In the satellite of Bitcoin, soundlessness is not ever golden. The caller weeks person seen Bitcoin’s terms volatility driblet to humanities lows, with the BTC terms trading mostly betwixt $29,000 and $30,000. However, beneath this placid surface, a fig of intriguing marketplace dynamics are astatine play.

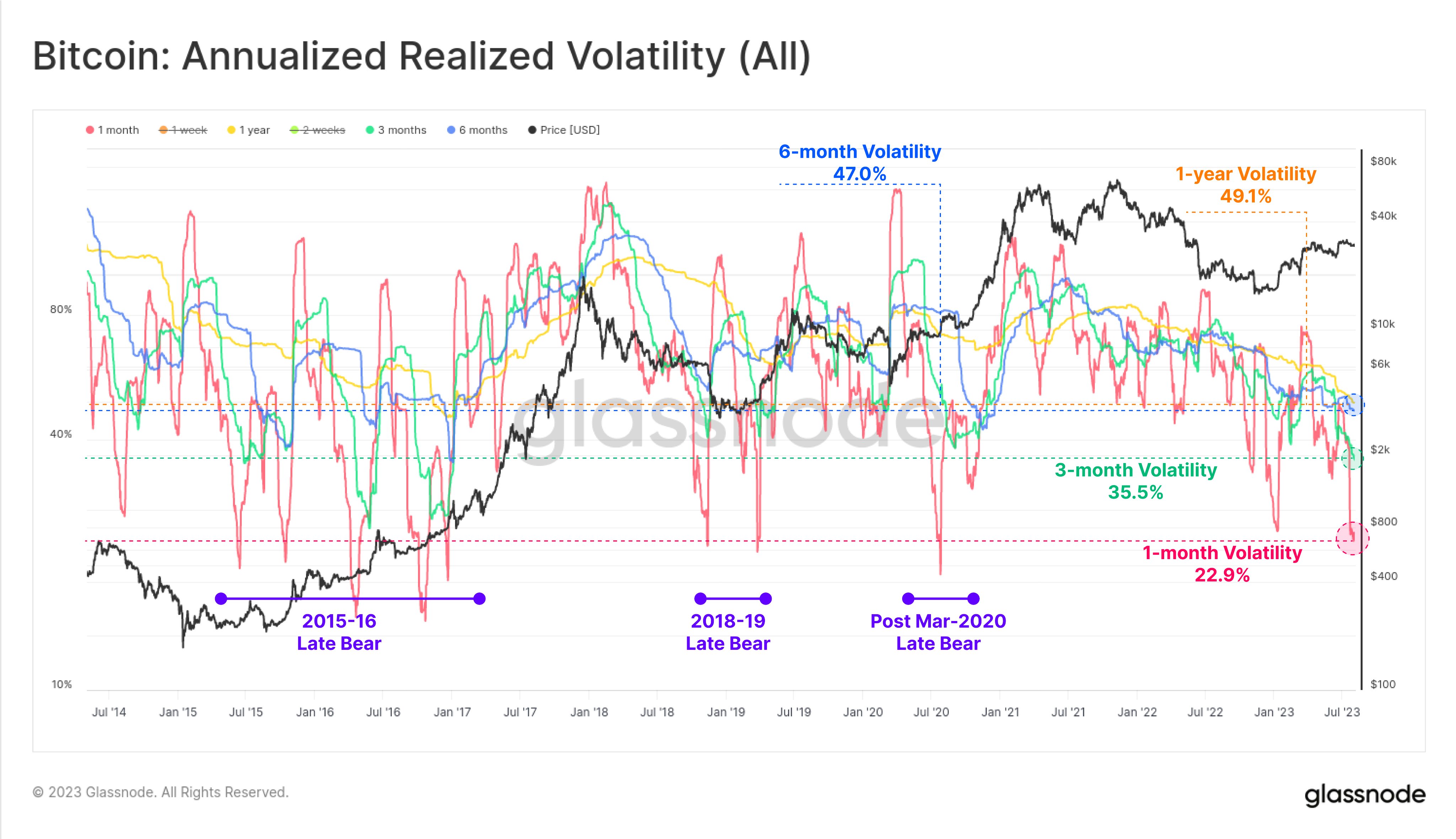

“Realized volatility for Bitcoin has collapsed to humanities lows. Across 1-month to 1yr timeframes, this is the quietest we person seen the maize since aft March 2020. Historically, specified debased volatility aligns with the post-bear-market hangover periods (re-accumulation phase),” stated Checkmate, pb on-chain expert astatine Glassnode.

Bitcoin volatility | Source: Twitter @_Checkmatey_

Bitcoin volatility | Source: Twitter @_Checkmatey_The illustration shared by Checkmate shows that annualized realized volatility resembles the post-bear epoch for Bitcoin from March 2020 erstwhile volatility was astatine 47%. Currently, 1-year volatility sits astatine 49.1%, 3-month volatility astatine 35.5%, and 1-month volatility astatine 22.9%.

Quit Before The Storm For Bitcoin

However, the debased volatility is not the lone story. Checkmate besides highlighted a caller all-time precocious for Bitcoin’s semipermanent holder supply, present astatine 14.59M BTC, which accounts for 75% of the circulating supply. This shows that an progressively precocious fig of Bitcoin investors are convinced of a aboriginal rally, starring to a proviso shortage, portion precocious hazard traders are washed retired of the marketplace owed to lacking volatility.

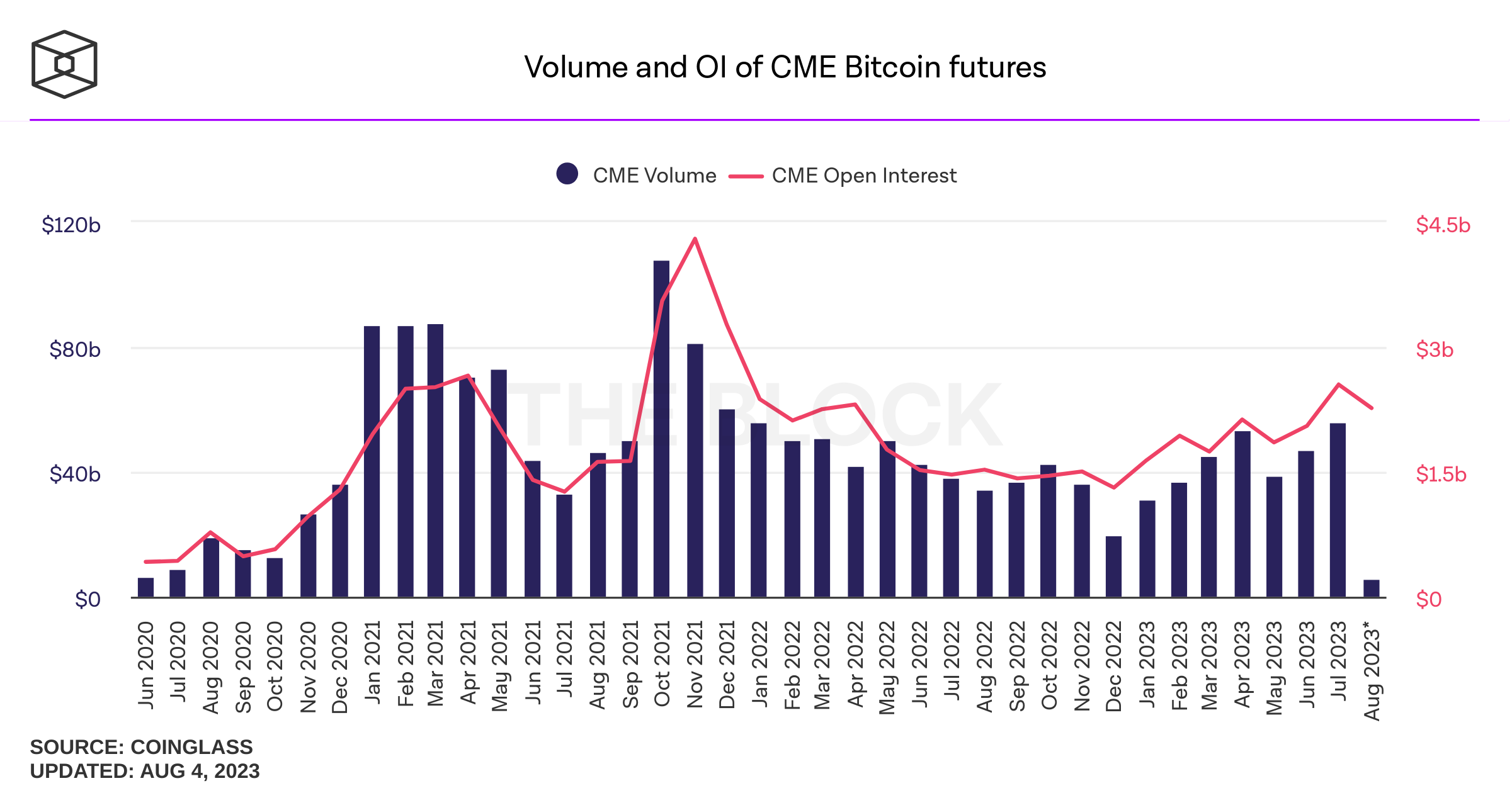

Simultaneously, there’s a surge successful organization positioning; measurement and unfastened involvement of the CME Bitcoin futures person reached a 20-month precocious successful July. Despite the Bitcoin spot markets signaling debased volumes, the CME futures saw the highest measurement since January 2022, with $55.8 cardinal successful July.

Volume and OI of CME Bitcoin futures | Source: Coinglass

Volume and OI of CME Bitcoin futures | Source: CoinglassThe CTFC information reveals a fascinating slugfest betwixt 2 capitalist groups. Asset managers are $1.2 cardinal nett long, portion hedge funds are nett abbreviated by -$980 million. This standoff suggests an imminent breakout successful Bitcoin’s price, perchance leaving 1 of these groups with burnt fingers.

On-chain expert Ali Martinez provided further insight: “Even arsenic Bitcoin dropped from $32,000 to $29,000, the fig of caller BTC addresses steadily rose! This bullish divergence betwixt terms and web maturation hints astatine a unchangeable semipermanent BTC uptrend. Buy the dip!”

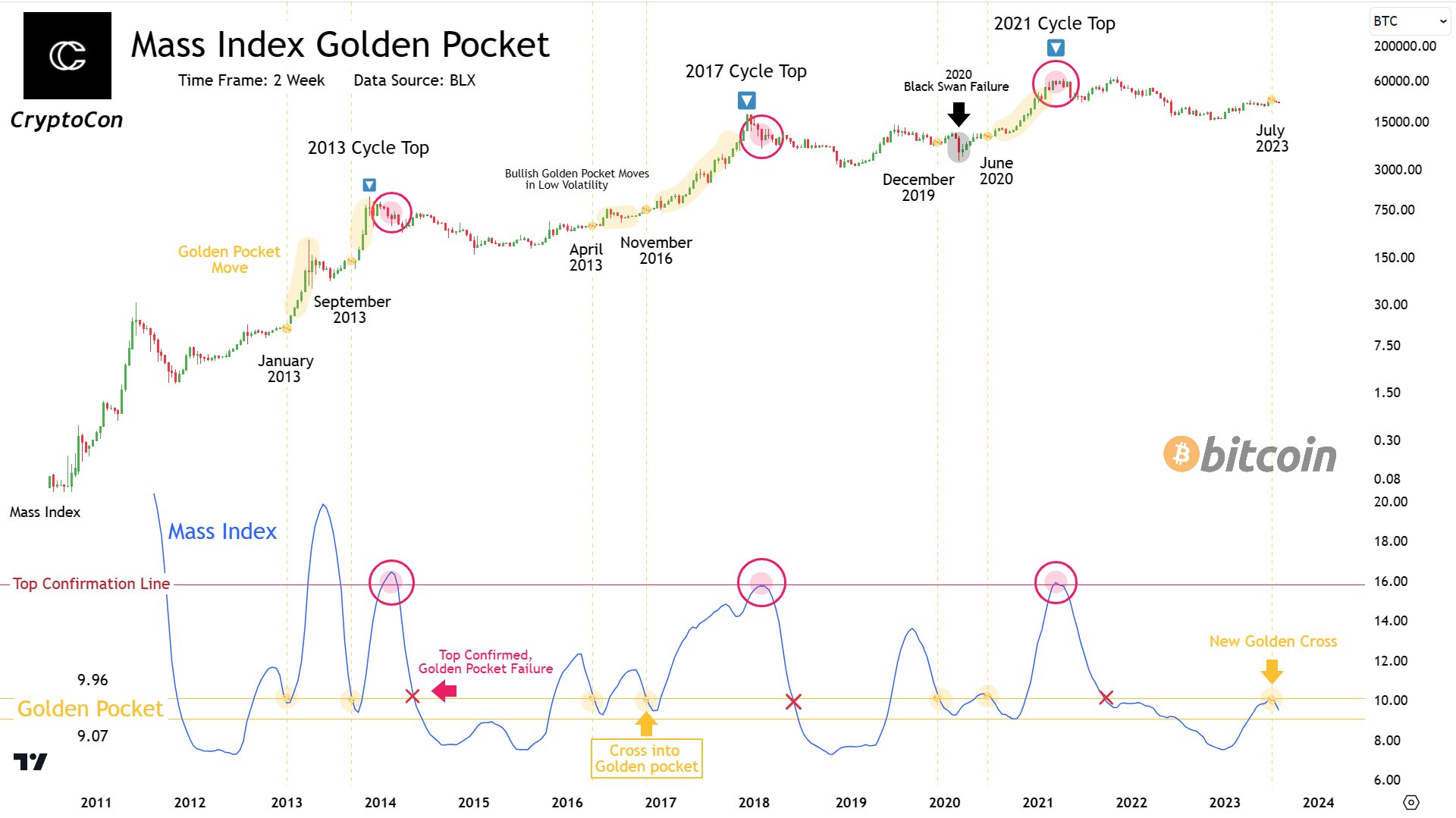

Indeed, the existent debased volatility signifier is not without precedent oregon predictive power. Renowned expert @CryptoCon provides a compelling position connected this, stating that specified periods of sideways terms enactment are not lone mean but perchance bullish.

“Bitcoin sideways terms enactment astatine this constituent successful the rhythm is wholly normal! The 2 Week Mass Index crosses into the aureate pouch astatine the astir stagnant rhythm points, conscionable earlier monolithic bullish moves. Data everyplace points to the aforesaid conclusion: Low volatility is bullish,” CryptoCon tweeted.

Bitcoin wide scale aureate pouch | Source: Twitter @CryptoCon

Bitcoin wide scale aureate pouch | Source: Twitter @CryptoConChris Burniske, spouse astatine Placeholder VC, besides shared his position connected the existent marketplace dynamics. “Currently, tourists are inactive portion residents are accumulating swiftly, owning 74.8% of each supply. That’s accordant with an early-stage bull market. Thirty percent of BTC has near for acold retention since 2020, leaving exchanges with 2.26 million. Bitcoin seems reasonably valued comparative to the fig of progressive entities connected the network.”

Burniske’s simplified price/cycle exemplary projects Bitcoin to scope adjacent $39,000 by the 4th fourth of 2023 and $92,000 (base scenario) by Q4 2025 with entities supra 600,000.

In conclusion, the existent debased volatility signifier of Bitcoin whitethorn look uneventful connected the surface, but the underlying marketplace dynamics suggest a antithetic story. The tug-of-war betwixt plus managers and hedge funds, the dependable emergence successful caller BTC addresses, and the swift accumulation by semipermanent holders each hint astatine a brewing storm.

At property time, the Bitcoin terms was astatine $29,076.

BTC supra $29k, 4-hour illustration | Source BTCUSD connected TradingView.com

BTC supra $29k, 4-hour illustration | Source BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)