale has been actively expanding their Ethereum holdings, utilizing the Spark platform’s revolving indebtedness feature. Spark level is simply a decentralized concern (DeFi) merchandise that enables users to get stablecoins similar USDC oregon DAI against their cryptocurrency holdings.

This capitalist has managed to withdraw 39,900 ETH worthy astir $99.5 cardinal from large exchanges specified arsenic Binance, Bybit, OKEx, and Bitfinex, leveraging the flexibility of revolving loans to boost their presumption successful Ethereum.

Further insights from Lookonchain uncover that these withdrawals by the whale correspond a continuous strategy alternatively than an isolated event. Since the commencement of the month, the whale has consistently been pulling retired ETH, averaging a withdrawal terms of $2,492, and has secured astir 56.8 cardinal DAI successful loans from the Spark level truthful far.

A whale is accumulating $ETH and going agelong $ETH by revolving loans connected #Spark!

The whale has withdrawn 39.9K $ETH($99.5M) from #Binance, #Bybit, #OKEx and #Bitfinex since Feb 1 astatine an mean terms of $2,492, and borrowed 56.8M $DAI from #Spark.https://t.co/9EQSrwHnJD pic.twitter.com/6CydURt2pc

— Lookonchain (@lookonchain) February 13, 2024

While bold, this strategy highlights the optimism surrounding Ethereum’s imaginable growth, particularly successful anticipation of the upcoming altcoin bull tally and the expanding involvement successful Ethereum-based concern products similar the spot exchange-traded funds (ETFs).

Spotlight On Ethereum Spot ETFs

While the United States Securities and Exchange Commission (SEC) is yet to disclose immoderate latest update connected the already filed applications of the spot Ethereum ETFs, plus manager Franklin Templeton has precocious jumped connected the spot ETH ETF queue.

A caller post by James Seyffart, an experienced expert astatine Bloomberg Intelligence, highlights that Franklin Templeton has joined the ranks arsenic the eighth steadfast successful the cryptocurrency assemblage to use for merchandise authorization.

This follows submissions by different salient plus managers for Ethereum ETFs, namely Hashdex, BlackRock, Fidelity, Ark and 21Shares, Grayscale, VanEck, Invesco, and Galaxy.

Here’s the astir caller array of different filers that I person pic.twitter.com/xCRRMwK76r

— James Seyffart (@JSeyff) February 12, 2024

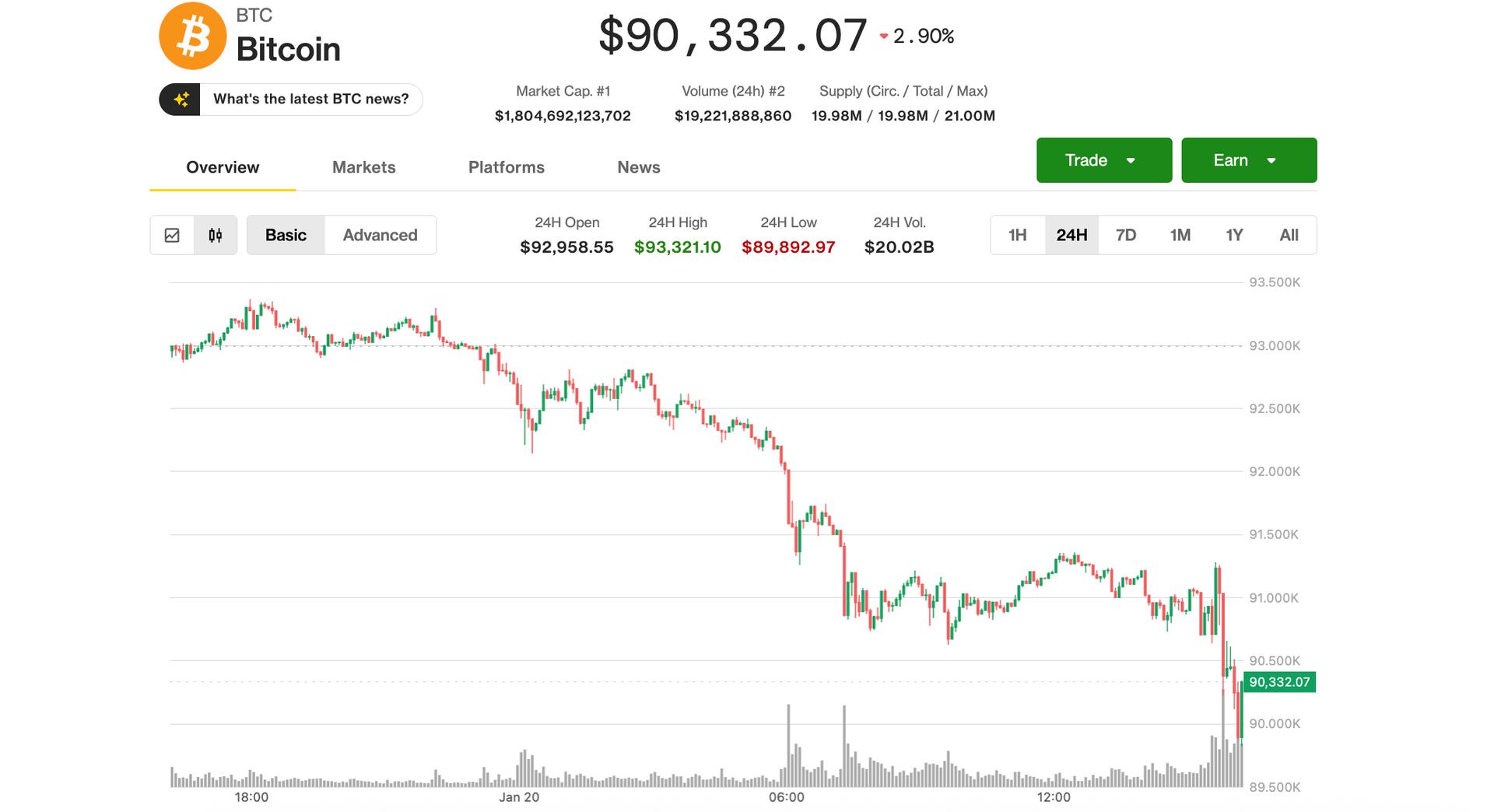

These developments travel erstwhile Ethereum has sustained a affirmative momentum, intimately tracking Bitcoin’s performance. The plus has witnessed much than 10% surge successful the past week, maintaining this upward inclination with an further astir 1% summation successful the past 24 hours.

This terms show has elevated Ethereum to a existent trading worth of $2,614 arsenic of this writing.

Featured representation from Unsplash, Chart from Tradingview

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)